Answered step by step

Verified Expert Solution

Question

1 Approved Answer

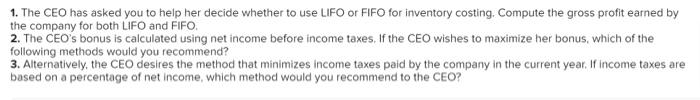

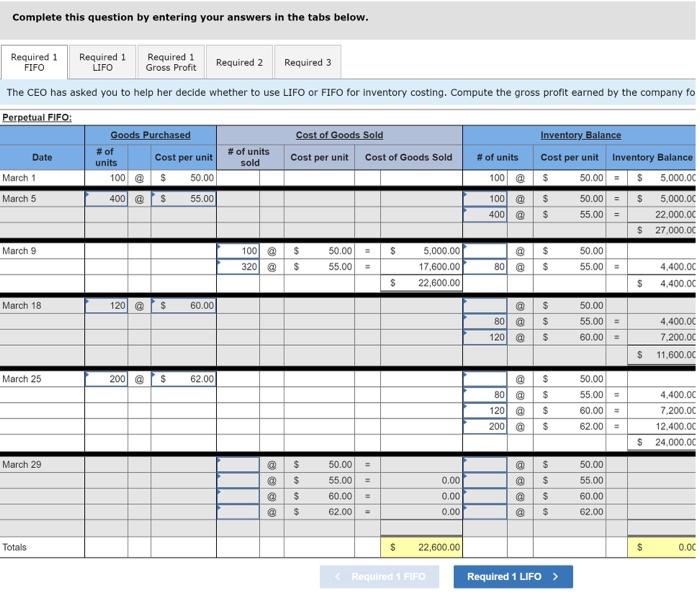

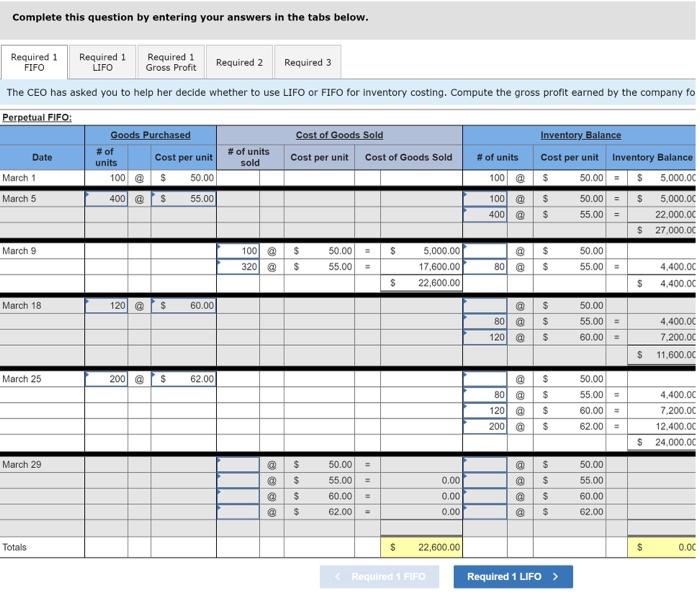

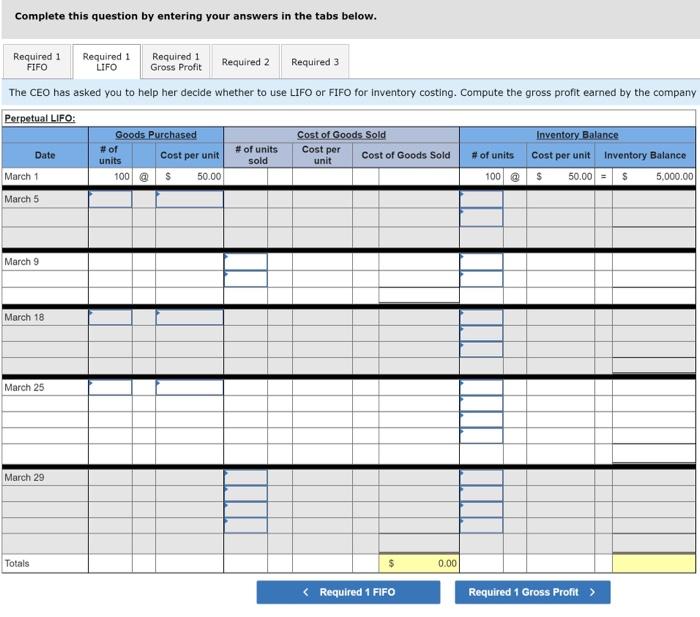

March 1st- Purchase 100 units @ $50 March 5th- Purchase 400 units @$55 March 9th- Sales 420 units @ $85 March 18th- Purchase 120 @

March 1st- Purchase 100 units @ $50

March 5th- Purchase 400 units @$55

March 9th- Sales 420 units @ $85

March 18th- Purchase 120 @ $60

March 25th- Purchase 200 unts @ $62

March 29th- Sales 160 units @ $95

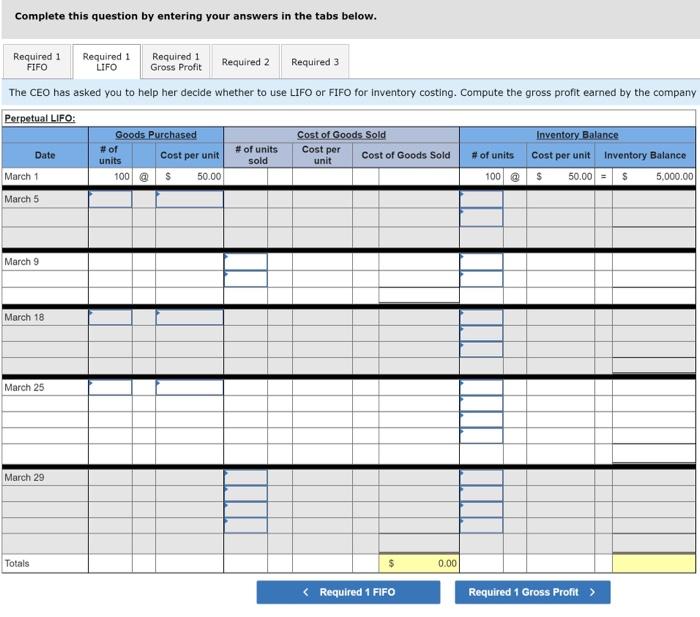

1. The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company for both LIFO and FIFO. 2. The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? 3. Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Complete this question by entering your answers in the tabs below. The CEO has asked you to help her decide whether to use LIFO or FIFO for inventory costing. Compute the gross profit earned by the company Complete this question by entering your answers in the tabs below March 5th- Purchase 400 units @$55

March 9th- Sales 420 units @ $85

March 18th- Purchase 120 @ $60

March 25th- Purchase 200 unts @ $62

March 29th- Sales 160 units @ $95

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started