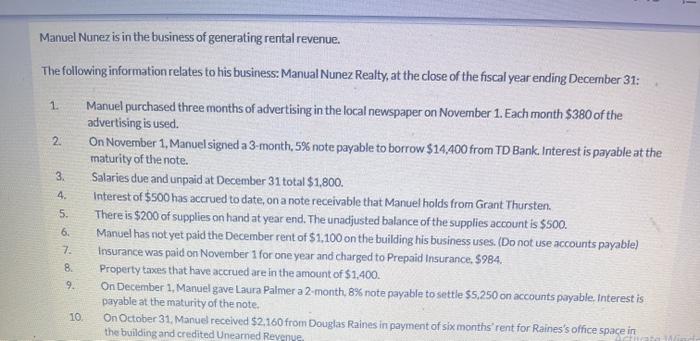

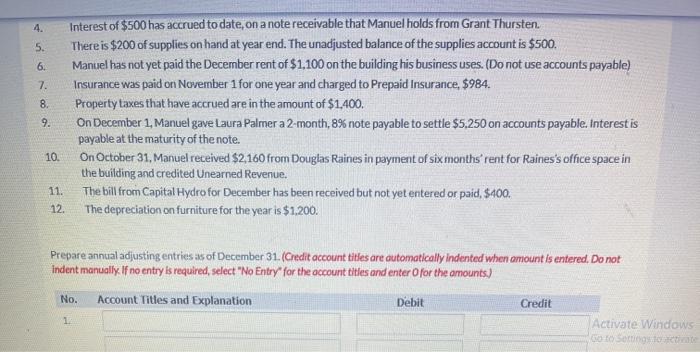

Manuel Nunez is in the business of generating rental revenue. 1. The following information relates to his business: Manual Nunez Realty, at the close of the fiscal year ending December 31: Manuel purchased three months of advertising in the local newspaper on November 1. Each month $380 of the advertising is used. 2. On November 1, Manuel signed a 3-month, 5% note payable to borrow $14,400 from TD Bank. Interest is payable at the maturity of the note. 3. Salaries due and unpaid at December 31 total $1,800. Interest of $500 has accrued to date, on a note receivable that Manuel holds from Grant Thursten. There is $200 of supplies on hand at year end. The unadjusted balance of the supplies account is $500. Manuel has not yet paid the December rent of $1.100 on the building his business uses. (Do not use accounts payable) Insurance was paid on November 1 for one year and charged to Prepaid Insurance. $984. Property taxes that have accrued are in the amount of $1,400. On December 1, Manuel gave Laura Palmer a 2-month, 8% note payable to settle 55.250 on accounts payable Interest is payable at the maturity of the note, On October 31, Manuel received $2.160 from Douglas Raines in payment of six months' rent for Raines's office space in the building and credited Unearned Revenue 4. 5. 6. 7. 8. 9. 10 4. 5. 6. 7. 8. 9. Interest of $500 has accrued to date, on a note receivable that Manuel holds from Grant Thursten. There is $200 of supplies on hand at year end. The unadjusted balance of the supplies account is $500. Manuel has not yet paid the December rent of $1.100 on the building his business uses. (Do not use accounts payable) Insurance was paid on November 1 for one year and charged to Prepaid Insurance $984. Property taxes that have accrued are in the amount of $1,400. On December 1, Manuel gave Laura Palmer a 2-month, 8% note payable to settle $5,250 on accounts payable. Interest is payable at the maturity of the note. On October 31, Manuel received $2,160 from Douglas Raines in payment of six months rent for Raines's office space in the building and credited Unearned Revenue. The bill from Capital Hydrofor December has been received but not yet entered or paid $400. The depreciation on furniture for the year is $1.200. 10 11. 12 Prepare annual adjusting entries as of December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit 1 Activate Windows 30