Answered step by step

Verified Expert Solution

Question

1 Approved Answer

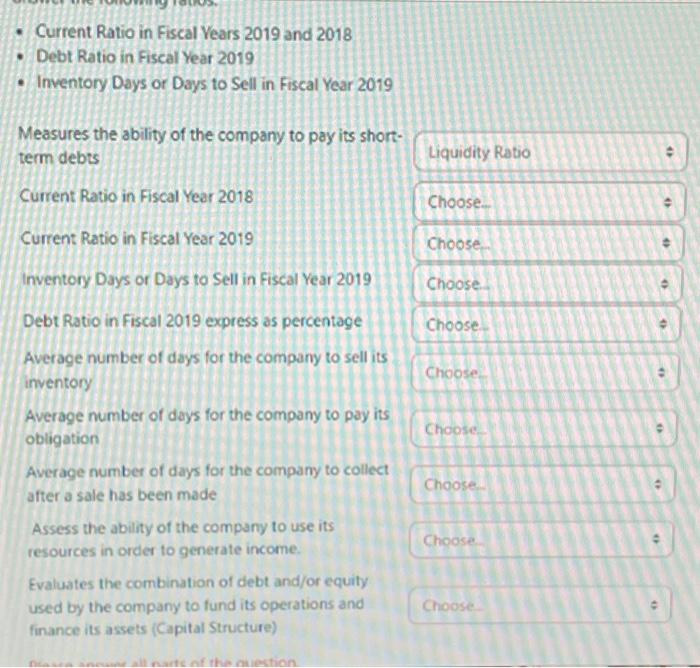

many have posted this questions but this drop downlist is the only option: I tried to answer but i dont know where my answer hit,

many have posted this questions but this drop downlist is the only option:

I tried to answer but i dont know where my answer hit, i hope the expert can answer. what do you think? where di i go wrong

