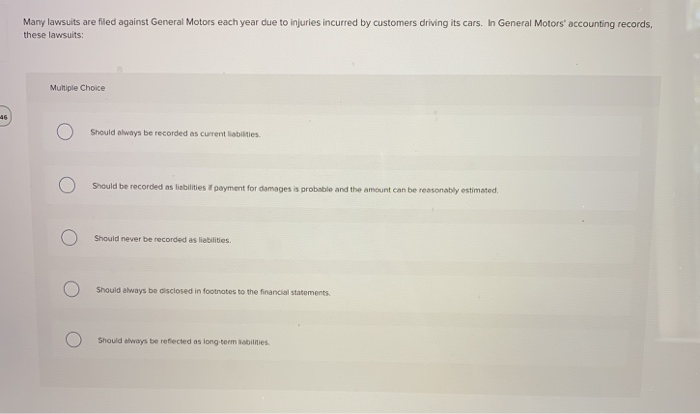

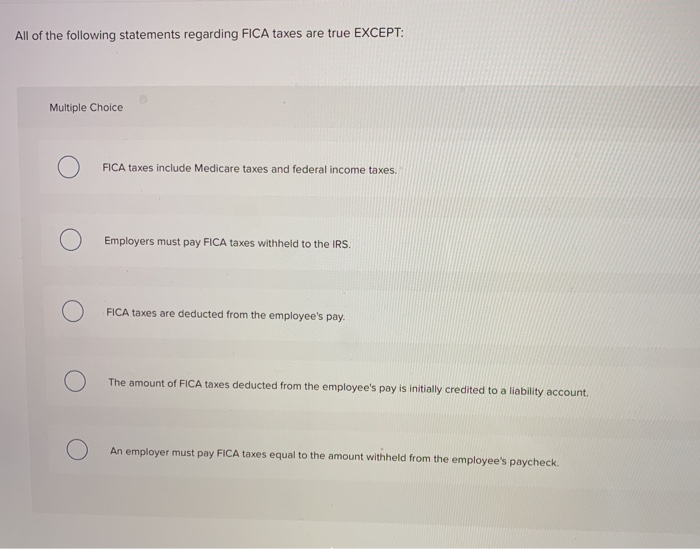

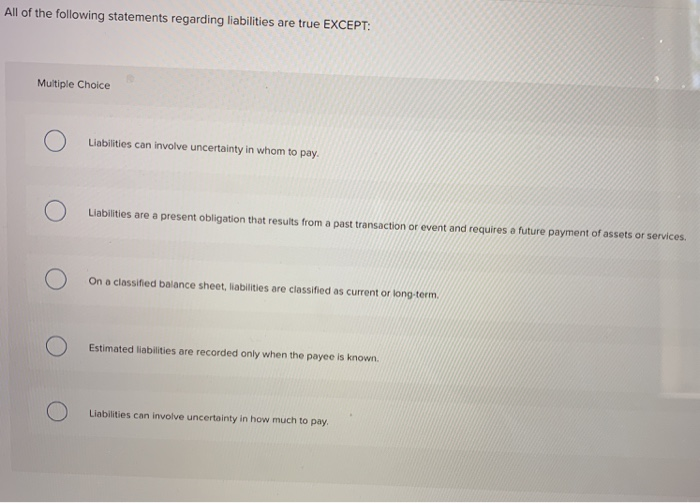

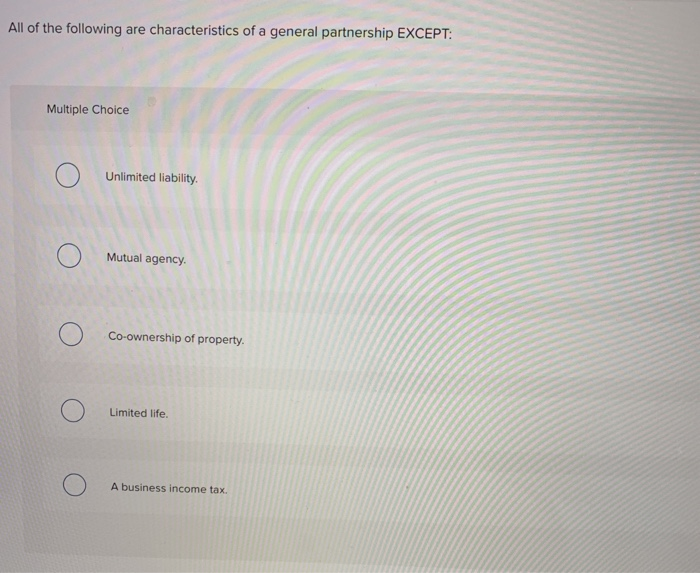

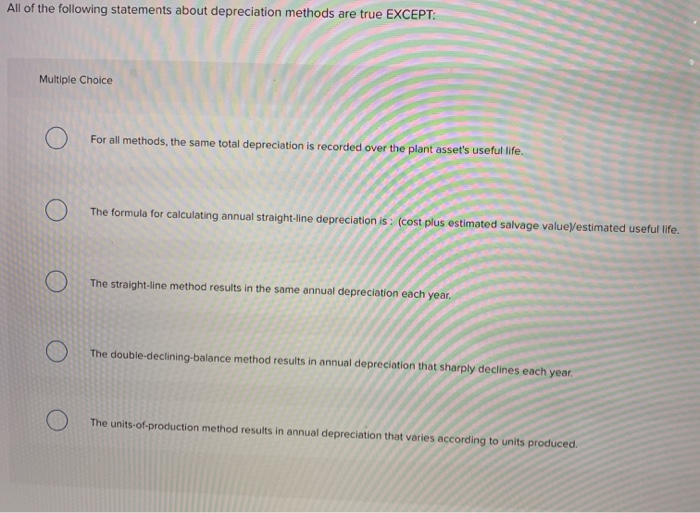

Many lawsuits are filed against General Motors each year due to injuries incurred by customers driving its cars. In General Motors' accounting records, these lawsuits Multiple Choice O Should always be recorded as current liabilities o Should be recorded as liabilities payment for damages is probable and the amount can be reasonably estimated o Should never be recorded as liabilities o Should always be disclosed in footnotes to the financial statements o o O Should be reflected as long term abilities All of the following statements regarding FICA taxes are true EXCEPT: Multiple Choice O ) FICA taxes include Medicare taxes and federal income taxes. O Employers must pay FICA taxes withheld to the IRS. O ) FICA taxes are deducted from the employee's pay. O The amount of FICA taxes deducted from the employee's pay is initially credited to a liability account. O An employer must pay FICA taxes equal to the amount withheld from the employee's paycheck. All of the following statements regarding liabilities are true EXCEPT: Multiple Choice Liabilities can involve uncertainty in whom to pay. O Liabilities are a present obligation that results from a past transaction or event and requires a future payment of assets or services O O On a classified balance sheet, liabilities are classified as current or long-term. O Estimated liabilities are recorded only when the payee is known O O Liabilities can involve uncertainty in how much to pay All of the following are characteristics of a general partnership EXCEPT: Multiple Choice Unlimited liability. Mutual agency. Co-ownership of property. Limited life. A business income tax. All of the following statements about depreciation methods are true EXCEPT: Multiple Choice O For all methods, the same total depreciation is recorded over the plant asset's useful life. 0 The formula for calculating annual straight-line depreciation is: (cost plus estimated salvage value estimated useful life. 0 The straight-line method results in the same annual depreciation each year. 0 The double-declining balance method results in annual depreciation that sharply declines each year, 