Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Many tax items are subject to annual adjustments for inflation. These include tax brackets, retirement contributions, standard deductions, and many others. What effect do certain

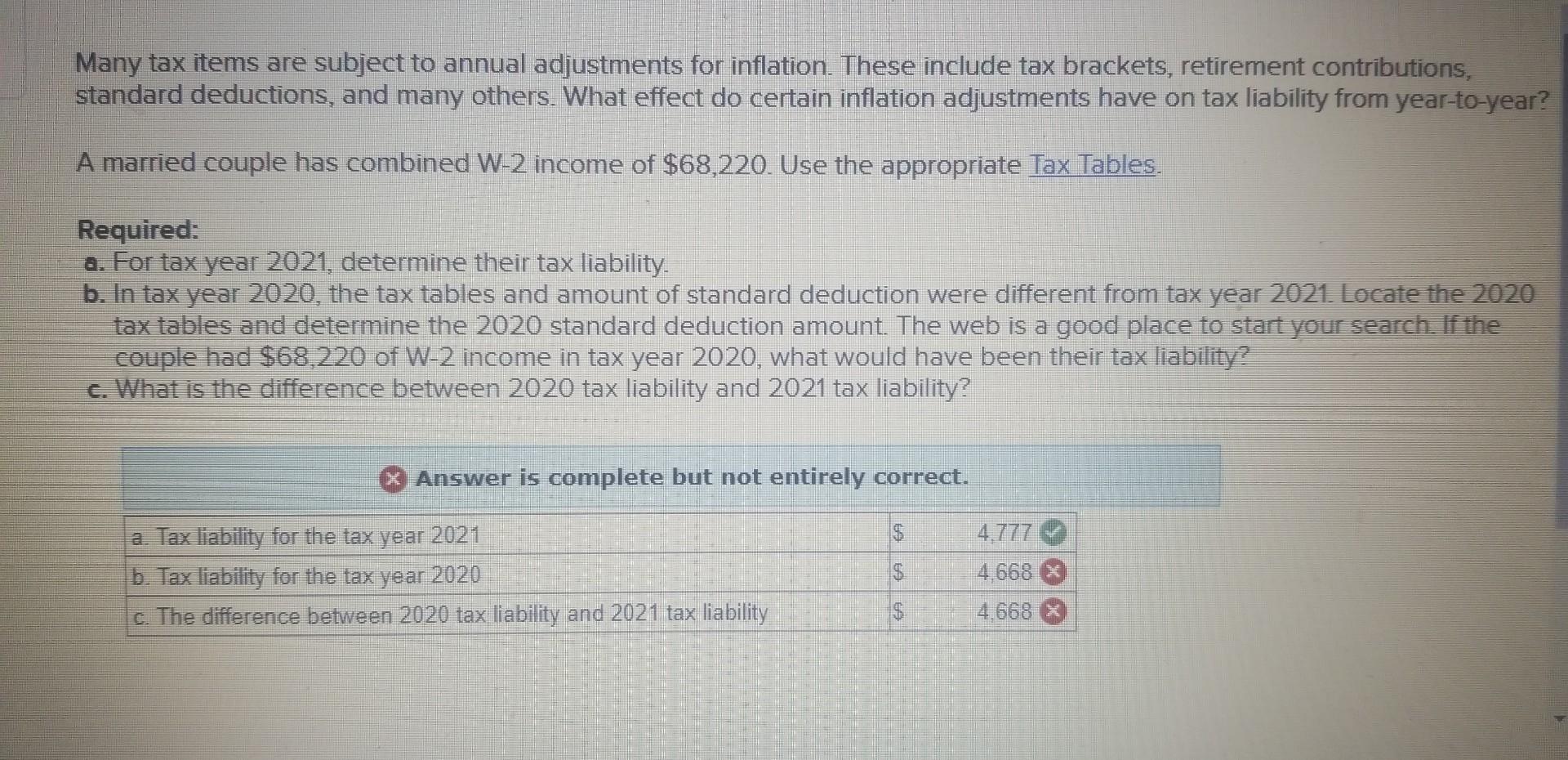

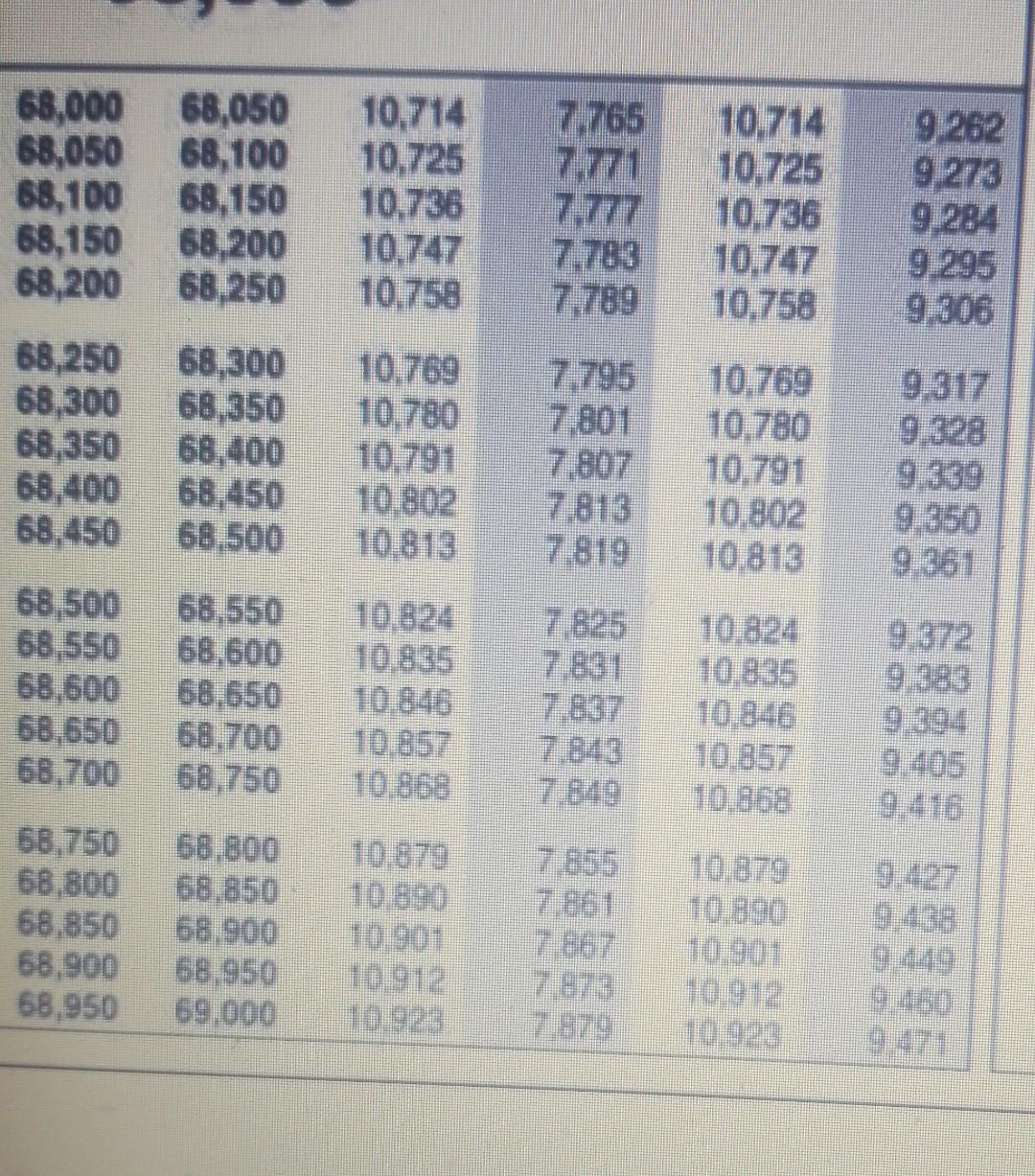

Many tax items are subject to annual adjustments for inflation. These include tax brackets, retirement contributions, standard deductions, and many others. What effect do certain inflation adjustments have on tax liability from year-to-year? A married couple has combined W-2 income of $68,220. Use the appropriate Tax Tables. Required: a. For tax year 2021 , determine their tax liability. b. In tax year 2020, the tax tables and amount of standard deduction were different from tax year 2021. Locate the 2020 tax tables and determine the 2020 standard deduction amount. The web is a good place to start your search. If the couple had $68,220 of W-2 income in tax year 2020 , what would have been their tax liability? c. What is the difference between 2020 tax liability and 2021 tax liability? d. How much of that difference is the result of changes to the tax tables? How much of that