Answered step by step

Verified Expert Solution

Question

1 Approved Answer

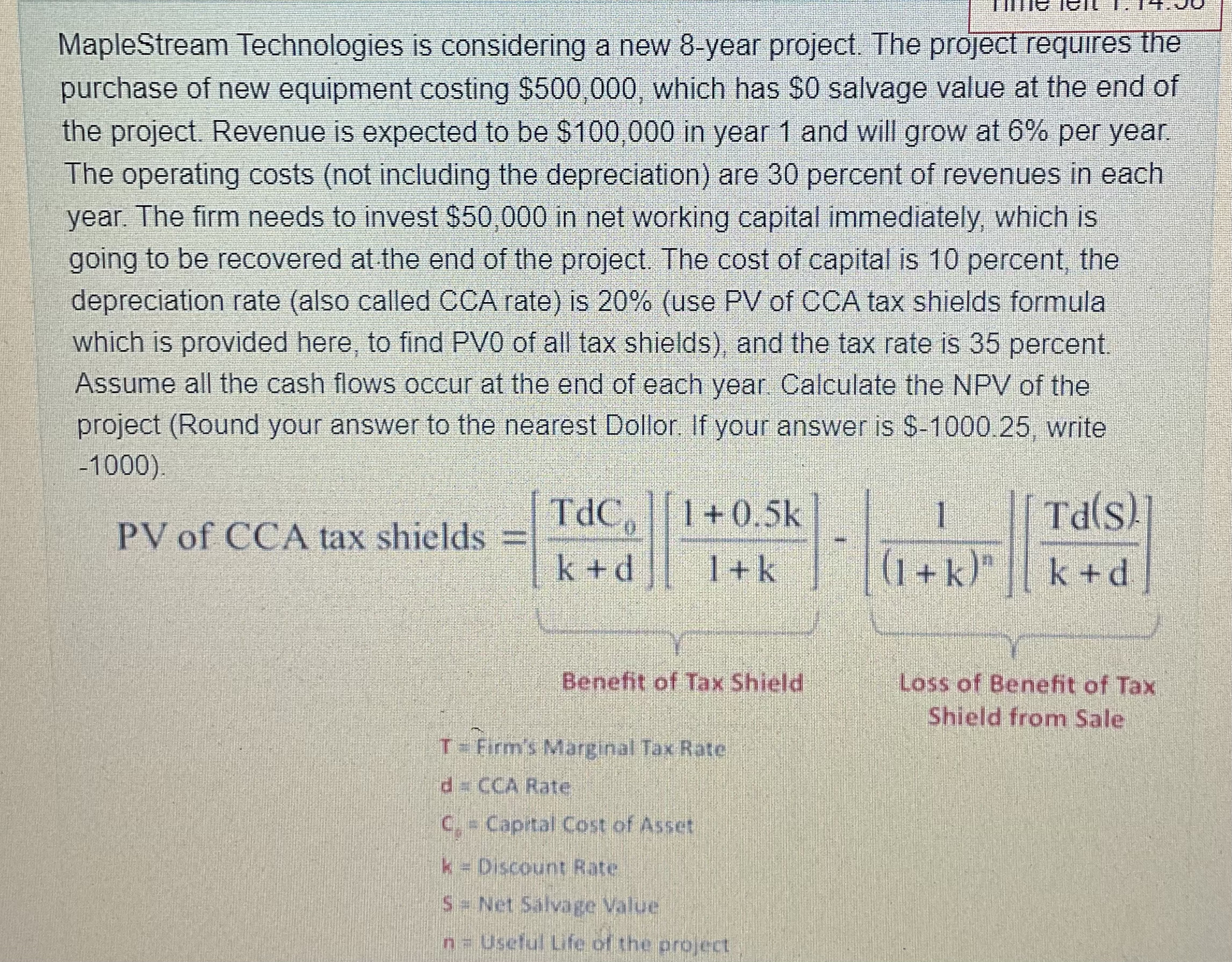

MapleStream Technologies is considering a new 8 - year project. The project requires the purchase of new equipment costing $ 5 0 0 , 0

MapleStream Technologies is considering a new year project. The project requires the purchase of new equipment costing $ which has $ salvage value at the end of the project. Revenue is expected to be $ in year and will grow at per year. The operating costs not including the depreciation are percent of revenues in each year. The firm needs to invest $ in net working capital immediately, which is going to be recovered at the end of the project. The cost of capital is percent, the depreciation rate also called CCA rate is use PV of CCA tax shields formula which is provided here, to find PV of all tax shields and the tax rate is percent. Assume all the cash flows occur at the end of each year. Calculate the NPV of the project Round your answer to the nearest Dollor. If your answer is $ write

CCA tax shields ~

Benefit Tax Shield

Loss Benefit Tax

Firm's Marginal Tax Rate

Shield from Sale

CCA Rate

Capital Cost Asset

Discount Rate

Net Salvage Value

Usetul Life the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started