March 1- Owners of OPJ invested an additional 55,000 cash into the business. the cash is put into the big bank.

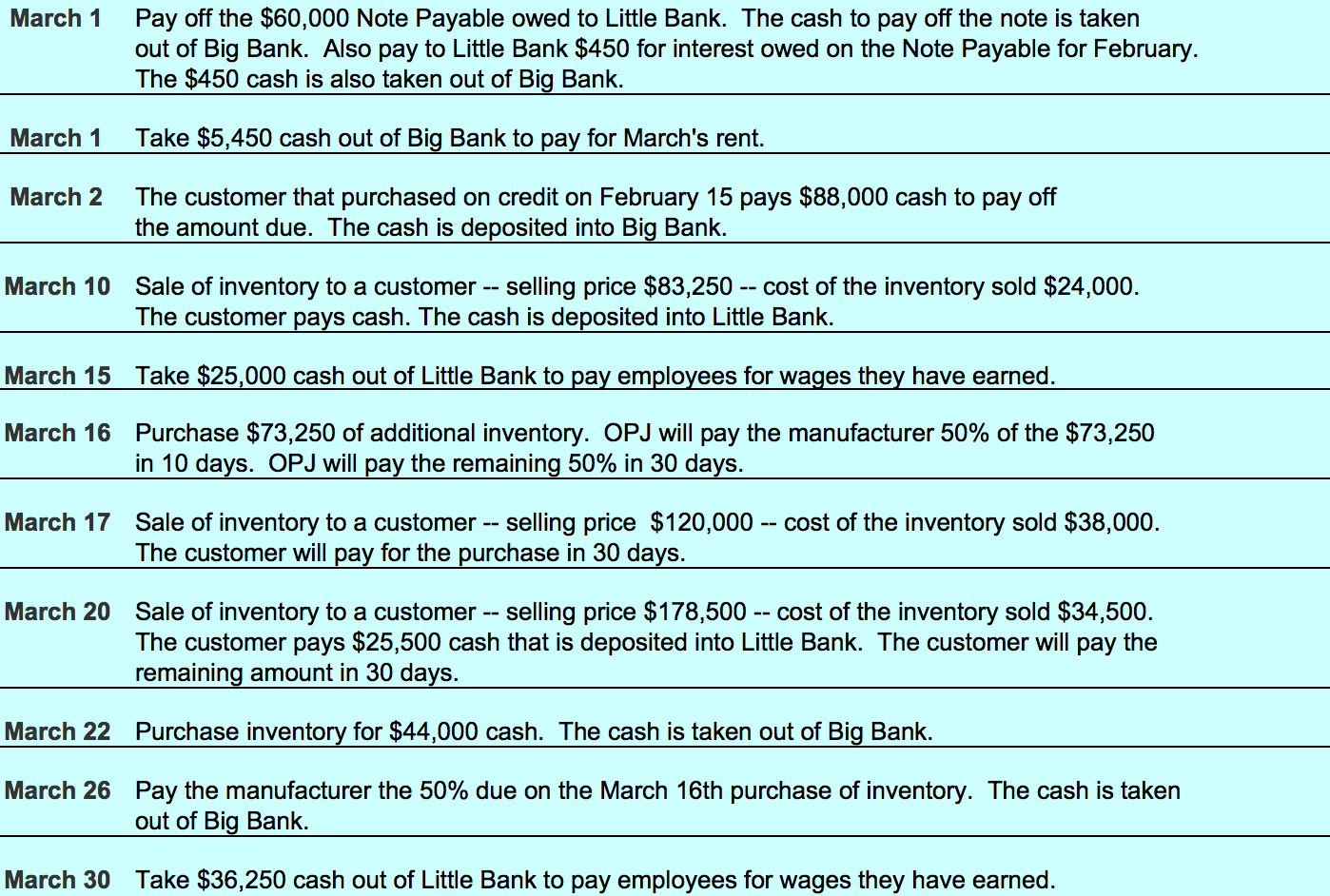

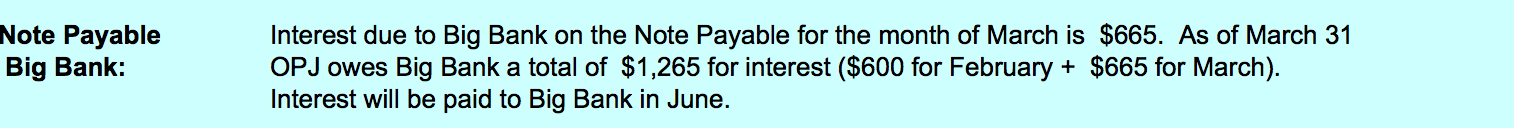

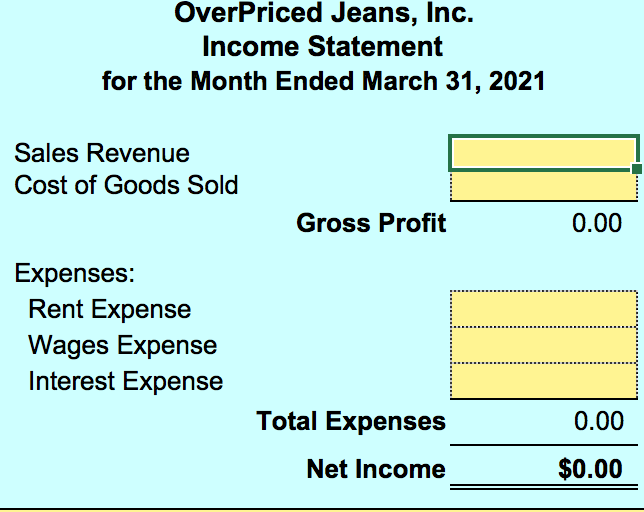

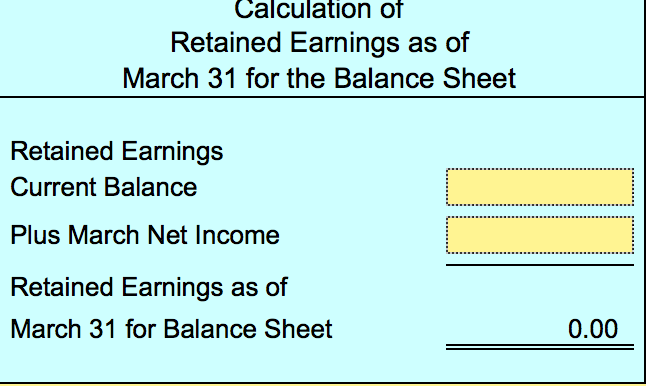

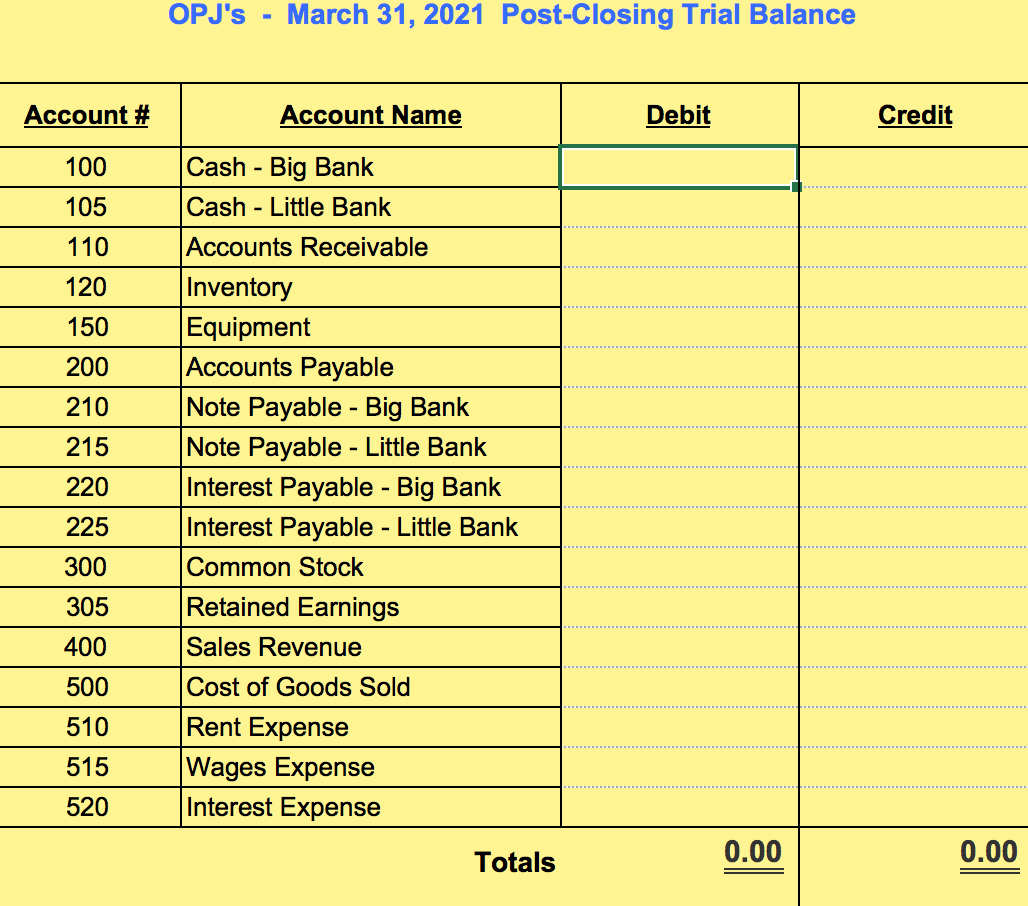

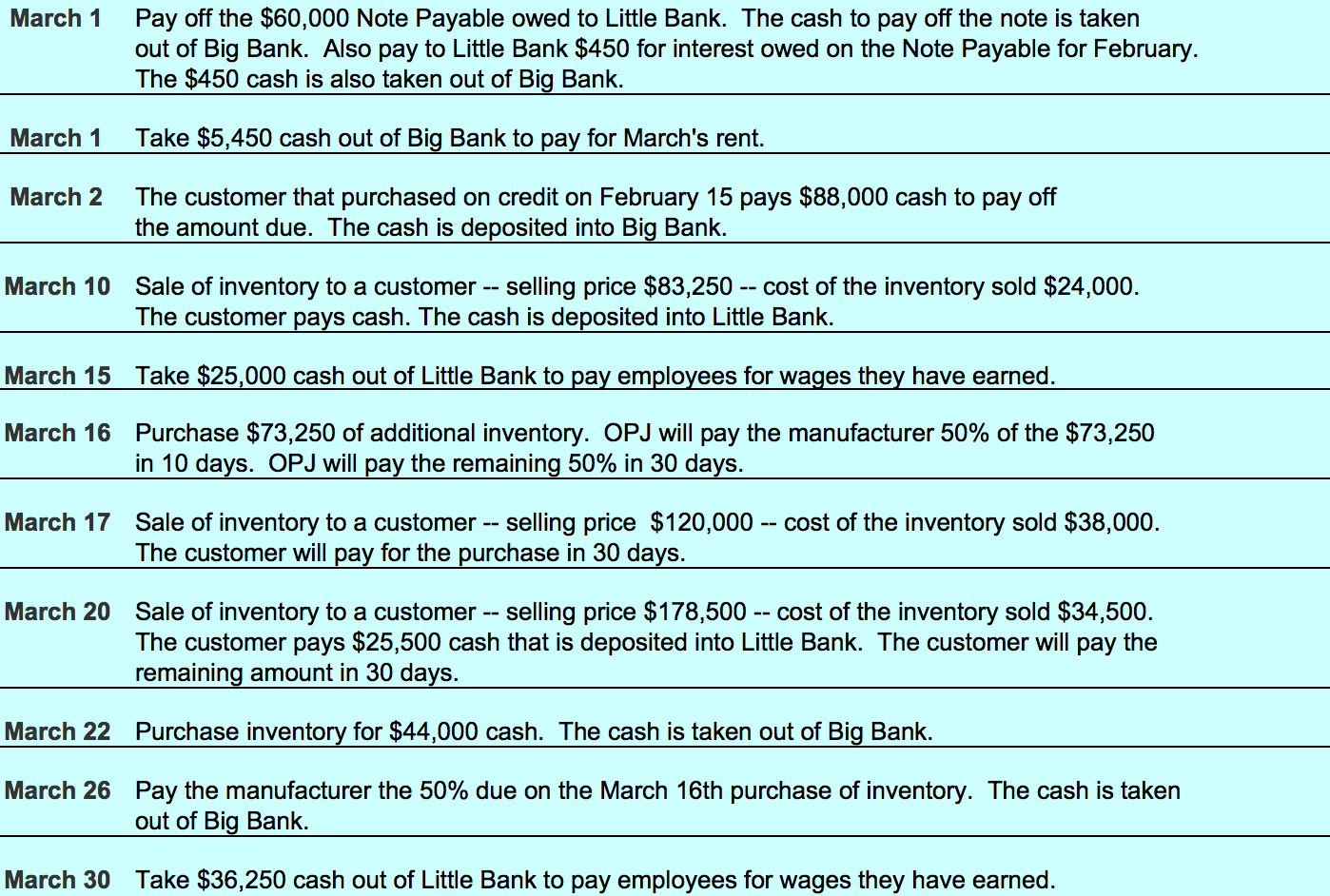

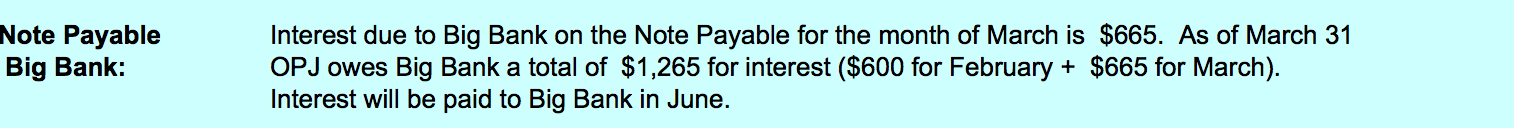

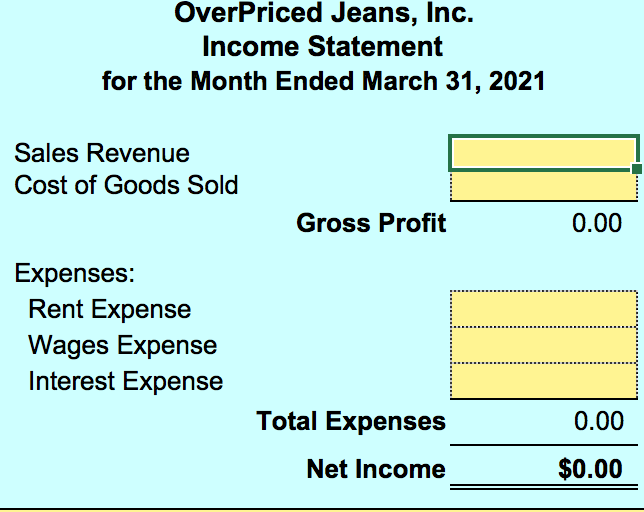

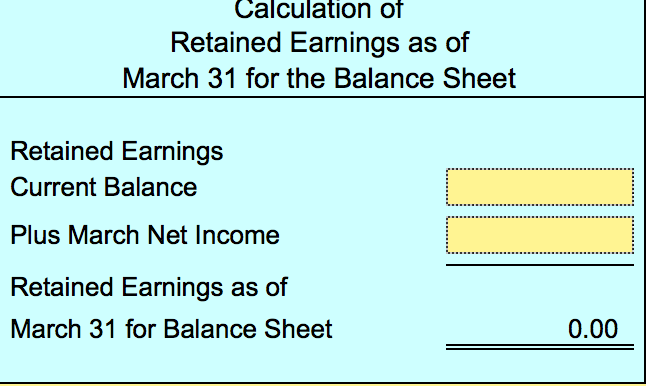

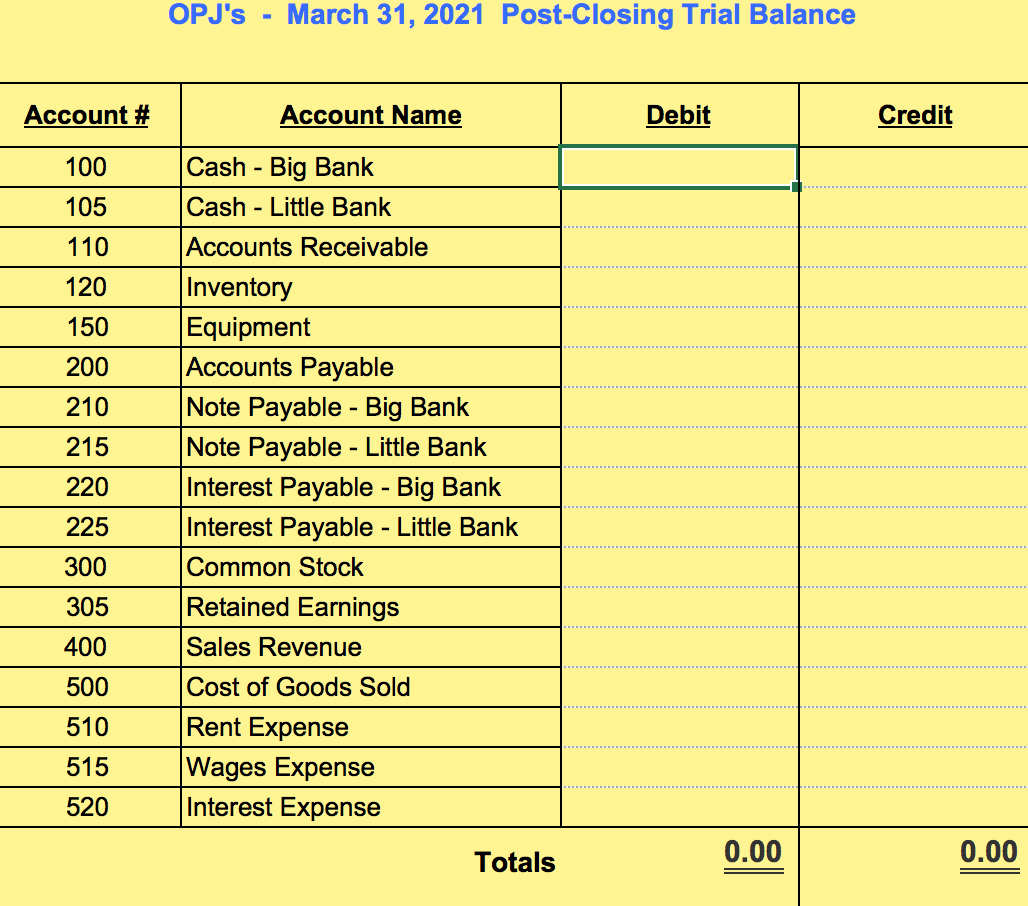

March 1 Pay off the $60,000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February. The $450 cash is also taken out of Big Bank. March 1 Take $5,450 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer -- selling price $83,250 -- cost of the inventory sold $24,000. The customer pays cash. The cash is deposited into Little