Answered step by step

Verified Expert Solution

Question

1 Approved Answer

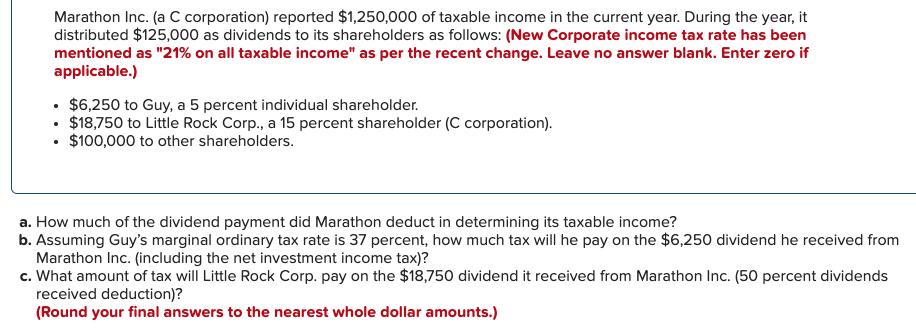

Marathon Inc. (a C corporation) reported $1,250,000 of taxable income in the current year. During the year, it distributed $125,000 as dividends to its

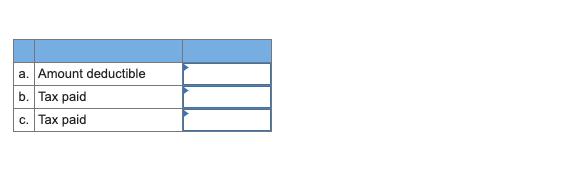

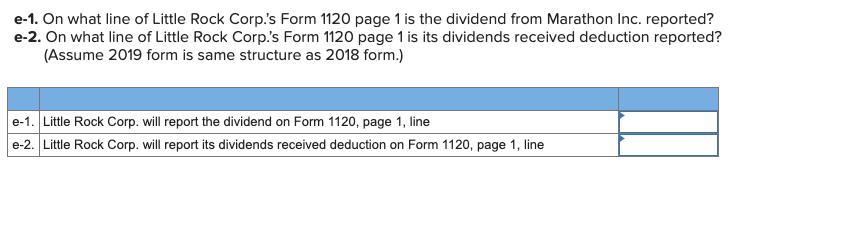

Marathon Inc. (a C corporation) reported $1,250,000 of taxable income in the current year. During the year, it distributed $125,000 as dividends to its shareholders as follows: (New Corporate income tax rate has been mentioned as "21% on all taxable income" as per the recent change. Leave no answer blank. Enter zero if applicable.) $6,250 to Guy, a 5 percent individual shareholder. $18,750 to Little Rock Corp., a 15 percent shareholder (C corporation). $100,000 to other shareholders. a. How much of the dividend payment did Marathon deduct in determining its taxable income? b. Assuming Guy's marginal ordinary tax rate is 37 percent, how much tax will he pay on the $6,250 dividend he received from Marathon Inc. (including the net investment income tax)? c. What amount of tax will Little Rock Corp. pay on the $18,750 dividend it received from Marathon Inc. (50 percent dividends received deduction)? (Round your final answers to the nearest whole dollar amounts.) a. Amount deductible b. Tax paid c. Tax paid e-1. On what line of Little Rock Corp.'s Form 1120 page 1 is the dividend from Marathon Inc. reported? e-2. On what line of Little Rock Corp.'s Form 1120 page 1 is its dividends received deduction reported? (Assume 2019 form is same structure as 2018 form.) e-1. Little Rock Corp. will report the dividend on Form 1120, page 1, line e-2. Little Rock Corp. will report its dividends received deduction on Form 1120, page 1, line

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Dividend Payment that Marathon deducted Amount deductible ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started