Answered step by step

Verified Expert Solution

Question

1 Approved Answer

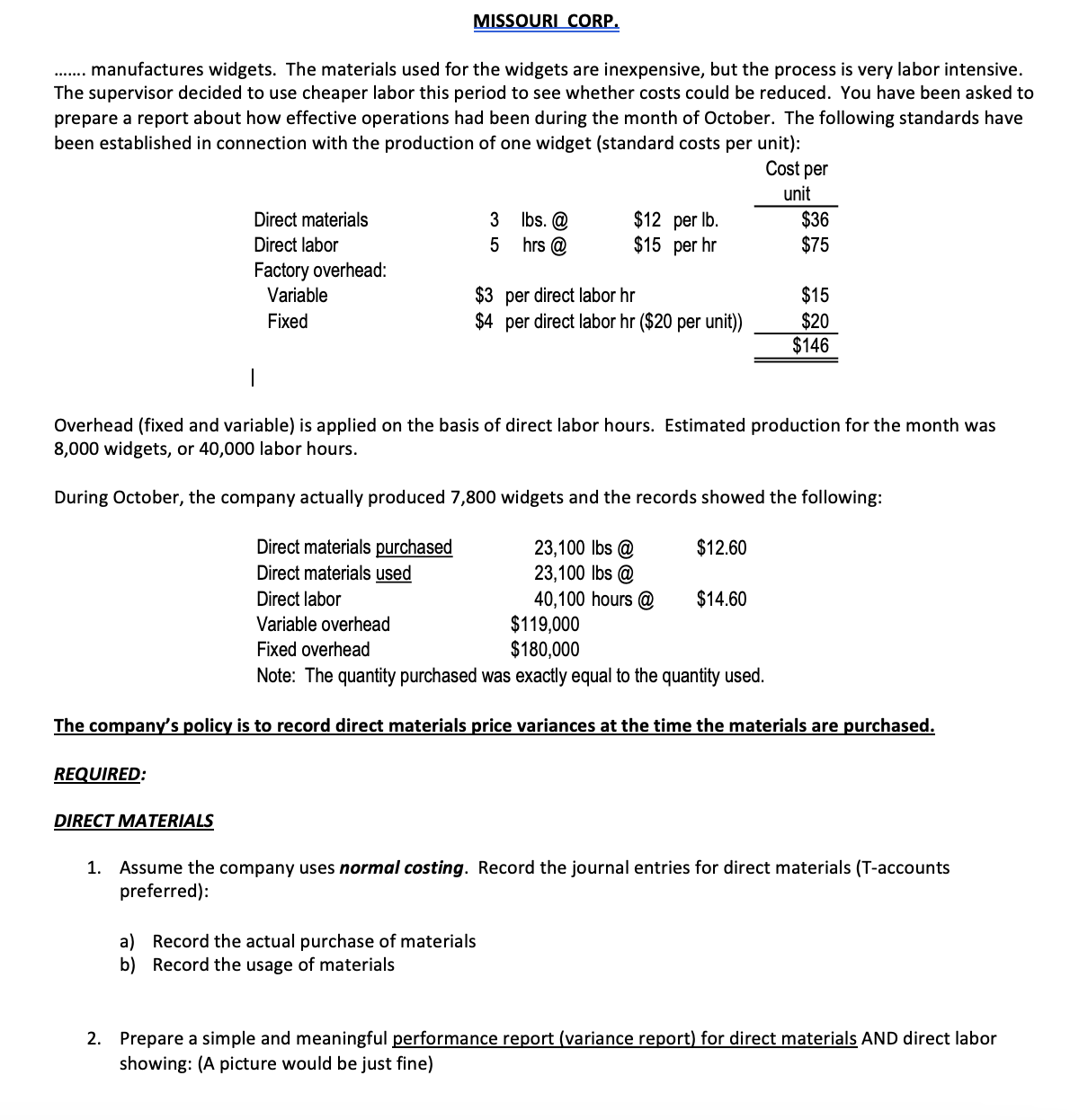

MISSOURI CORP. manufactures widgets. The materials used for the widgets are inexpensive, but the process is very labor intensive. The supervisor decided to use

