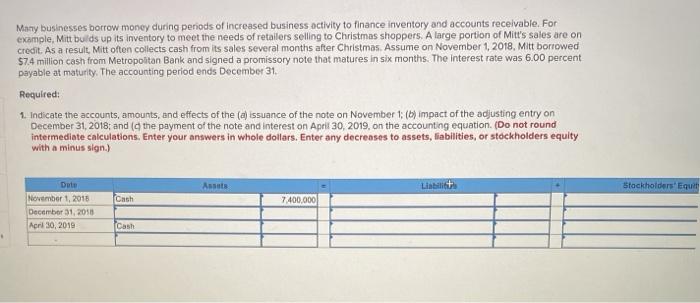

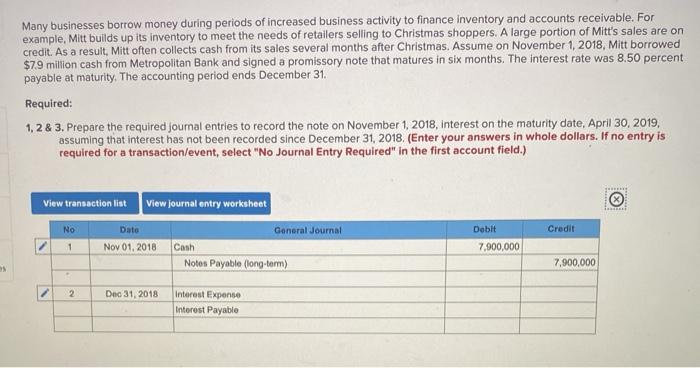

Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. For example, Mitt builds up its inventory to meet the needs of retailers selling to Christmas shoppers. A large portion of Mitt's sales are on credit. As a result, Mitt often collects cash from its sales several months after Christmas. Assume on November 1, 2018, Mitt borrowed 57.4 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 6.00 percent payable at maturity. The accounting period ends December 31. Required: 1. Indicate the accounts, amounts, and effects of the (a) issuance of the note on November 1: (b) impact of the adjusting entry on December 31, 2018; and (the payment of the note and interest on April 30, 2019, on the accounting equation. (Do not round intermediate calculations. Enter your answers in whole dollars. Enter any decreases to assets, liabilities, or stockholders equity with a minus sign.) Assets Liabilit Stackholders' Equi Cash Date November 1, 2015 December 31, 2017 April 30, 2010 7.400,000 Cash . Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. For example, Mitt builds up its inventory to meet the needs of retailers selling to Christmas shoppers. A large portion of Mitt's sales are on credit. As a result, Mitt often collects cash from its sales several months after Christmas. Assume on November 1, 2018, Mitt borrowed $7.9 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 8.50 percent payable at maturity. The accounting period ends December 31. Required: 1, 2 & 3. Prepare the required journal entries to record the note on November 1, 2018, Interest on the maturity date, April 30, 2019, assuming that interest has not been recorded since December 31, 2018. (Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Dato General Journal 1 Nov 01, 2018 Cash Notos Payable (long-term) Credit Dobit 7,900,000 7,900,000 2 Dec 31, 2018 Interest Expense Interest Payable