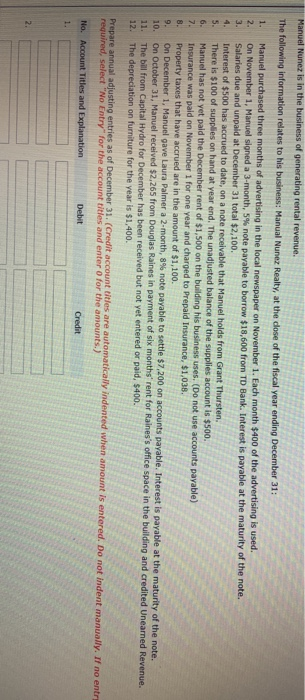

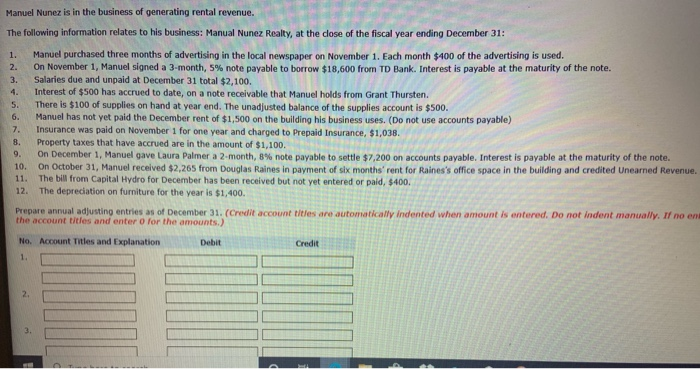

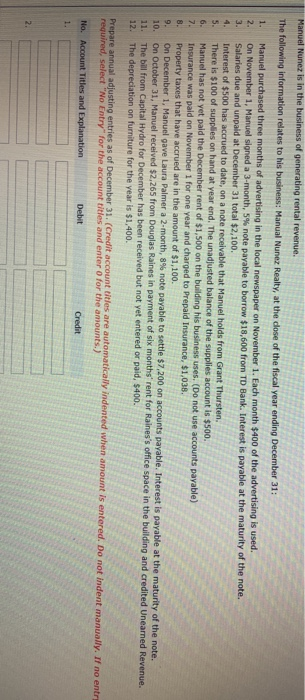

Manuel Nunez is in the business of generating rental revenue. The following information relates to his business: Manual Nunez Realty, at the dose of the fiscal year ending December 31: 1. Manuel purchased three months of advertising in the local newspaper on November 1. Each month $400 of the advertising is used. 2. On November 1, Manuel signed a 3-month, 5% note payable to borrow $18,600 from TD Bank. Interest is payable at the maturity of the note. 3. Salaries due and unpaid at December 31 total $2,100. 4. Interest of $500 has accrued to date, on a note receivable that Manuel holds from Grant Thursten. 5. There is $100 of supplies on hand at year end. The unadjusted balance of the supplies account is $500. 6. Manuel has not yet paid the December rent of $1,500 on the building his business uses. (Do not use accounts payable) Insurance was paid on November 1 for one year and charged to Prepaid Insurance, $1,038. 8. Property taxes that have accrued are in the amount of $1,100. 9. On December 1, Manuel gave Laura Palmer a 2-month, 8% note payable to settle $7,200 on accounts payable. Interest is payable at the maturity of the note. 10. On October 31, Manuel received $2,265 from Douglas Raines in payment of six months' rent for Raines's office space in the building and credited Unearned Revenue. 11. The bill from Capital Hydro for December has been received but not yet entered or paid, $400. 12. The depreciation on furniture for the year is $1,400. Prepare annual adjusting entries as of December 31. (Credit account titles are automatically indented whe required, select "No Entry for the account titles and enter for the amounts.) ount is entered. Do not indent manually. If no entry No. Account Titles and Explanation Debit Credit Manuel Nunez is in the business of generating rental revenue. The following information relates to his business: Manual Nunez Realty, at the dose of the fiscal year ending December 31: 1. Manuel purchased three months of advertising in the local newspaper on November 1. Each month $400 of the advertising is used. 2. On November 1, Manuel signed a 3-month, 5% note payable to borrow $18,600 from TD Bank. Interest is payable at the maturity of the note. 3. Salaries due and unpaid at December 31 total $2,100. 4. Interest of $500 has accrued to date, on a note receivable that Manuel holds from Grant Thursten. 5. There is $100 of supplies on hand at year end. The unadjusted balance of the supplies account is $500. Manuel has not yet paid the December rent of $1,500 on the building his business uses. (Do not use accounts payable) 7. Insurance was paid on November 1 for one year and charged to Prepaid Insurance, $1,038. 8. Property taxes that have accrued are in the amount of $1,100. 9. on December 1, Manuel gave Laura Palmer a 2 month, 8% note payable to settle $7.200 on accounts payable Interest is payable at the maturity of the note. 10. On October 31, Manuel received $2,265 from Douglas Raines in payment of six months rent for Raine's office space in the building and credited Unearned Revenue 11. The bill from Capital Hydro for December has been received but not yet entered or paid, $400. 12. The depreciation on furniture for the year is $1,400. Prepare annual adjusting entries as of December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no en the account titles and enter for the amounts.) No. Account Titles and Explanation Debit