Answered step by step

Verified Expert Solution

Question

1 Approved Answer

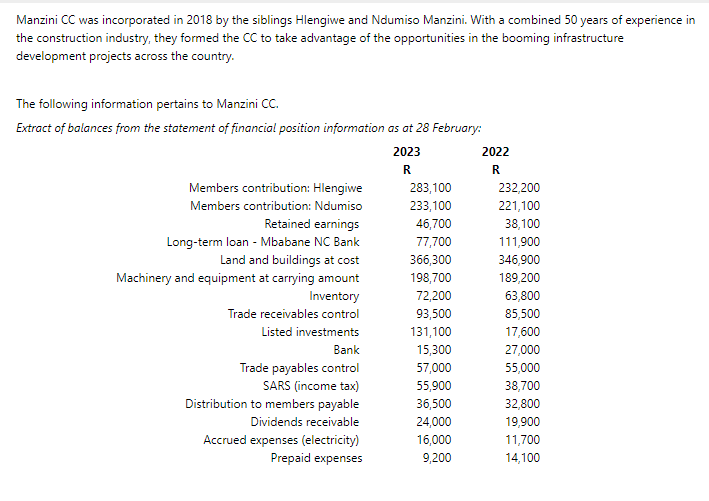

Manzini CC was incorporated in 2018 by the siblings Hlengiwe and Ndumiso Manzini. With a combined 50 years of experience in the construction industry, they

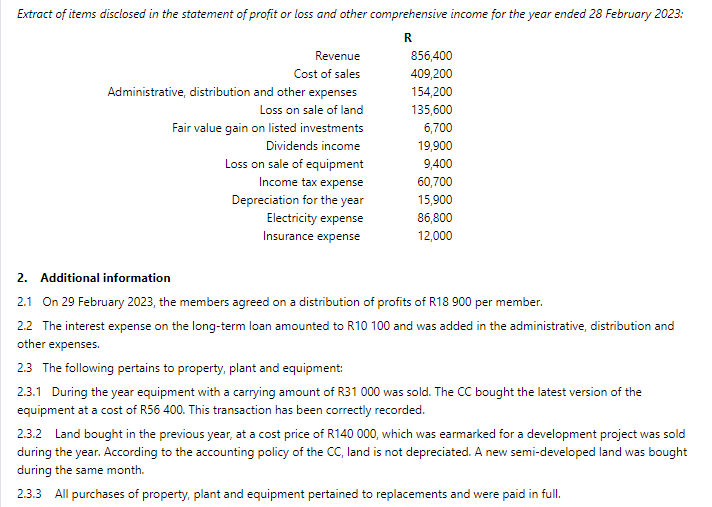

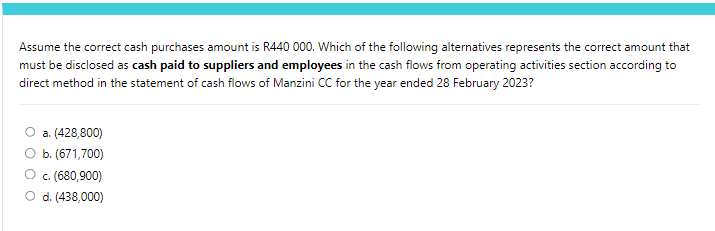

Manzini CC was incorporated in 2018 by the siblings Hlengiwe and Ndumiso Manzini. With a combined 50 years of experience in the construction industry, they formed the CC to take advantage of the opportunities in the booming infrastructure development projects across the country. The following information pertains to Manzini CC. Extract of balances from the statement of financial position information as at 28 February: 2. Additional information 2.1 On 29 February 2023, the members agreed on a distribution of profits of R18 900 per member. 2.2 The interest expense on the long-term loan amounted to R10 100 and was added in the administrative, distribution and other expenses. 2.3 The following pertains to property, plant and equipment: 2.3.1 During the year equipment with a carrying amount of R31 000 was sold. The CC bought the latest version of the equipment at a cost of R56 400. This transaction has been correctly recorded. 2.3.2 Land bought in the previous year, at a cost price of R140 000, which was earmarked for a development project was sold during the year. According to the accounting policy of the CC, land is not depreciated. A new semi-developed land was bought during the same month. 2.3.3 All purchases of property, plant and equipment pertained to replacements and were paid in full. Assume the correct cash purchases amount is R440 000. Which of the following alternatives represents the correct amount that must be disclosed as cash paid to suppliers and employees in the cash flows from operating activities section according to direct method in the statement of cash flows of Manzini CC for the year ended 28 February 2023 ? a. (428,800) b. (671,700) c. (680,900) d. (438,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started