Answered step by step

Verified Expert Solution

Question

1 Approved Answer

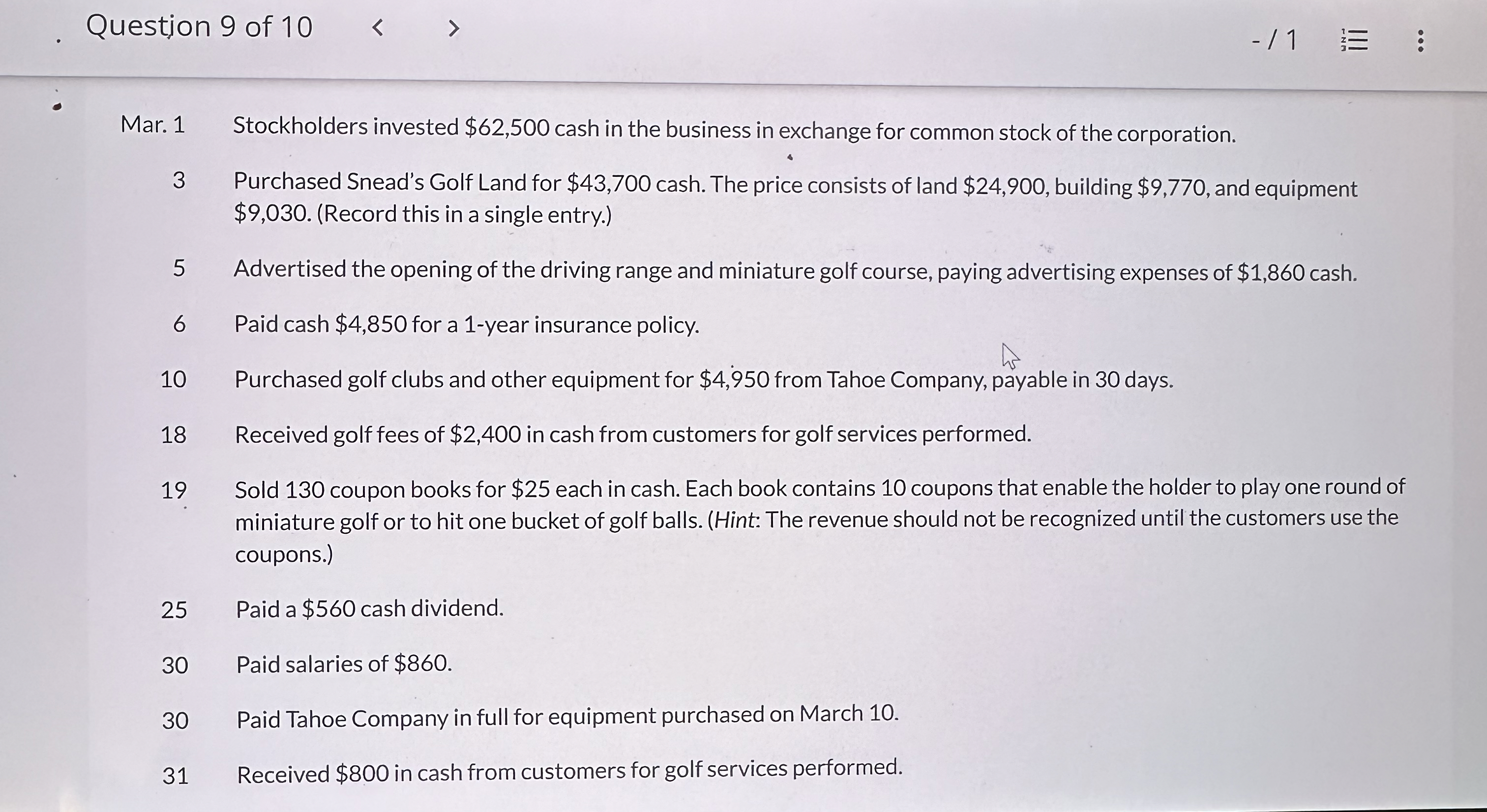

Mar. 1 Stockholders invested $ 6 2 , 5 0 0 cash in the business in exchange for common stock of the corporation. 3 Purchased

Mar. Stockholders invested $ cash in the business in exchange for common stock of the corporation.

Purchased Snead's Golf Land for $ cash. The price consists of land $ building $ and equipment

$Record this in a single entry.

Advertised the opening of the driving range and miniature golf course, paying advertising expenses of $ cash.

Paid cash $ for a year insurance policy.

Purchased golf clubs and other equipment for $ from Tahoe Company, payable in days.

Received golf fees of $ in cash from customers for golf services performed.

Sold coupon books for $ each in cash. Each book contains coupons that enable the holder to play one round of

miniature golf or to hit one bucket of golf balls. Hint: The revenue should not be recognized until the customers use the

coupons.

Paid a $ cash dividend.

Paid salaries of $

Paid Tahoe Company in full for equipment purchased on March

Received $ in cash from customers for golf services performed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started