Bank. March 15 Take $25,000 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $73,250 of additional inventory. OPJ will pay the manufacturer 50% of the $73,250 in 10 days. OPJ will pay the remaining 50% in 30 days. March 17 Sale of inventory to a customer -- selling price $120,000 -- cost of the inventory sold $38,000. The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer -- selling price $178,500 -- cost of the inventory sold $34,500. The customer pays $25,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $44,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $36,250 cash out of Little Bank to pay employees for wages they have earned. Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $665. As of March 31 OPJ owes Big Bank a total of $1,265 for interest ($600 for February + $665 for March). Interest will be paid to Big Bank in June. Overpriced Jeans, Inc. Income Statement for the Month Ended March 31, 2021 Sales Revenue Cost of Goods Sold .. Gross Profit 0.00 Expenses: Rent Expense Wages Expense Interest Expense Total Expenses 0.00 Net Income $0.00 Calculation of Retained Earnings as of March 31 for the Balance Sheet Retained Earnings Current Balance Plus March Net Income Retained Earnings as of March 31 for Balance Sheet 0.00 OPJ's - March 31, 2021 Post-Closing Trial Balance Account # Account Name Debit Credit 100 Cash - Big Bank Cash - Little Bank 105 110 120 150 200 210 215 220 225 Accounts Receivable Inventory Equipment Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense 300 305 400 500 510 515 520 Totals 0.00 0.00 March 1 Pay off the $60,000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February. The $450 cash is also taken out of Big Bank. March 1 Take $5,450 