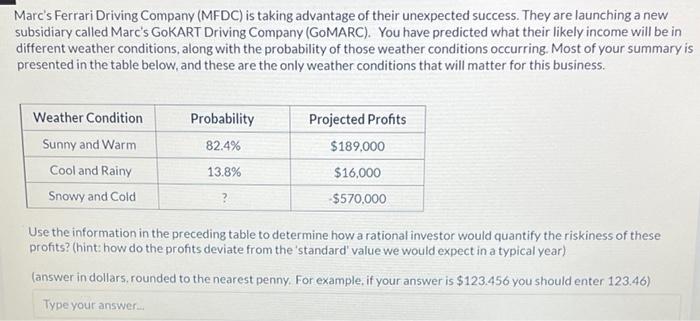

Marc's Ferrari Driving Company (MFDC) is taking advantage of their unexpected success. They are launching a new subsidiary called Marc's GoKART Driving Company (GoMARC). You have predicted what their likely income will be in different weather conditions, along with the probability of those weather conditions occurring. Most of your summary is presented in the table below, and these are the only weather conditions that will matter for this business. Weather Condition Probability Projected Profits Sunny and Warm 82.4% $189,000 Cool and Rainy 13.8% $16,000 Snowy and Cold ? -$570,000 Use the information in the preceding table to determine how a rational investor would quantify the riskiness of these profits? (hint: how do the profits deviate from the 'standard' value we would expect in a typical year) (answer in dollars, rounded to the nearest penny. For example, if your answer is $123.456 you should enter 123.46) Type your answer..... Assume that the firm in the prior questions (MFDC) needs to raise funds to launch GOMARC. The investor community wants to be reasonably confident that this business won't lose money. Will the investor community want to lend to this company? Explain why you believe they would or wouldn't, offering specific evidence to support your argument. Marc's Ferrari Driving Company (MFDC) is taking advantage of their unexpected success. They are launching a new subsidiary called Marc's GoKART Driving Company (GoMARC). You have predicted what their likely income will be in different weather conditions, along with the probability of those weather conditions occurring. Most of your summary is presented in the table below, and these are the only weather conditions that will matter for this business. Weather Condition Probability Projected Profits Sunny and Warm 82.4% $189,000 Cool and Rainy 13.8% $16,000 Snowy and Cold ? -$570,000 Use the information in the preceding table to determine how a rational investor would quantify the riskiness of these profits? (hint: how do the profits deviate from the 'standard' value we would expect in a typical year) (answer in dollars, rounded to the nearest penny. For example, if your answer is $123.456 you should enter 123.46) Type your answer..... Assume that the firm in the prior questions (MFDC) needs to raise funds to launch GOMARC. The investor community wants to be reasonably confident that this business won't lose money. Will the investor community want to lend to this company? Explain why you believe they would or wouldn't, offering specific evidence to support your argument