Question

Many people count on tax returns for income to help them catch up on bills, buy something nice, etc. Lets say you claim head of

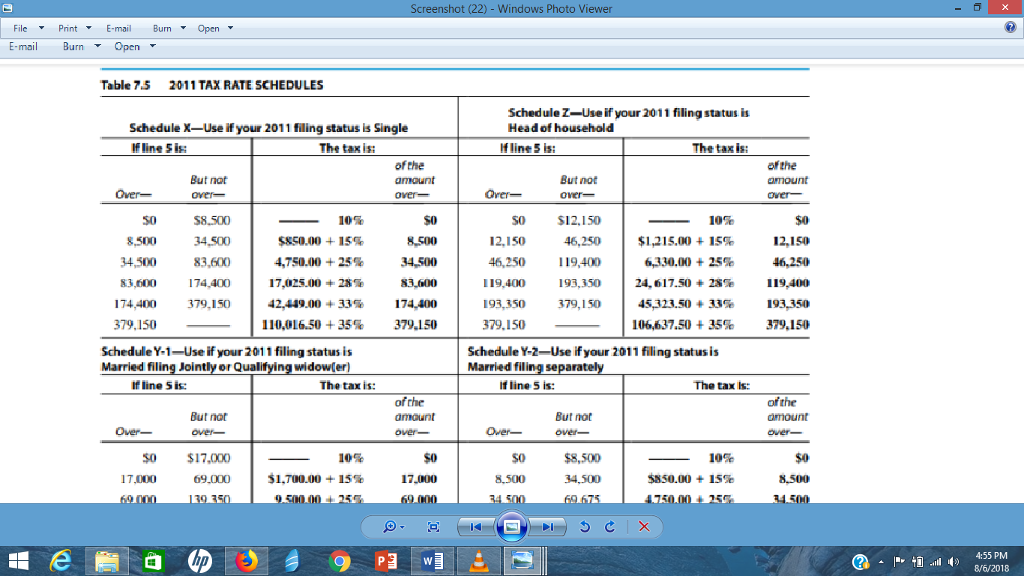

Many people count on tax returns for income to help them catch up on bills, buy something nice, etc. Lets say you claim head of household for tax purposes. With the new house though, your itemized deductions are $12,150. Annual gross wages are 57408. 11,100 in exemptions. Taxable income 34,158. Tax liability is 4698.70. Total montly payments are 1291.70. Federal withholding amount 529.92.

17)Determine if you will get a refund or have to pay the IRS after you file your taxes, and the amount of money. How much do you have to pay/get refunded?

I'm not sure if this table is needed for this problem, if not then disregard. I'm also not entirely certain what else is needed to answer this question.

Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started