Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marchunk Bhd is a company manufacturing varieties of drinks located in Northern Malaysia. The financial year of Marchunk Bhd ends on 31 December each

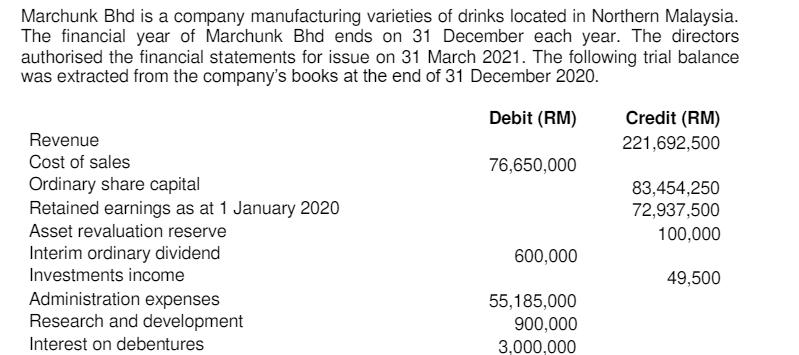

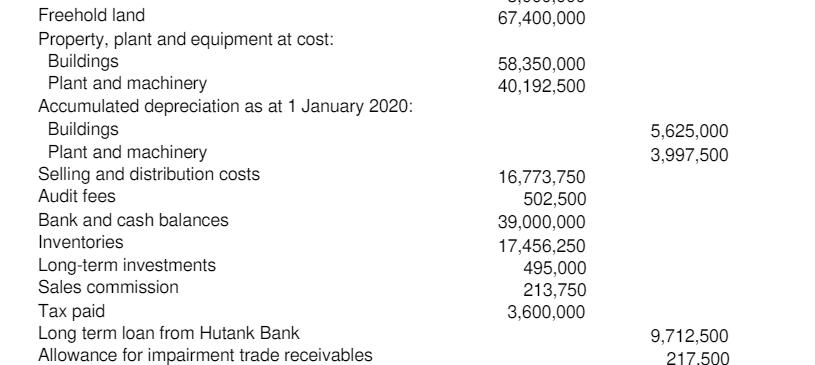

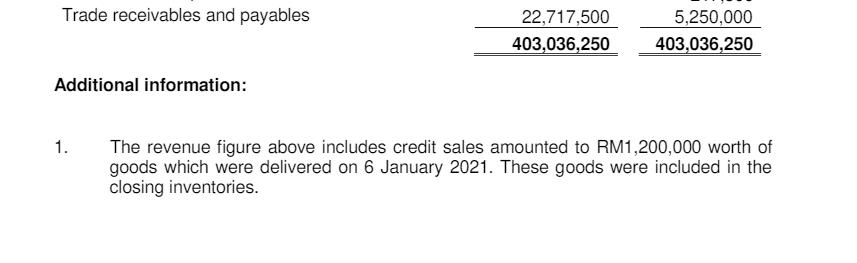

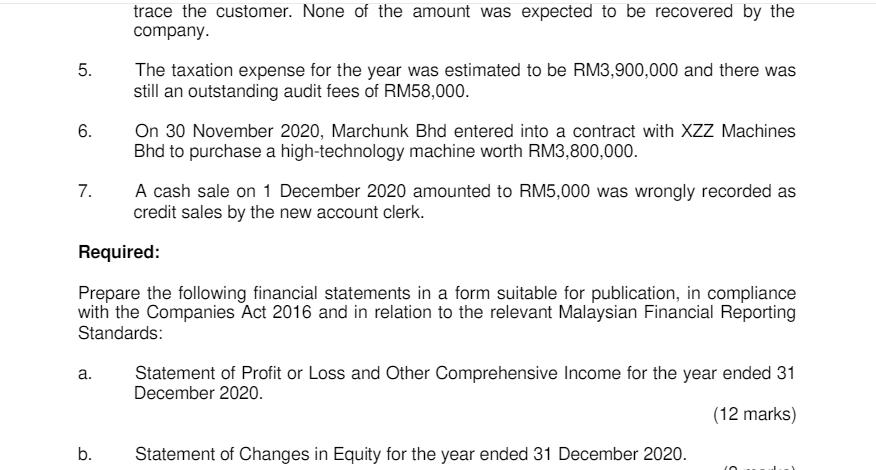

Marchunk Bhd is a company manufacturing varieties of drinks located in Northern Malaysia. The financial year of Marchunk Bhd ends on 31 December each year. The directors authorised the financial statements for issue on 31 March 2021. The following trial balance was extracted from the company's books at the end of 31 December 2020. Debit (RM) Revenue Cost of sales Ordinary share capital Retained earnings as at 1 January 2020 Asset revaluation reserve Interim ordinary dividend Investments income Administration expenses Research and development Interest on debentures 76,650,000 600,000 55,185,000 900,000 3,000,000 Credit (RM) 221,692,500 83,454,250 72,937,500 100,000 49,500 Freehold land Property, plant and equipment at cost: Buildings Plant and machinery Accumulated depreciation as at 1 January 2020: Buildings Plant and machinery Selling and distribution costs Audit fees Bank and cash balances Inventories Long-term investments Sales commission Tax paid Long term loan from Hutank Bank Allowance for impairment trade receivables 67,400,000 58,350,000 40,192,500 16,773,750 502,500 39,000,000 17,456,250 495,000 213,750 3,600,000 5,625,000 3,997,500 9,712,500 217.500 Trade receivables and payables Additional information: 1. 22,717,500 403,036,250 5,250,000 403,036,250 The revenue figure above includes credit sales amounted to RM1,200,000 worth of goods which were delivered on 6 January 2021. These goods were included in the closing inventories. 2. 3. 4. It is the company's policy to depreciate its property, plant and equipment on a yearly basis based on the following rates: Buildings 5% on cost Plant and machinery 10% on carrying value On 31 December 2020, the freehold land was valued at RM67,250,000. The directors decided to incorporate the revalued amount in the books of account. It is the company's policy to measure the land using revaluation model. Meanwhile, the building and plant and machinery were measured based on cost model. In April 2020, one of the customers took a legal action against the company for breach of contract that caused the customer's loss. The legal advisor of the company was in the opinion that the company will be held liable for the sue, hence the company needs to pay RM320,000. No payment has been made as at 31 December 2020. On 25 September 2020, one of the customers who owed Marchunk Bhd RM150,000 went missing. Several reminders had been sent but the company was still unable to 5. 6. 7. a. trace the customer. None of the amount was expected to be recovered by the company. b. The taxation expense for the year was estimated to be RM3,900,000 and there was still an outstanding audit fees of RM58,000. On 30 November 2020, Marchunk Bhd entered into a contract with XZZ Machines Bhd to purchase a high-technology machine worth RM3,800,000. Required: Prepare the following financial statements in a form suitable for publication, in compliance with the Companies Act 2016 and in relation to the relevant Malaysian Financial Reporting Standards: A cash sale on 1 December 2020 amounted to RM5,000 was wrongly recorded as credit sales by the new account clerk. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. (12 marks) Statement of Changes in Equity for the year ended 31 December 2020. C. Statement of Financial Position as at 31 December 2020. d. The following notes accompany the above statements: Property, plant and equipment Capital commitment or contingent liabilities (if any) i. ii.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 December 2020 Revenue 221692500 Cost of sales 76650000 Gross profit 145042500 Other income 49500 Administrative expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started