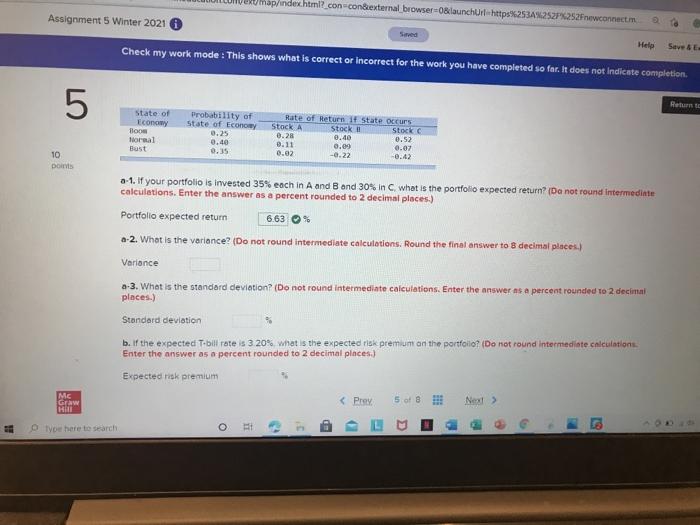

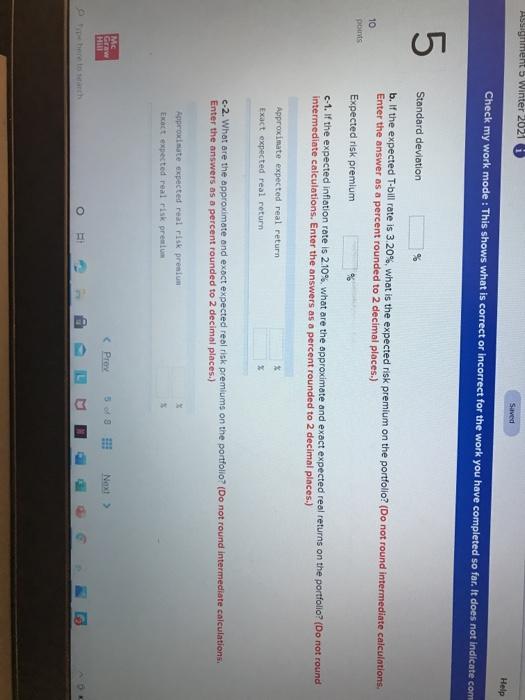

map/index.html?_con-congexternal browser=0&launchurl-https253A%252F%252Fnewconnect Assignment 5 Winter 2021 Save SE Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 5 Return to State of Economy formal Probability of State of Economy 0.25 0.40 0.35 Rate of Return it state occurs Stock A Stock 1 Stock 0.28 0.40 0.52 0.11 0.09 0.07 0.02 -0.22 -0.42 10 point a-1. If your portfolio is invested 35% each in A and B and 30% in what is the portfolio expected return? (Do not round Intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Portfolio expected return 6.63 % a-2. What is the variance? (Do not round intermediate calculations. Round the final answer to 8 decimal places.) Variance 2-3. What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation b. If the expected T-bill rate is 3 20% what is the expected risk premium on the portfolio? (Do not round intermediate calculation Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium Me Graw HI Toe here to search Assignment 5 Winter 2021 Saved Help Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate com 5 Standard deviation 10 pos b. If the expected T-bill rate is 3.20%, what is the expected risk premium on the portfolio? (Do not round intermediate calculations, Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium c-1. If the expected inflation rate is 2.10%, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) Approximate expected real return Exact expected real return c-2. What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) x Approximate expected real risk premium Erict expected real risk prentum Me Graw Proy Next > Thereth BD LM