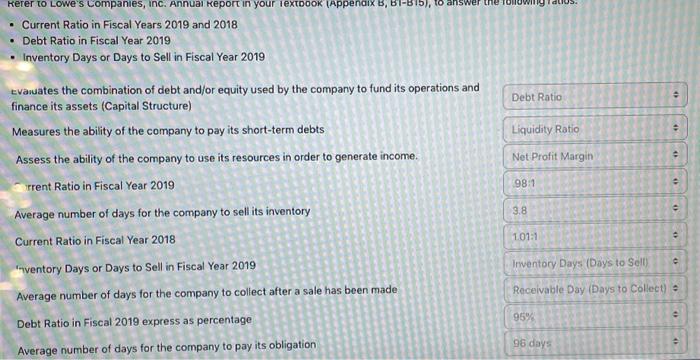

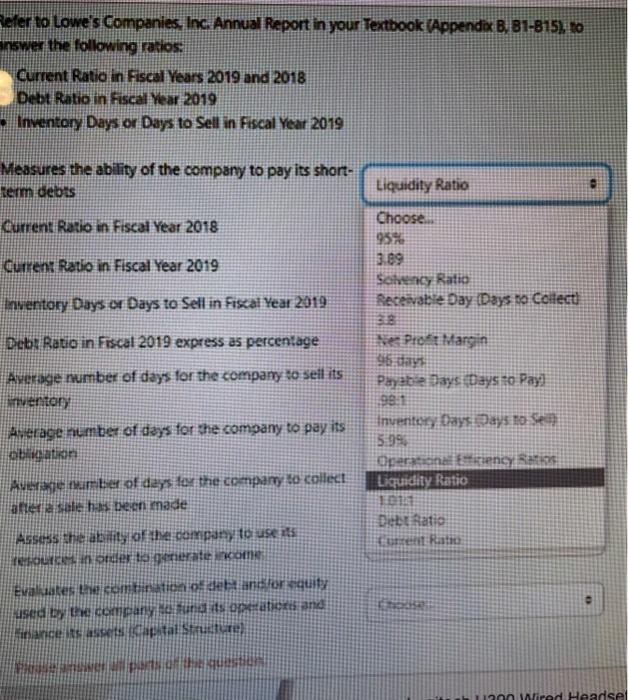

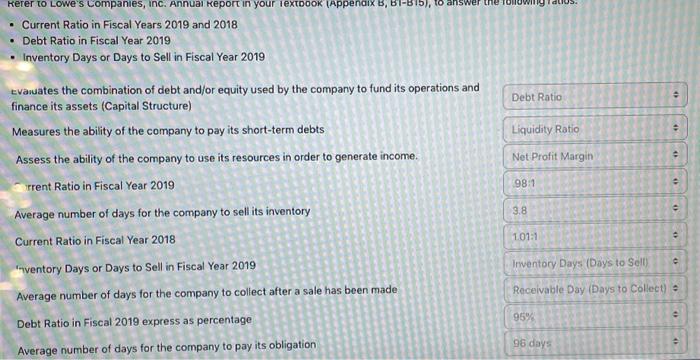

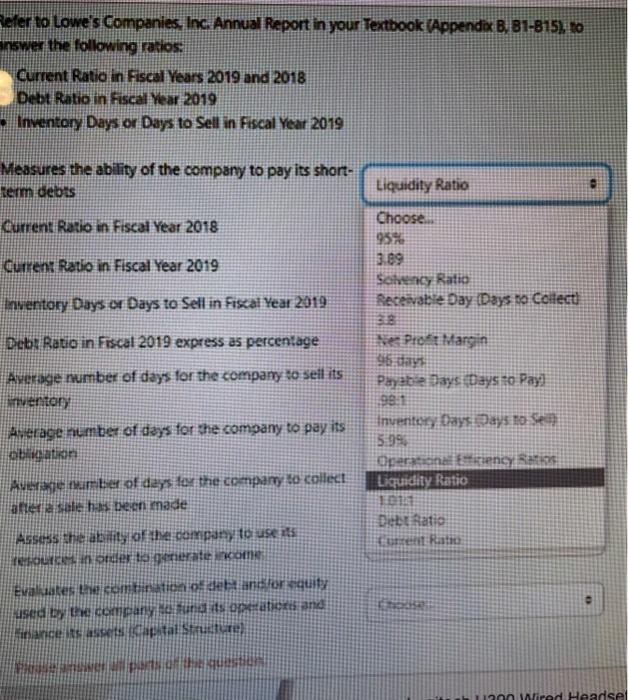

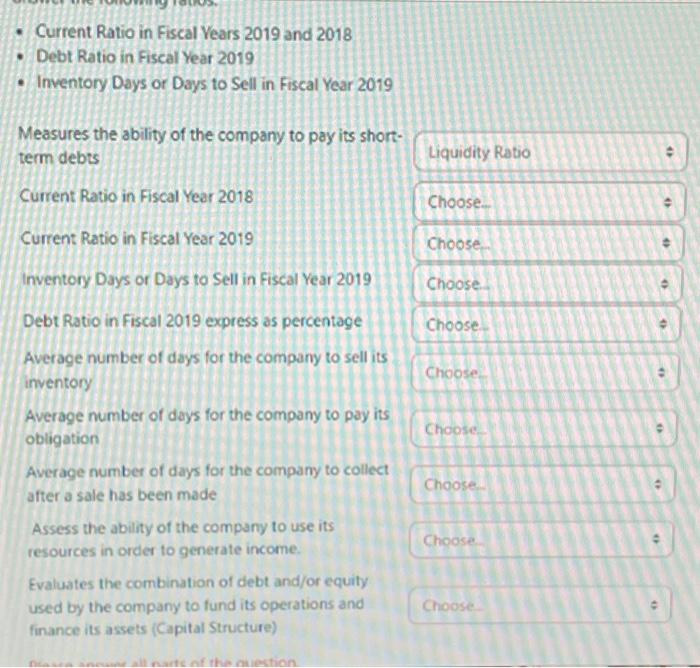

first photo my answer , there is wrong amd right. can my answer be corrected pls.