0 The units-of-production method results in annual depreciation that varies according to units produced. Many lawsuits are filed against General Motors each year due to injuries incurred by customers driving its cars. In General Motors' accounting records, these lawsuits Multiple Choice O Should always be recorded as current liabilities o Should be recorded as liabilities payment for damages is probable and the amount can be reasonably estimated o Should never be recorded as liabilities o Should always be disclosed in footnotes to the financial statements o o O Should be reflected as long term abilities All of the following statements regarding FICA taxes are true EXCEPT: Multiple Choice O ) FICA taxes include Medicare taxes and federal income taxes. O Employers must pay FICA taxes withheld to the IRS. O ) FICA taxes are deducted from the employee's pay. O The amount of FICA taxes deducted from the employee's pay is initially credited to a liability account. O An employer must pay FICA taxes equal to the amount withheld from the employee's paycheck. All of the following statements regarding liabilities are true EXCEPT: Multiple Choice Liabilities can involve uncertainty in whom to pay. O Liabilities are a present obligation that results from a past transaction or event and requires a future payment of assets or services O O On a classified balance sheet, liabilities are classified as current or long-term. O Estimated liabilities are recorded only when the payee is known O O Liabilities can involve uncertainty in how much to pay All of the following are characteristics of a general partnership EXCEPT: Multiple Choice Unlimited liability. Mutual agency. Co-ownership of property. Limited life. A business income tax. All of the following statements about depreciation methods are true EXCEPT: Multiple Choice O For all methods, the same total depreciation is recorded over the plant asset's useful life. 0 The formula for calculating annual straight-line depreciation is: (cost plus estimated salvage value estimated useful life. 0 The straight-line method results in the same annual depreciation each year. 0 The double-declining balance method results in annual depreciation that sharply declines each year, 0 The units-of-production method results in annual depreciation that varies according to units produced