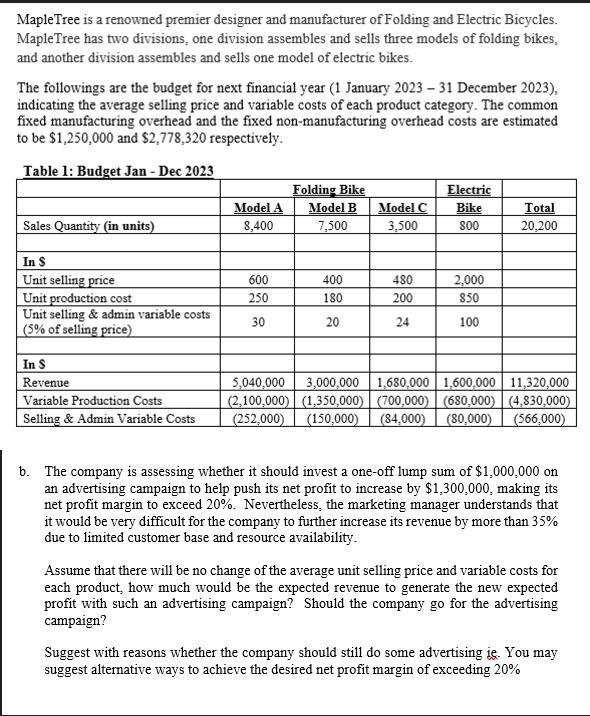

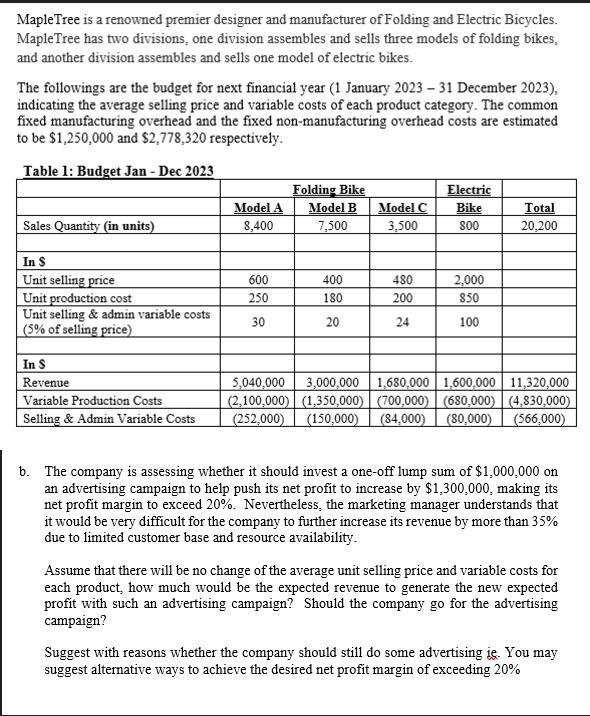

MapleTree is a renowned premier designer and manufacturer of Folding and Electric Bicycles. MapleTree has two divisions, one division assembles and sells three models of folding bikes, and another division assembles and sells one model of electric bikes. The followings are the budget for next financial year (1 January 2023 - 31 December 2023), indicating the average selling price and variable costs of each product category. The common fixed manufacturing overhead and the fixed non-manufacturing overhead costs are estimated to be $1,250,000 and $2,778,320 respectively. b. The company is assessing whether it should invest a one-off lump sum of $1,000,000 on an advertising campaign to help push its net profit to increase by $1,300,000, making its net profit margin to exceed 20%. Nevertheless, the marketing manager understands that it would be very difficult for the company to further increase its revenue by more than 35% due to limited customer base and resource availability. Assume that there will be no change of the average unit selling price and variable costs for each product, how much would be the expected revenue to generate the new expected profit with such an advertising campaign? Should the company go for the advertising campaign? Suggest with reasons whether the company should still do some advertising ie. You may suggest alternative ways to achieve the desired net profit margin of exceeding 20% MapleTree is a renowned premier designer and manufacturer of Folding and Electric Bicycles. MapleTree has two divisions, one division assembles and sells three models of folding bikes, and another division assembles and sells one model of electric bikes. The followings are the budget for next financial year (1 January 2023 - 31 December 2023), indicating the average selling price and variable costs of each product category. The common fixed manufacturing overhead and the fixed non-manufacturing overhead costs are estimated to be $1,250,000 and $2,778,320 respectively. b. The company is assessing whether it should invest a one-off lump sum of $1,000,000 on an advertising campaign to help push its net profit to increase by $1,300,000, making its net profit margin to exceed 20%. Nevertheless, the marketing manager understands that it would be very difficult for the company to further increase its revenue by more than 35% due to limited customer base and resource availability. Assume that there will be no change of the average unit selling price and variable costs for each product, how much would be the expected revenue to generate the new expected profit with such an advertising campaign? Should the company go for the advertising campaign? Suggest with reasons whether the company should still do some advertising ie. You may suggest alternative ways to achieve the desired net profit margin of exceeding 20%