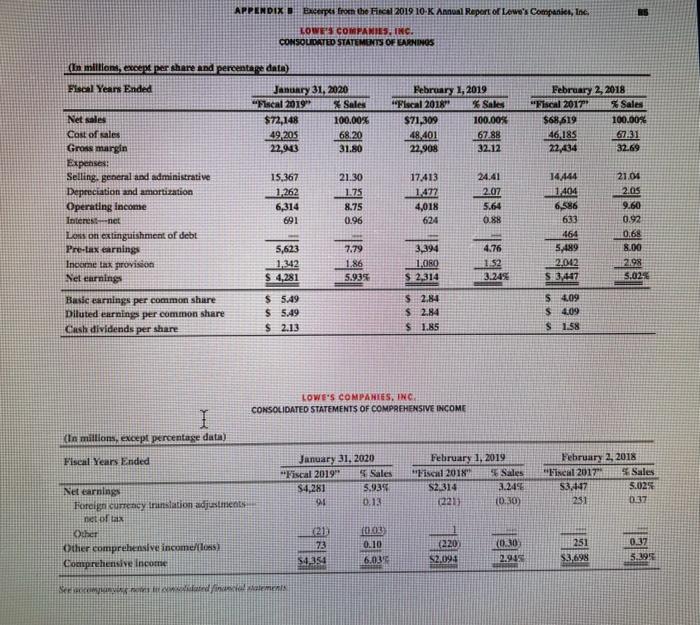

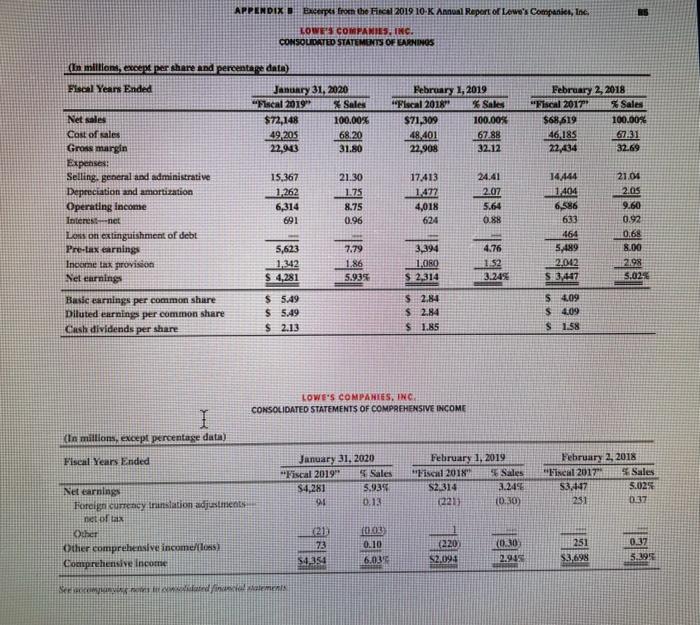

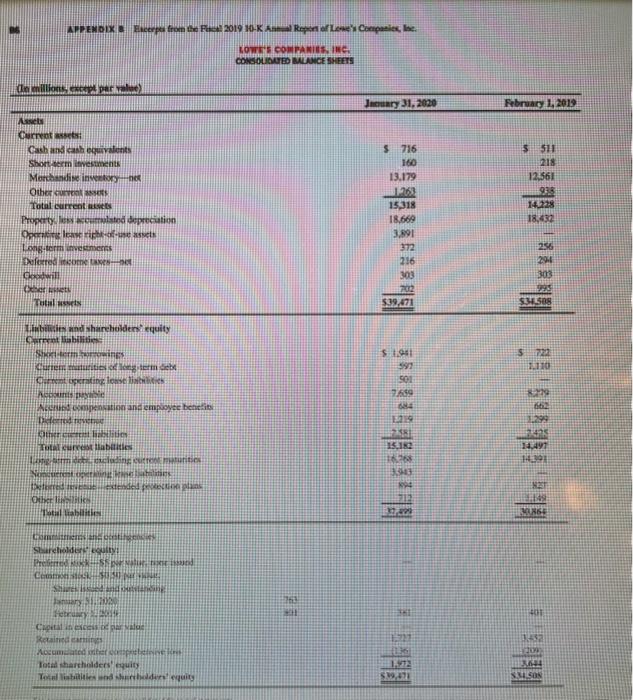

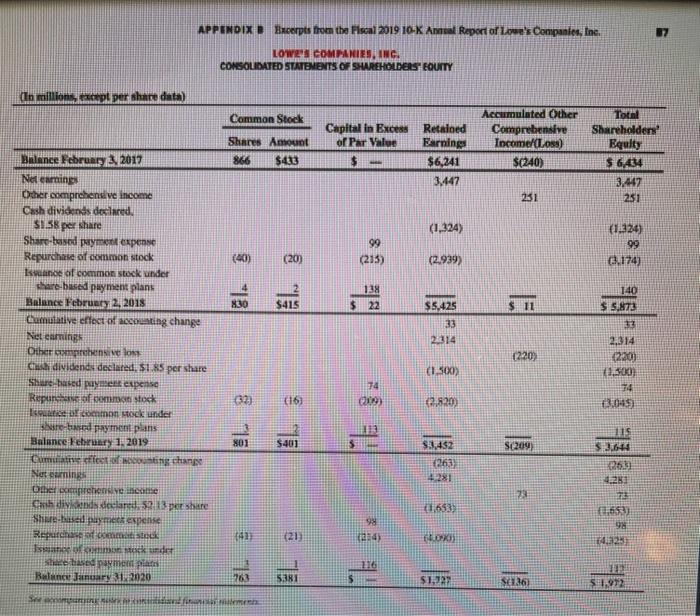

continuation of the question. annual reports of Lowe's Companies, Inc.

