Answered step by step

Verified Expert Solution

Question

1 Approved Answer

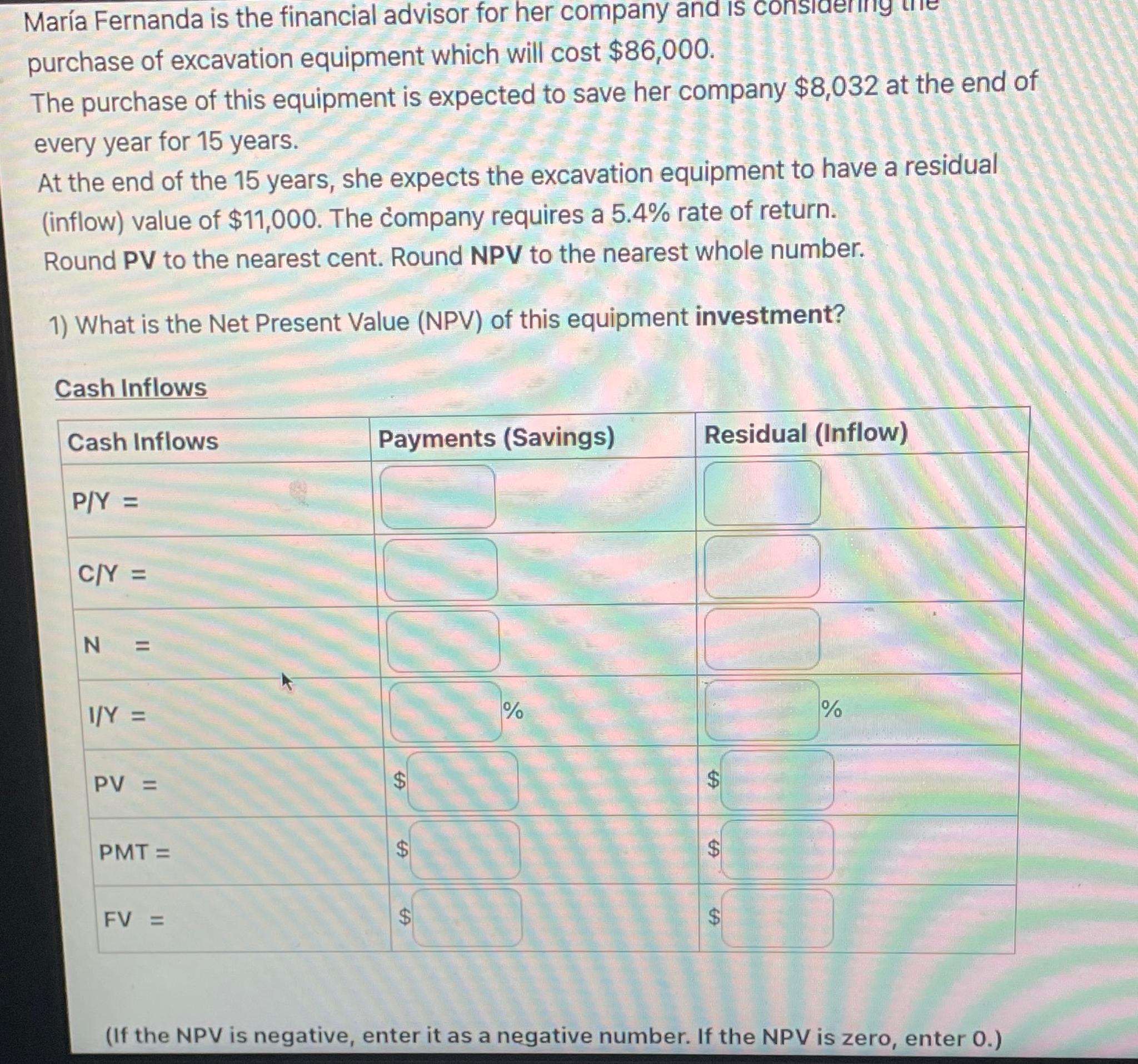

Mar a Fernanda is the financial advisor for her company and is considernig tie purchase of excavation equipment which will cost $ 8 6 ,

Mara Fernanda is the financial advisor for her company and is considernig tie purchase of excavation equipment which will cost $

The purchase of this equipment is expected to save her company $ at the end of every year for years.

At the end of the years, she expects the excavation equipment to have a residual inflow value of $ The company requires a rate of return.

Round PV to the nearest cent. Round NPV to the nearest whole number.

What is the Net Present Value NPV of this equipment investment?

Cash Inflows

tableCash Inflows,Payments SavingsResidual Inflow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started