Answered step by step

Verified Expert Solution

Question

1 Approved Answer

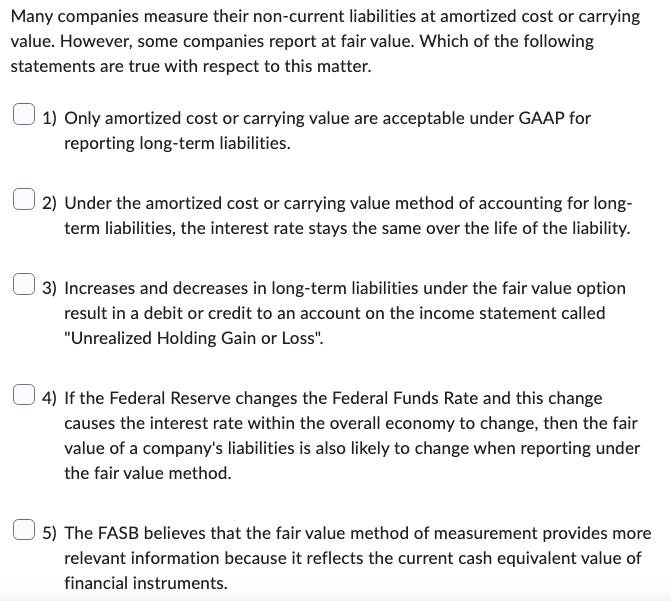

Many companies measure their non - current liabilities at amortized cost or carrying value. However, some companies report at fair value. Which of the following

Many companies measure their noncurrent liabilities at amortized cost or carrying

value. However, some companies report at fair value. Which of the following

statements are true with respect to this matter.

Only amortized cost or carrying value are acceptable under GAAP for

reporting longterm liabilities.

Under the amortized cost or carrying value method of accounting for long

term liabilities, the interest rate stays the same over the life of the liability.

Increases and decreases in longterm liabilities under the fair value option

result in a debit or credit to an account on the income statement called

"Unrealized Holding Gain or Loss".

If the Federal Reserve changes the Federal Funds Rate and this change

causes the interest rate within the overall economy to change, then the fair

value of a company's liabilities is also likely to change when reporting under

the fair value method.

The FASB believes that the fair value method of measurement provides more

relevant information because it reflects the current cash equivalent value of

financial instruments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started