Answered step by step

Verified Expert Solution

Question

1 Approved Answer

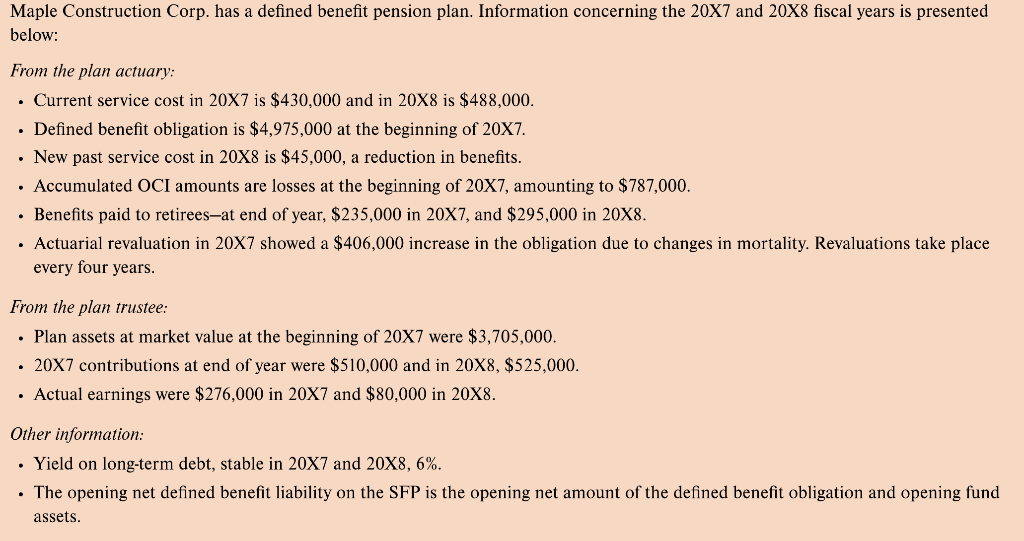

Maple Construction Corp. has a defined benefit pension plan. Information concerning the 20X7 and 20X8 fiscal years is presented below: From the plan actuary:

Maple Construction Corp. has a defined benefit pension plan. Information concerning the 20X7 and 20X8 fiscal years is presented below: From the plan actuary: Current service cost in 20X7 is $430,000 and in 20X8 is $488,000. Defined benefit obligation is $4,975,000 at the beginning of 20X7. New past service cost in 20X8 is $45,000, a reduction in benefits. Accumulated OCI amounts are losses at the beginning of 20X7, amounting to $787,000. Benefits paid to retirees-at end of year, $235,000 in 20X7, and $295,000 in 20X8. Actuarial revaluation in 20X7 showed a $406,000 increase in the obligation due to changes in mortality. Revaluations take place every four years. From the plan trustee: Plan assets at market value at the beginning of 20X7 were $3,705,000. 20X7 contributions at end of year were $510,000 and in 20X8, $525,000. Actual earnings were $276,000 in 20X7 and $80,000 in 20X8. Other information: Yield on long-term debt, stable in 20X7 and 20X8, 6%. The opening net defined benefit liability on the SFP is the opening net amount of the defined benefit obligation and opening fund assets.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Pension Worksheet 20X7 Items Annual Pension Expense Cash OCIGainLoss Pension Assetliability Projected benefit obligation Plan Asset Balance Jan 120X7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started