MAP4C (Grade12 Math) Questions ABC. Reference included. Written Answers Please :)

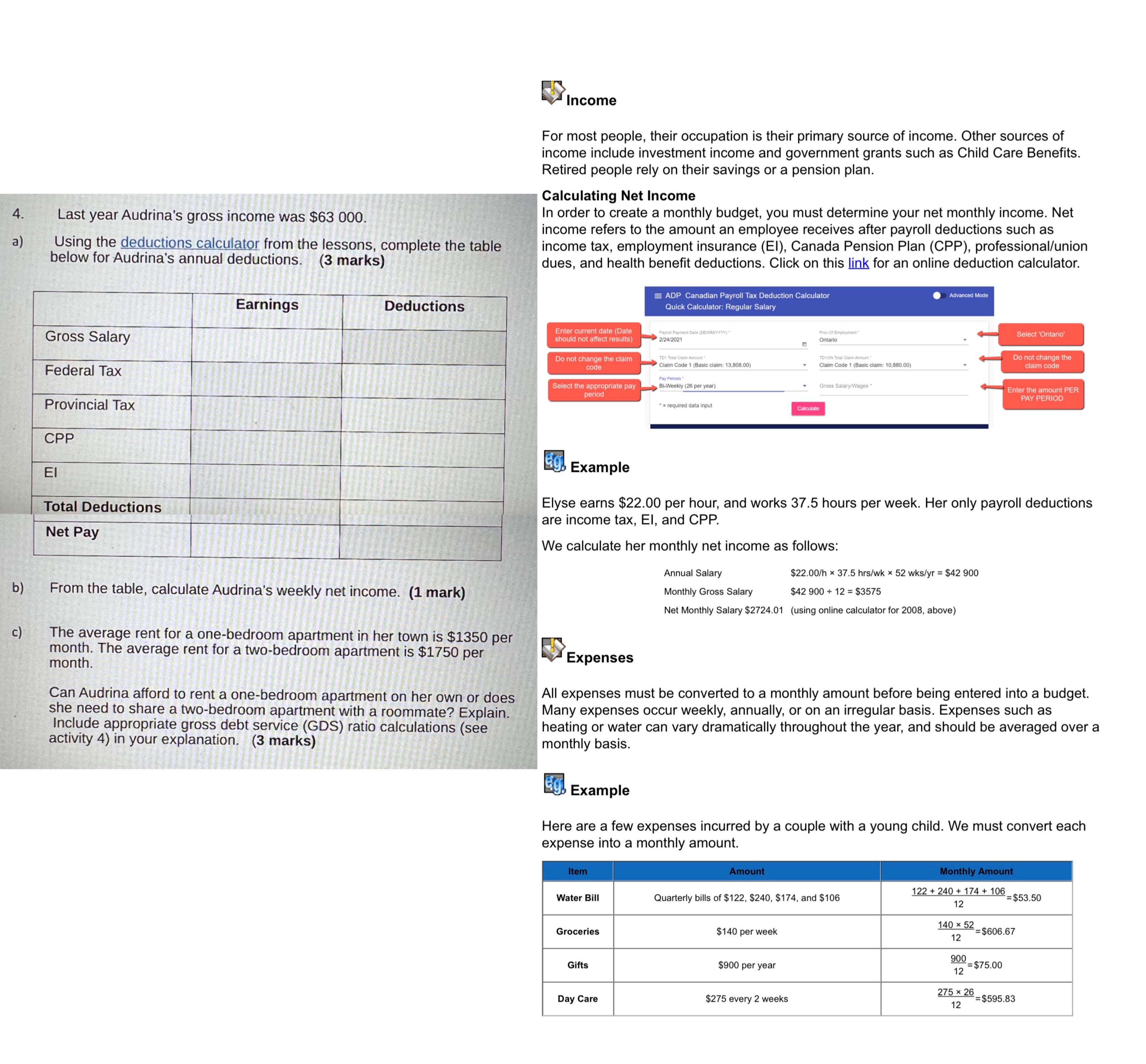

@Income For most people, their occupation is their primary source of income. Other sources of income include investment income and government grants such as Child Care Benefits. Retired people rely on their savings or a pension plan. Calculating Net Income In order to create a monthly budget, you must determine your net monthly income. Net income refers to the amount an employee receives after payroll deductions such as income tax, employment insurance (El), Canada Pension Plan (CPP), professional/union - dues, and health benefit deductions. Click on this link for an online deduction calculator. 4. Last year Audrina's gross income was $63 000. a) Using the deductions calculator from the lessons, complete the table below for Audrina's annual deductions. (3 marks) & = ADP Canadian Payroll Tax Deduction Calculator [ Mode Earnings Deductions Quick Calculator: Regular Salary T O R ey N 5 Gross Salary should not affect resuits) 224200 . omao 9 el + pol asi cla: 13,808.00) ~ Clam Code 1 (Basic i 10,880.00) - claim code Federal Tax o Select the appropriate pay Bl-Weekly (26 per year) = Enter the amount PER 25 l' ol [T Provincial Tax * = required data input m L El Example - Total Deductions Net Pay ~ Elyse earns $22.00 per hour, and works 37.5 hours per week. Her only payroll deductions are income tax, El, and CPP. We calculate her monthly net income as follows: Annual Salary $22.00/h x 37.5 hrs/wk x 52 wks/yr = $42 900 b) From the table, calculate Audrina's weekly net income. (1 mark) Monthly Gross Salary $42 900 + 12 = $3575 | Net Monthly Salary $2724.01 (using online calculator for 2008, above) c) The ahve_rrge rent for a one-bedroom apartment in her town is $1350 per month. The a - i Q} hi verage rent for a two-bedroom apartment is $1750 per Expenses Can Audrina afford to rent a one-bedroom apartment on her own or does All expenses must be converted to a monthly amount before being entered into a budget. she need to share a two-bedroom apartment with a roommate? Explain. ~ Many expenses occur weekly, annually, or on an irregular basis. Expenses such as Include appropriate gross debt service (GDS) ratio calculations (see | heating or water can vary dramatically throughout the year, and should be averaged over a activity 4) in your explanation. (3 marks) ~ monthly basis. m Example Here are a few expenses incurred by a couple with a young child. We must convert each expense into a monthly amount. Water Bill Quarterly bills of $122, $240, $174, and $106 W%SS.SO ' Groceries $140 per week 1401; = =$606.67 Gifts $900 per year %=$75.00 Day Care $275 every 2 weeks 2751; 25 _4505.83