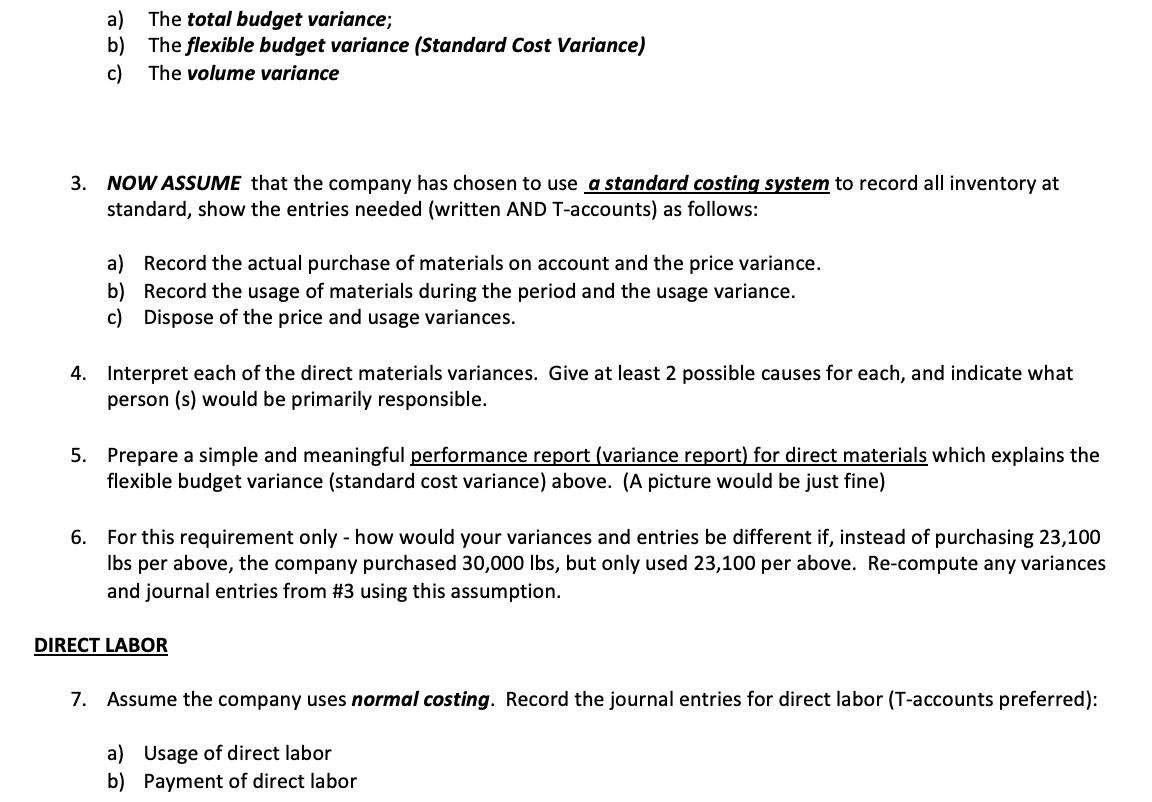

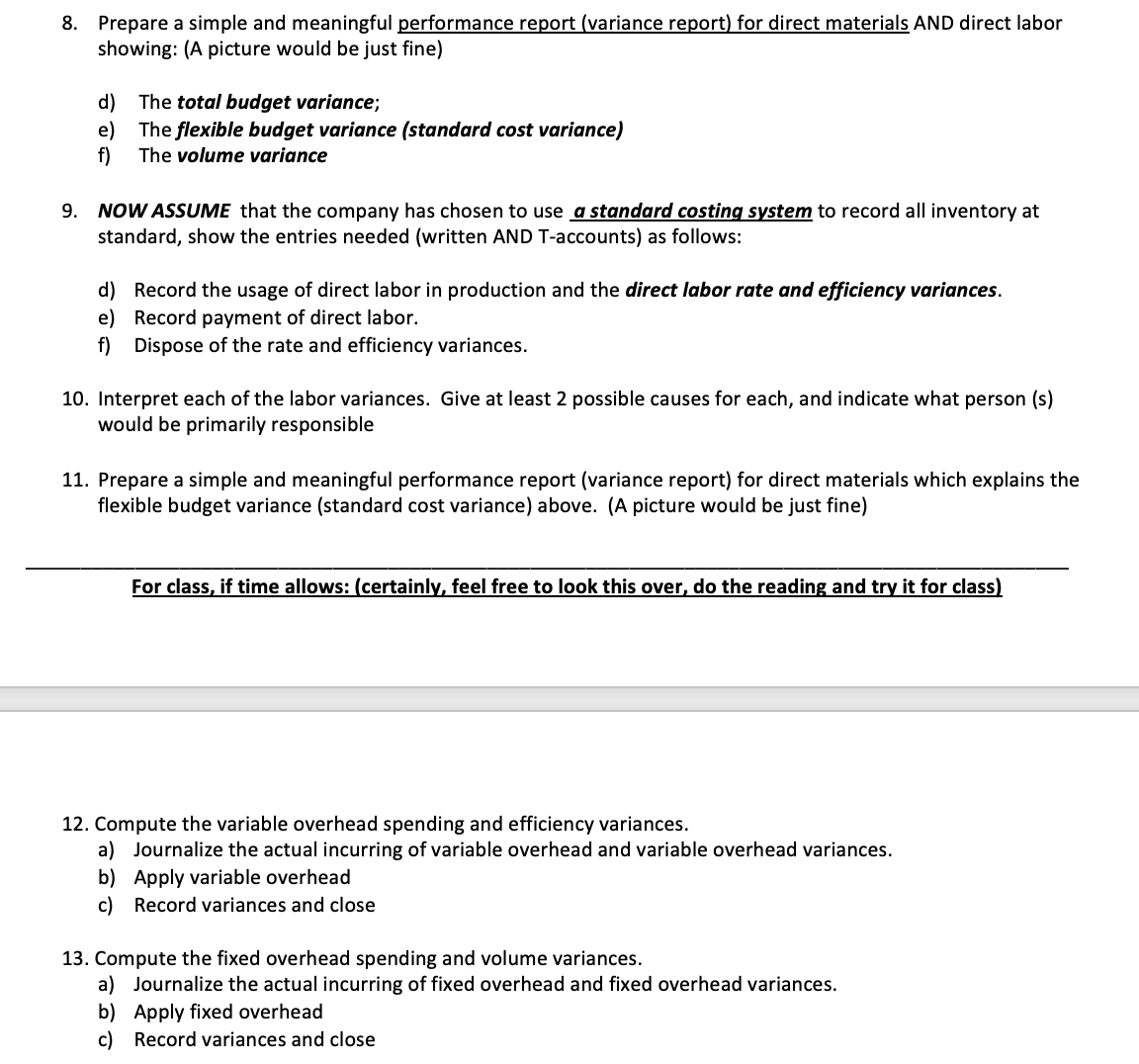

MISSOURI CORP. manufactures widgets. The materials used for the widgets are inexpensive, but the process is very labor intensive. The supervisor decided to use cheaper labor this period to see whether costs could be reduced. You have been asked to prepare a report about how effective operations had been during the month of October. The following standards have been established in connection with the production of one widget (standard costs per unit): Cost per unit Direct materials Direct labor 3 lbs. @ $12 per lb. $36 5 hrs @ $15 per hr $75 Factory overhead: Variable Fixed $3 per direct labor hr $15 $4 per direct labor hr ($20 per unit)) $20 $146 Overhead (fixed and variable) is applied on the basis of direct labor hours. Estimated production for the month was 8,000 widgets, or 40,000 labor hours. During October, the company actually produced 7,800 widgets and the records showed the following: Direct materials purchased Direct materials used Direct labor Variable overhead Fixed overhead 23,100 lbs @ 23,100 lbs @ $12.60 40,100 hours @ $14.60 $119,000 $180,000 Note: The quantity purchased was exactly equal to the quantity used. The company's policy is to record direct materials price variances at the time the materials are purchased. REQUIRED: DIRECT MATERIALS 1. Assume the company uses normal costing. Record the journal entries for direct materials (T-accounts preferred): a) Record the actual purchase of materials b) Record the usage of materials 2. Prepare a simple and meaningful performance report (variance report) for direct materials AND direct labor showing: (A picture would be just fine) a) The total budget variance; b) The flexible budget variance (Standard Cost Variance) c) The volume variance 3. NOW ASSUME that the company has chosen to use a standard costing system to record all inventory at standard, show the entries needed (written AND T-accounts) as follows: a) Record the actual purchase of materials on account and the price variance. b) Record the usage of materials during the period and the usage variance. c) Dispose of the price and usage variances. 4. Interpret each of the direct materials variances. Give at least 2 possible causes for each, and indicate what person (s) would be primarily responsible. 