Question

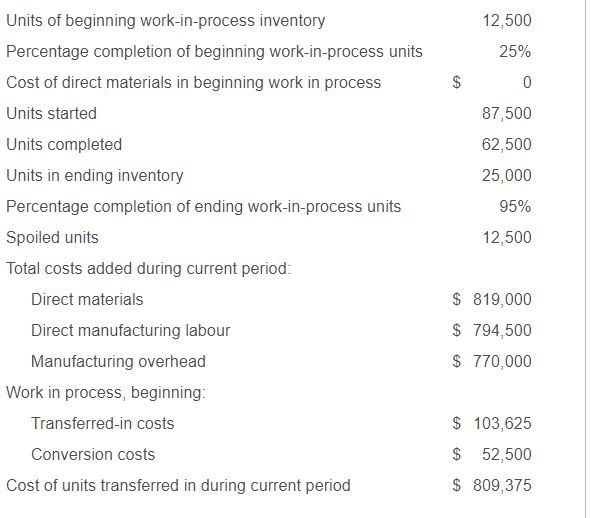

Manufacturing is a furniture manufacturer with two departments: Moulding and Finishing. The company uses the weighted-average method of process costing. In August, the following data

Manufacturing is a furniture manufacturer with two departments: Moulding and Finishing. The company uses the weighted-average method of process costing. In August, the following data were recorded for the Finishing department:

Conversion costs are added evenly during the process. Direct materials costs are added when production is 90% complete. The inspection point is at the 80% stage of production. Normal spoilage is 10% of all good units that pass inspection. Spoiled units are disposed of at zero net disposal value.

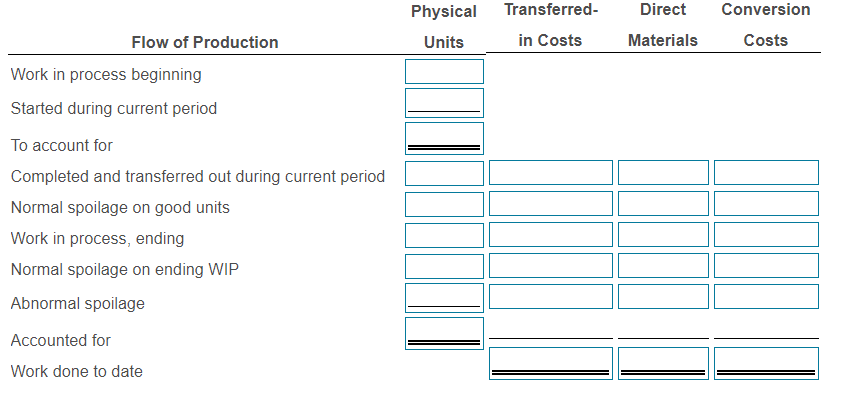

Requirement #1 For each cost category, calculate equivalent units. Show physical units in the first column of your schedule.

Enter the physical units in first, then calculate the equivalent units. (Enter an amount in each input cell. If the balance is zero, enter "0".)

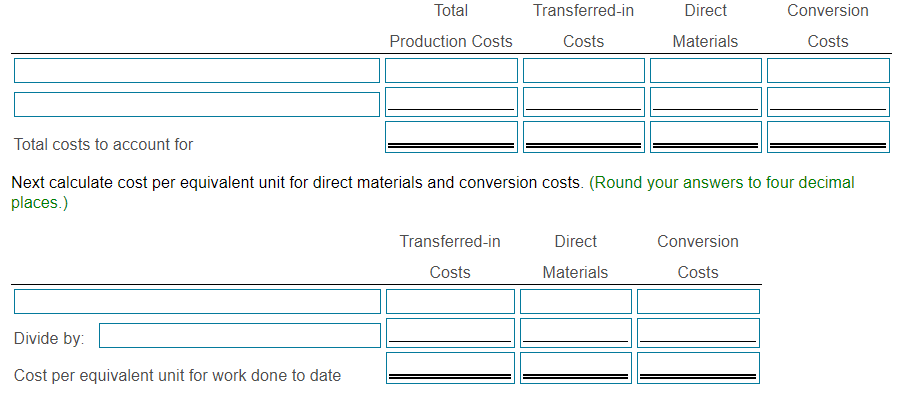

Summarize total costs to account for, calculate cost per equivalent unit for each cost category, and assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

Begin by summarizing the total costs to account for.

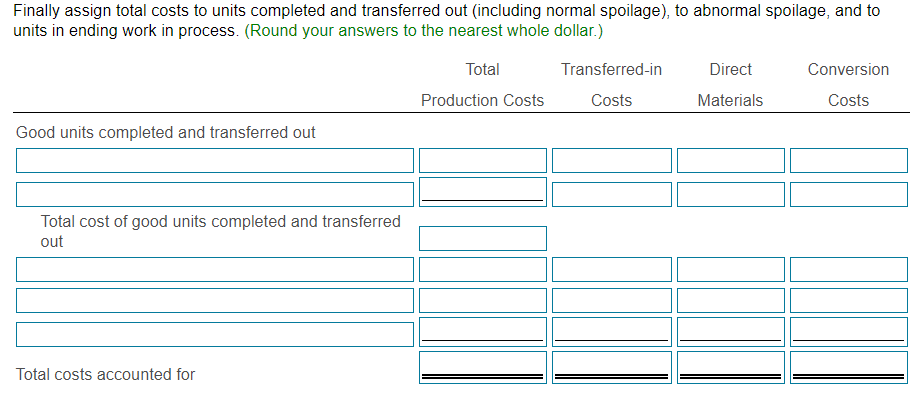

Finally assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. (Round your answers to the nearest whole dollar.)

Finally assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. (Round your answers to the nearest whole dollar.)

12,500 25% $ 0 87,500 62,500 25,000 95% 12,500 Units of beginning work-in-process inventory Percentage completion of beginning work-in-process units Cost of direct materials in beginning work in process Units started Units completed Units in ending inventory Percentage completion of ending work-in-process units Spoiled units Total costs added during current period: Direct materials Direct manufacturing labour Manufacturing overhead Work in process, beginning: Transferred-in costs Conversion costs Cost of units transferred in during current period $ 819,000 $ 794,500 $ 770,000 $ 103,625 $ 52,500 $ 809,375 Direct Physical Units Transferred- in Costs Conversion Costs Materials Flow of Production Work in process beginning Started during current period To account for Completed and transferred out during current period Normal spoilage on good units Work in process, ending Normal spoilage on ending WIP Abnormal spoilage Accounted for Work done to date Total Transferred-in Direct Conversion Production Costs Costs Materials Costs Total costs to account for Next calculate cost per equivalent unit for direct materials and conversion costs. (Round your answers to four decimal places.) Transferred-in Direct Conversion Costs Materials Costs Divide by: Cost per equivalent unit for work done to date Finally assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. (Round your answers to the nearest whole dollar.) Total Transferred-in Direct Conversion Production Costs Costs Materials Costs Good units completed and transferred out Total cost of good units completed and transferred out Total costs accounted for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started