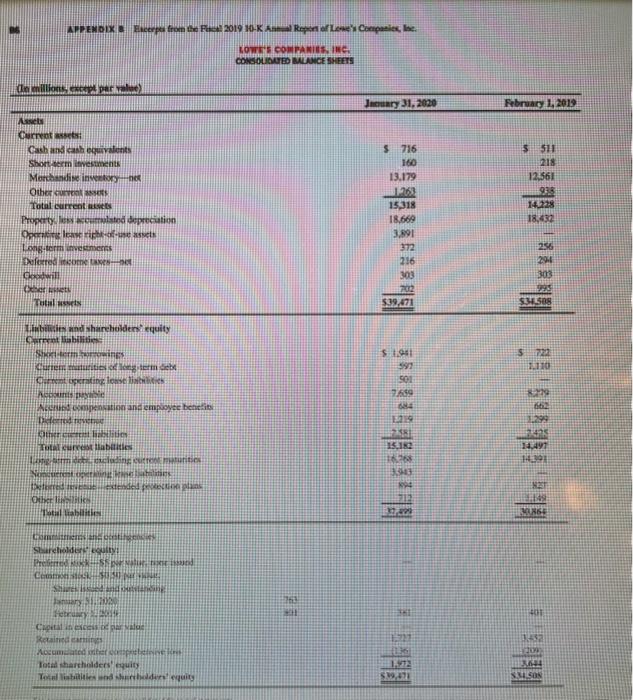

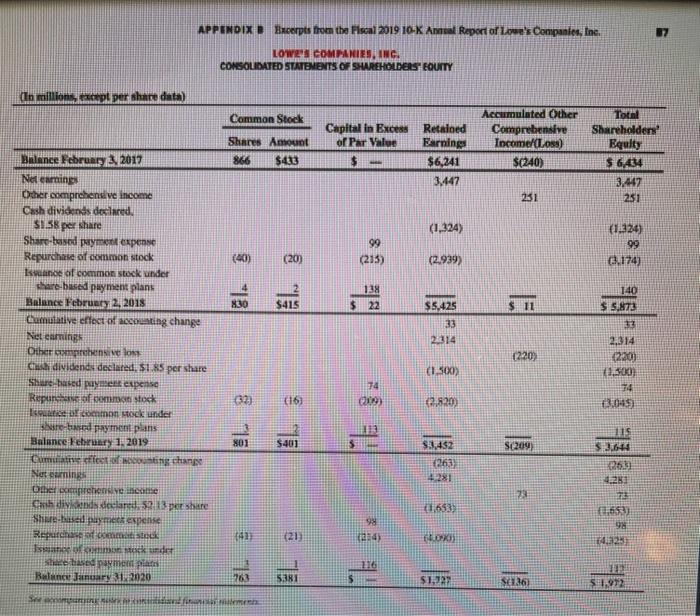

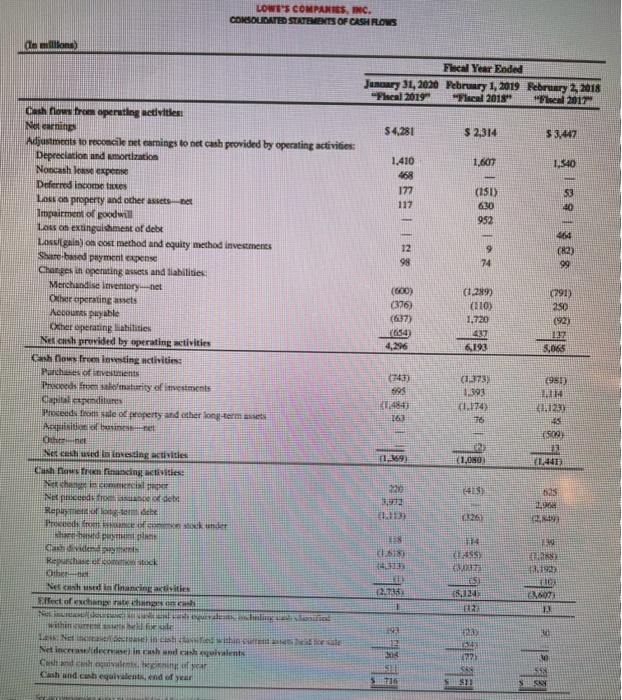

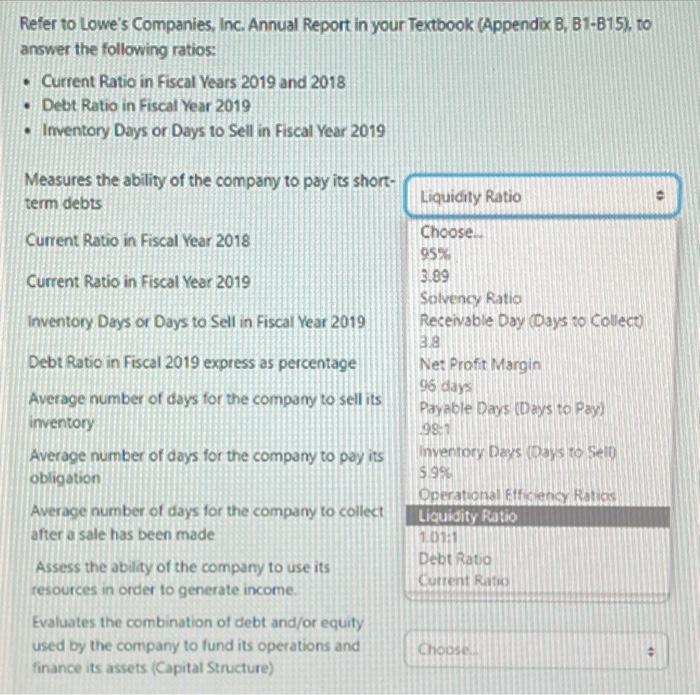

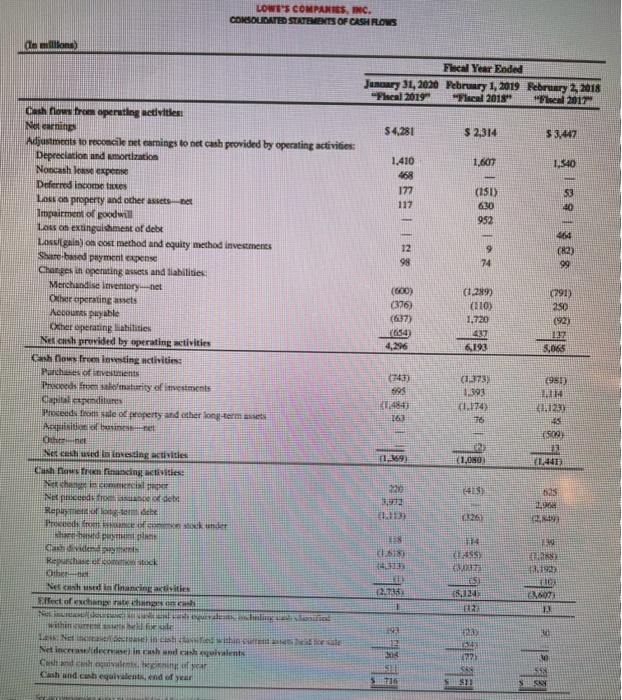

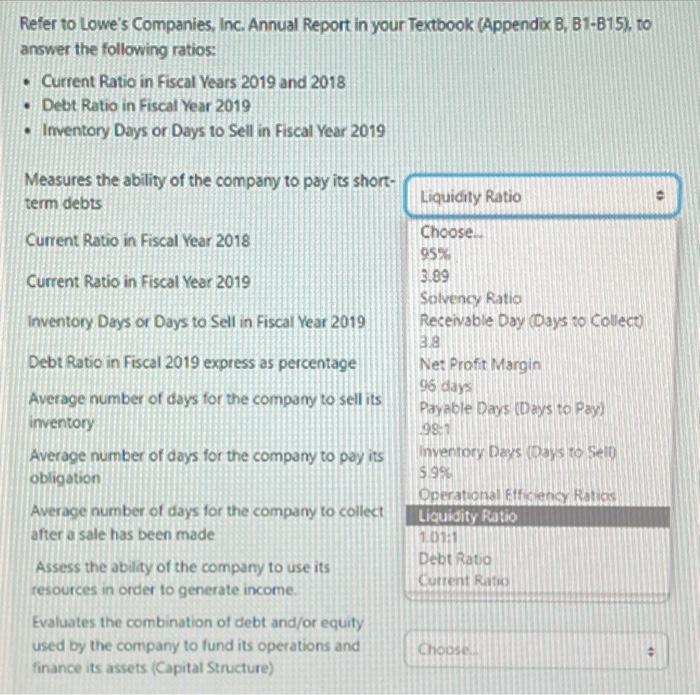

7. lowes compuns, ime. (In millions, except per share data) Low's compautes, nec, Lefer to Lowe's Companies, Inc. Annual Report in your Textbook (Appendix B, 81-815), to the following ratios: Current Ratio in Fisel Years 2019 and 2018 Debt Ratio in fiscal Year 2019 Inventory Days or Days to Sell in Fiscal Year 2019 Measures the ability of the company to pay its shortterm debts Current Ratio in Fiscal Year 2018 Current Ratio in Fiscal Year 2019 inentory Days or Days to Sell in Fiscal Year 2019 Debt Ratio in Fracal 2019 express as percentage A Ferage number of days for the company to seil its mientory A. Erage number of days for the company to pay its obication afte a sali has been made Assess the ab ity of the company to use ils Evalates the comtintion of debt ansifor satity used by the company fofind its ope-atictis and Lowers colnpawis, ike. consou parto starkmbis of yevmes Refer to Lowe's Companies, Inc. Annual Report in your Textbook (Appendix B, B1-B15), to answer the following ratios: - Current Ratio in Fiscal Years 2019 and 2018 - Debt Ratio in Fiscal Year 2019 - Inventory Days or Days to Sell in Fiscal Year 2019 Measures the ability of the company to pay its shortterm debts Current Ratio in Fiscal Year 2018 Current Ratio in