5. Prepare a simple and meaningful performance report (variance report) for direct materials which explains the flexible budget variance (standard cost variance) above. (A picture would be just fine) 6. For this requirement only - how would your variances and entries be different if, instead of purchasing 23,100 lbs per above, the company purchased 30,000 lbs, but only used 23,100 per above. Re-compute any variances and journal entries from #3 using this assumption. DIRECT LABOR 7. Assume the company uses normal costing. Record the journal entries for direct labor (T-accounts preferred): a) Usage of direct labor b) Payment of direct labor 8. Prepare a simple and meaningful performance report (variance report) for direct materials AND direct labor showing: (A picture would be just fine) d) The total budget variance; e) The flexible budget variance (standard cost variance) f) The volume variance 9. NOW ASSUME that the company has chosen to use a standard costing system to record all inventory at standard, show the entries needed (written AND T-accounts) as follows: d) Record the usage of direct labor in production and the direct labor rate and efficiency variances. e) Record payment of direct labor. f) Dispose of the rate and efficiency variances. 10. Interpret each of the labor variances. Give at least 2 possible causes for each, and indicate what person (s) would be primarily responsible 11. Prepare a simple and meaningful performance report (variance report) for direct materials which explains the flexible budget variance (standard cost variance) above. (A picture would be just fine) For class, if time allows: (certainly, feel free to look this over, do the reading and try it for class) 12. Compute the variable overhead spending and efficiency variances. a) Journalize the actual incurring of variable overhead and variable overhead variances. b) Apply variable overhead c) Record variances and close 13. Compute the fixed overhead spending and volume variances. a) Journalize the actual incurring of fixed overhead and fixed overhead variances. b) Apply fixed overhead c) Record variances and close

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started