Question

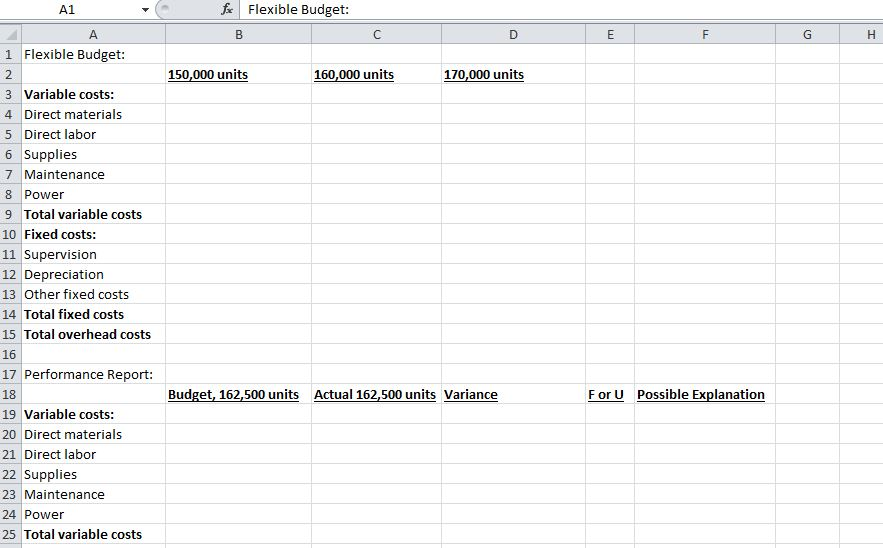

Marcus Company has the following budgeted variable costs per unit produced: Direct materials $7.50 Direct labor 1.65 Supplies .24 Maintenance .18 Power .16 Budgeted fixed

Marcus Company has the following budgeted variable costs per unit produced:

Direct materials $7.50

Direct labor 1.65

Supplies .24

Maintenance .18

Power .16

Budgeted fixed overhead costs per month include supervision of $88,000, depreciation of $75,000, and other overhead of $235,000.

Required: Prepare a flexible budget for all costs of production for the following level of production: 150,000 units, 160,000 units, and 170,000 units. For consistency, please use the Excel template provided.

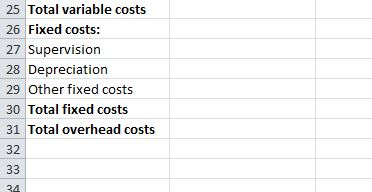

Suppose that in April, Marcus Company produced 162,500 units and had the following actual costs:

Direct materials - $1,080,000

Direct labor - $257,300

Supplies - $36,350

Maintenance - $32,960

Power - $27,540

Supervision 89,500

Depreciation - $75,000

Other overhead - $232,000.

Required: Prepare a performance report for Marcus Company comparing actual costs with the flexible budget for actual units produced. Remember to identify each variable as either F (favorable) or U (unfavorable). In addition, discuss a possible reason that each of the variances exists (we dont have any information to KNOW the reason, so you are speculating here on POSSIBLE reasons). For consistency, please use the Excel template provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started