difference is the result of the change to the standard deduction? \begin{tabular}{lllllll} \hline 68,000 & 68,050 & 10,714 & 7,765 & 10,714 & 9,262 \\ 68,050 & 68,100 & 10,725 & 7,771 & 10,725 & 9,273 \\ 68,100 & 68,150 & 10,736 & 7,777 & 10,736 & 9,284 \\ 68,150 & 68,200 & 10,747 & 7,783 & 10,747 & 9,295 \\ 68,200 & 68,250 & 10,758 & 7,789 & 10,758 & 9,306 \\ 68,250 & 68,300 & 10,769 & 7,795 & 10,769 & 9,317 \\ 68,300 & 68,350 & 10,780 & 7,801 & 10,780 & 9,328 \\ 68,350 & 68,400 & 10,791 & 7,807 & 10,791 & 9,339 \\ 68,400 & 68,450 & 10,802 & 7,813 & 10,802 & 9,350 \\ 68,450 & 68,500 & 10,813 & 7,819 & 10,813 & 9,361 \\ 68,500 & 68,550 & 10,824 & 7,825 & 10,824 & 9,372 \\ 68,550 & 68,600 & 10,835 & 7,831 & 10,835 & 9,383 \\ 68,600 & 68,650 & 10,846 & 7,837 & 10,846 & 9,394 \\ 68,650 & 68,700 & 10,857 & 7,843 & 10,857 & 9,405 \\ 68,700 & 68,750 & 10,868 & 7,849 & 10,868 & 9,416 \\ 68,750 & 68,800 & 10,879 & 7,855 & 10,879 & 9,427 \\ 68,800 & 68,850 & 10,890 & 7,861 & 10,890 & 9,438 \\ 68,850 & 68,900 & 10,901 & 7,867 & 10,901 & 9449 \\ 68,900 & 68,950 & 10,912 & 7,873 & 10,912 & 9.460 \\ 68,950 & 69,000 & 10,923 & 7,879 & 10,923 & 9447 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started