Fiscal Year 2019 Inventory Days or Days to Sell in Fiscal Kear 2019 Debt Ratio in Fiscal 2019 express as percentage Average number of days for the company to seil its inventory Average number of days for the company to pay its obligation Average number of days for the company to collext after a sale has been made Assess the ability of the company to use its resources in order to generate income. Evaluates the combination of debt and/or equity used by the company to fund its operations and finance its assets (Capital Structure) - Current Ratio in Fiscal Years 2019 and 2018 - Debt Ratio in Fiscal Year 2019 - Inventory Days or Days to Sell in Fiscal Year 2019 Evaruates the combination of debt and/or equity used by the company to fund its operations and finance its assets (Capital Structure) Measures the ability of the company to pay its short-term debts Assess the ability of the company to use its resources in order to generate income. rrent Ratio in Fiscal Year 2019 Average number of days for the company to sell its inventory Current Ratio in Fiscal Year 2018 'iventory Days or Days to Sell in Fiscal Year 2019 Average number of days for the company to collect after a sale has been made Debt Ratio in Fiscal 2019 express as percentage Average number of days for the company to pay its obligation - Current Ratio in Fiscal Years 2019 and 2018 - Debt Ratio in Fiscal Year 2019 - Inventory Days or Days to Sell in Fiscal Year 2019 Measures the ability of the company to pay its shortterm