Question

Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. Target Corporation is one of Americas largest general merchandise

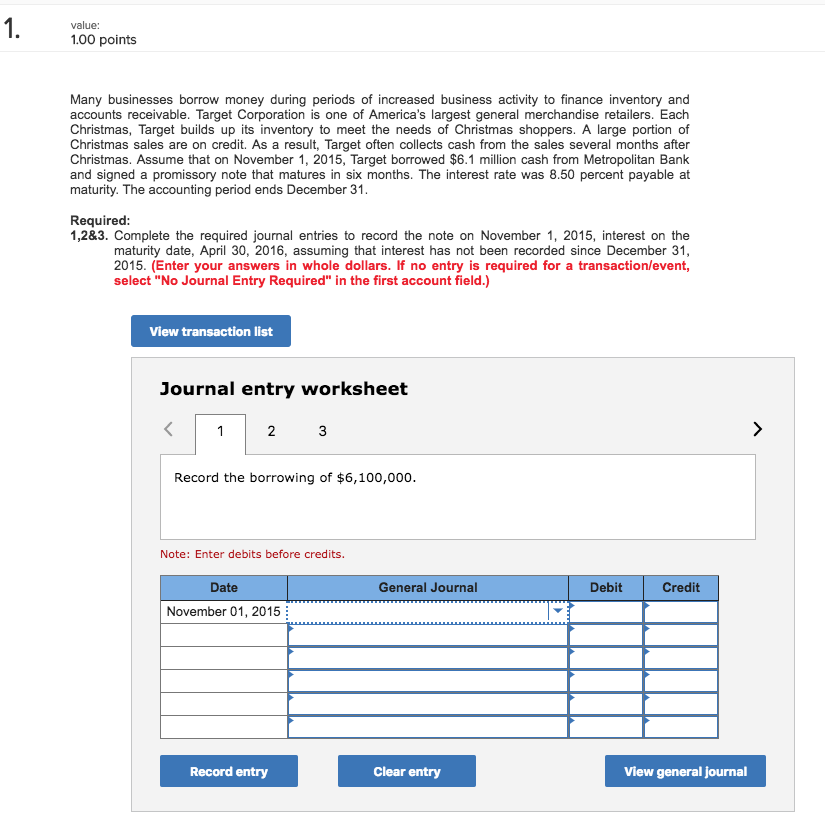

Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. Target Corporation is one of Americas largest general merchandise retailers. Each Christmas, Target builds up its inventory to meet the needs of Christmas shoppers. A large portion of Christmas sales are on credit. As a result, Target often collects cash from the sales several months after Christmas. Assume that on November 1, 2015, Target borrowed $6.1 million cash from Metropolitan Bank and signed a promissory note that matures in six months. The interest rate was 8.50 percent payable at maturity. The accounting period ends December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started