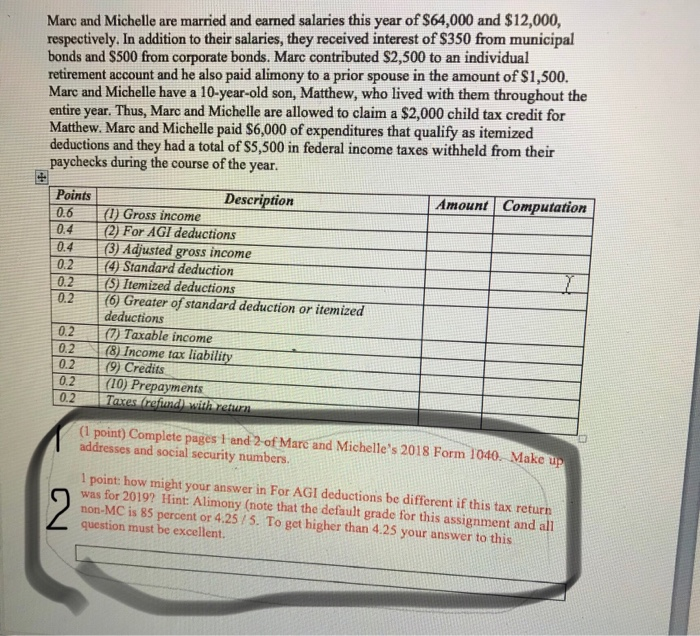

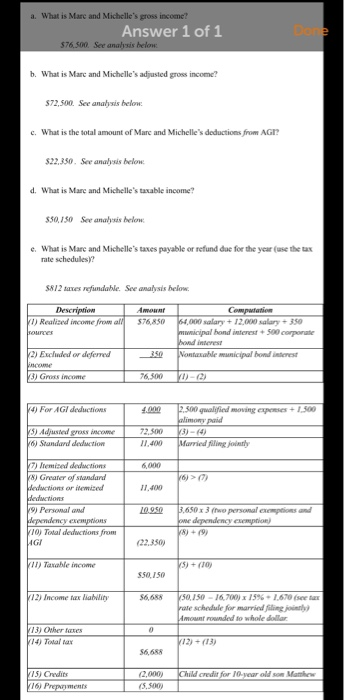

Mare and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account and he also paid alimony to a prior spouse in the amount of $1,500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year. Points 0.6 Amount Computation Description | (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard deduction or itemized deductions (7) Taxable income (8) Income tax liability (9) Credits (10) Prepayments Tara Tares (refund with return 0.2 (1 point) Complete pages 1 and 2 of Mare and Michelle's 2018 Form 1040. Make up addresses and social security numbers 1 point: how might your answer in For AGI deductions be different if this tax return was for 2019? Hint: Alimony (note that the default grade for this assignment and all non-MC is 85 percent or 4.25/5. To get higher than 4.25 your answer to this question must be excellent. a. What is Mare and Michelle's gross income! Answer 1 of 1 $76,500. See analysis belon b. What is Mare and Michelle's adjusted gross income? $72.500. See analysis below c. What is the total amount of Mare and Michelle deductions from AG 302.350. Se analysis below d. What is Mare and Michelle's taxable income? $50.150 Se analysis below the e. What is Marc and Michelle's taxes payable or refund due for the years rate schedules)? S82 taxes refundable. See analysis below Description (1) Realand income wall Tourer Amon 576,250 Complete 000 salary + 12.000 salary 350 municipal hond interest 500 corporate Hand interest Montaxable municipal bond interest 2) Excluded or deferred 350 G ince 76,500 VI-(2) 14) For AGI deductions 1.500 3) Add 3 Standard deduction 4.000 2.500 qualified moving Lapud 2003) 11.400 Married filling 6,000 7) dec Grer of standard 60 11.200 indows Personal and 209 3.6503 the personal de VIOy Tales from AGI 2220 In The VS - (Toy SS150 (12) Income la la 56.68 V50,150 - 16.00 x 15% 1670 pate schedule for married ling Amountrunded to whole dollar 173) Other fores 114) Tota la V12 (13) 56,688 Chillard for o ur Man V3 Onli. 116) Prements (2.000) 18. Sy