debts Current Ratio in Fiscal Year 2018 Current Ratio in Fiscal Year 2019 Inventory Days or Days to Sell in Fiscal Year 2019 Debt Ratio in Fiscal 2019 express as percentage Average number of days for the company to sell its inventory Average number of days for the company to pay its obligation Average number of days for the company to collect after a sale has been made Assess the ability of the company to use its resources in order to generate income. Evaluates the combination of debt and/or equity used by the company to fund its operations and finance its assets (Capital Structure) resisets Charrent assetsi Cach and cash eowivalions Short werm invesments Morkandise invertor not Other surant assets: Total current wists Property les aceralated spreciation Longtermi invecties: oviored insome taxes - nat Tatal assets Iitmbieties nod rhareheldecsi equity ompre siabiline: Acopuris positie Totar curcos tiabetitios 5716 160 13.179 15,3181263 15,318 18,669 3.891 5511 218 12.561 14228935 18,432 18,432 2582843035.90554.508 orber listic ratial trabilitio Szirchober ecuiry: tatary sine 3+x3 Cigetal incices as par vas init Stisi 5 i2 sn 1110 501 7.599 os 29 15,182281=1+4973475 Rained carnitys Iotal thartholdecr' equity current ratio in fiscal years 2019 and 2018

debt ratio in fiscal year 2019

inventory days or days to sell in fiscal year 2019. (drop down list is the option to get the right match to the question) Thank you team chegg!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started