Question

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350

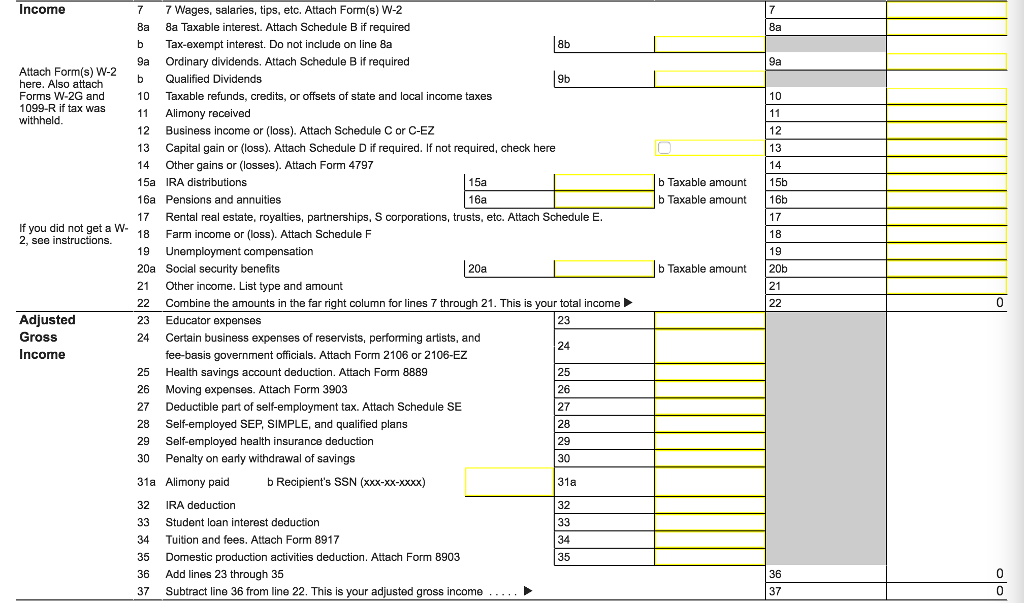

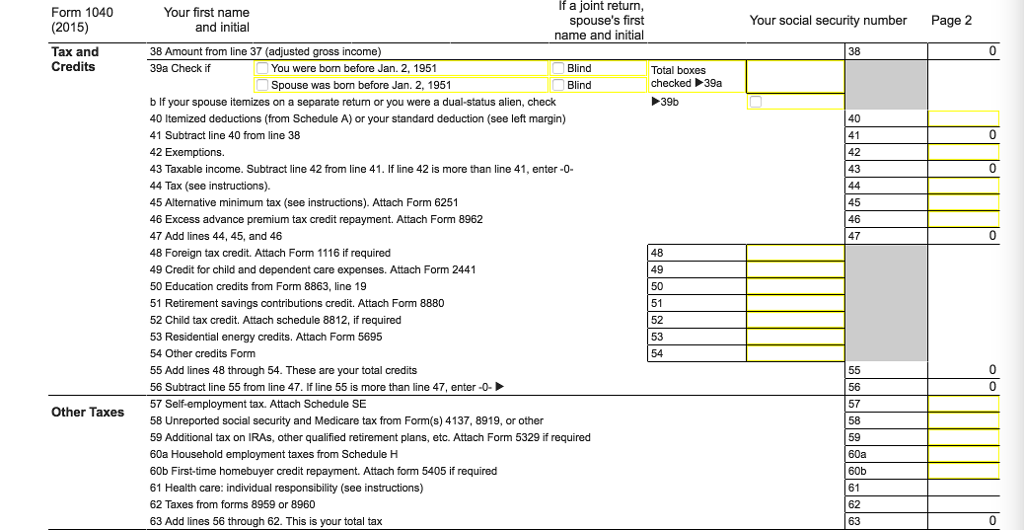

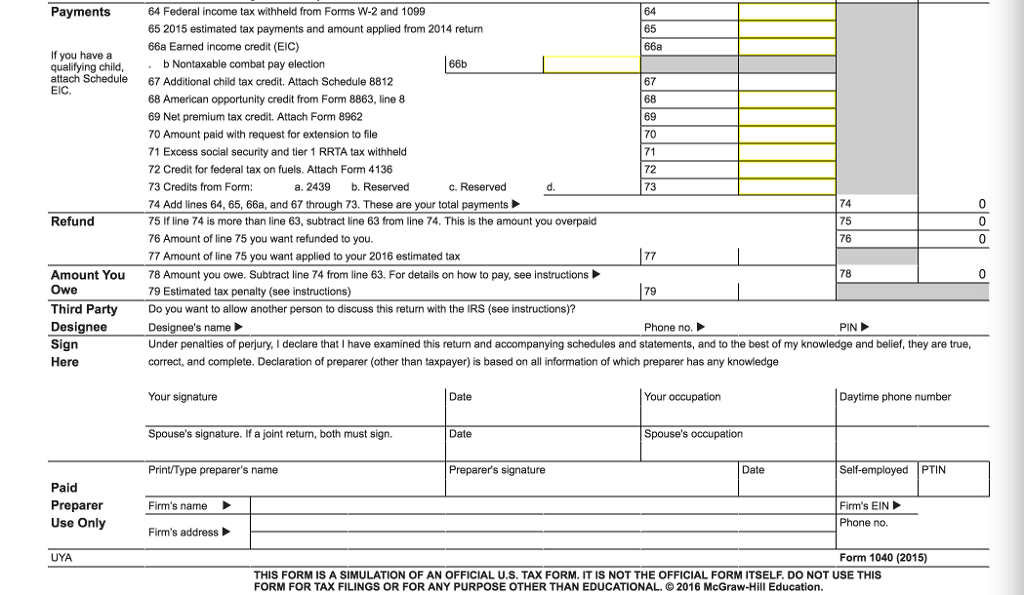

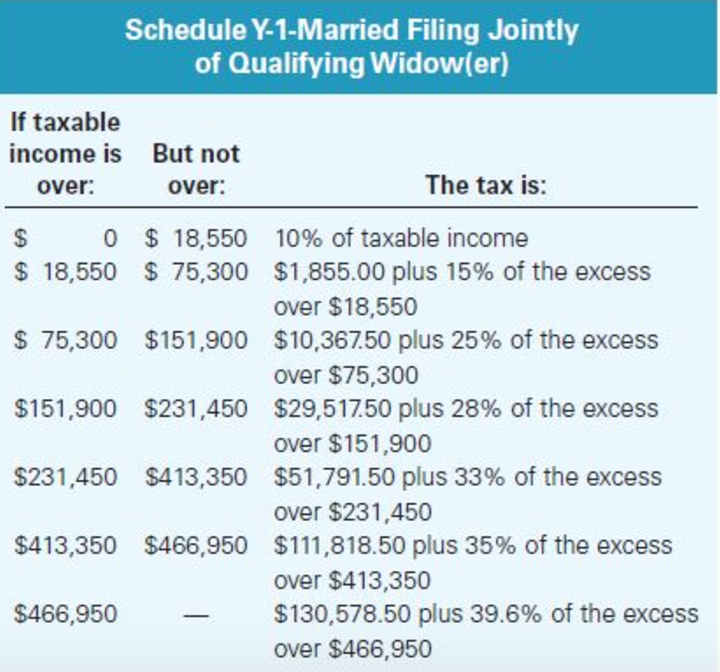

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc and Michelle also paid $2,500 of qualifying moving expenses, and Marc paid alimony to a prior spouse in the amount of $1,500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $1,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year. (use the tax rate schedules. )

Complete the first two pages of Marc and Michelles Form 1040.

Marc and Michelles address is 19010 N.W. 135th Street, Miami, FL 33054.

Social security numbers:

Marc: 111-22-3333 Michelle: 222-33-4444

Matthew: 333-44-5555 Alimony recipient: 000-11-2222

(Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2016 tax laws and 2015 tax form)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started