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer -- selling price $83,250 -- cost of the inventory sold $24,000. The customer pays cash. The cash is deposited into Little Bank. March 15 Take $25,000 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $73,250 of additional inventory. OPJ will pay the manufacturer 50% of the $73,250 in 10 days. OPJ will pay the remaining 50% in 30 days. March 17 Sale of inventory to a customer -- selling price $120,000 -- cost of the inventory sold $38,000. The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer -- selling price $178,500 -- cost of the inventory sold $34,500. The customer pays $25,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $44,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $36,250 cash out of Little Bank to pay employees for wages they have earned. Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $665. As of March 31 OPJ owes Big Bank a total of $1,265 for interest ($600 for February + $665 for March). Interest will be paid to Big Bank in June. Overpriced Jeans, Inc. Income Statement for the Month Ended March 31, 2021 Sales Revenue Cost of Goods Sold .. Gross Profit 0.00 Expenses: Rent Expense Wages Expense Interest Expense Total Expenses 0.00 Net Income $0.00 Calculation of Retained Earnings as of March 31 for the Balance Sheet Retained Earnings Current Balance Plus March Net Income Retained Earnings as of March 31 for Balance Sheet 0.00 OPJ's - March 31, 2021 Post-Closing Trial Balance Account # Account Name Debit Credit 100 Cash - Big Bank Cash - Little Bank 105 110 120 150 200 210 215 220 225 Accounts Receivable Inventory Equipment Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense 300 305 400 500 510 515 520 Totals 0.00 0.00