Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (8 marks) Agora Corporation, a private Canadian entity using ASPE, has factory equipment that has a cost of $7,500,000 and accumulated depreciation of

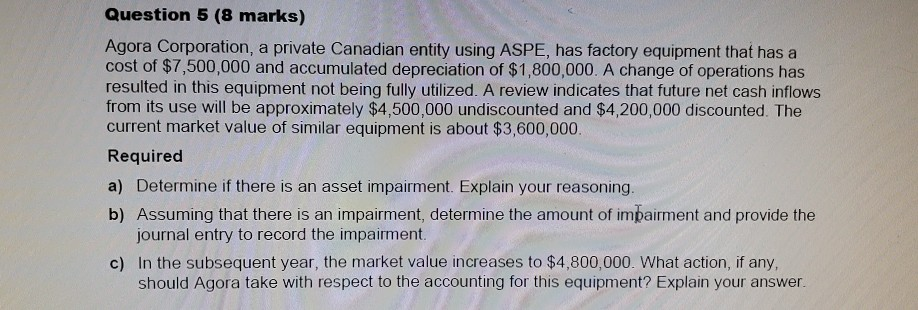

Question 5 (8 marks) Agora Corporation, a private Canadian entity using ASPE, has factory equipment that has a cost of $7,500,000 and accumulated depreciation of $1,800,000. A change of operations has resulted in this equipment not being fully utilized. A review indicates that future net cash inflows from its use will be approximately $4,500,000 undiscounted and $4,200,000 discounted. The current market value of similar equipment is about $3,600,000 Required a) Determine if there is an asset impairment. Explain your reasoning. b) Assuming that there is an impairment, determine the amount of impairment and provide the journal entry to record the impairment. c) In the subsequent year, the market value increases to $4,800,000. What action, if any, should Agora take with respect to the accounting for this equipment? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started