Question

Margaret Hancock and her husband, J.W., operated Hancock Enterprises, a business that purchased large tracts of land that were then subdivided, rezoned, and improved. Single-family

Margaret Hancock and her husband, J.W., operated Hancock Enterprises, a business that purchased large tracts of land that were then subdivided, rezoned, and improved. Single-family homes were constructed on most of the lots and then sold to customers. The business began in Year One, and enjoyed considerable success until Year Sixteen, when the local housing market slumped and J.W. died.

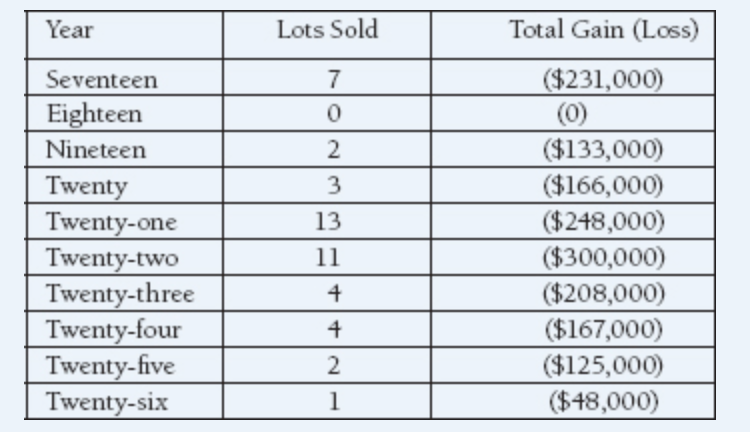

At the time of J.W.s death, the business had 48 parcels of real property that had been acquired in Year Ten. Margaret continued her efforts at selling these lots, but she ceased any development activities on these properties. Because of poor market conditions, she reported tax losses from the sale of the lots for several years, as shown below:

During these years, Margaret paid all expenses related to the lots, including property taxes and insurance costs. She occasionally met with prospective buyers, 505hung for sale signs on several properties, and attended various homebuilders meetings to solicit potential buyers. Margaret sometimes listed various lots with local real estate agents, but did not do so in Years Twenty-two through Twenty-four.

Margaret reported all of the losses listed above as ordinary losses. The Service challenged her claimed losses for Year Twenty-three and Year Twenty-four, concluding that the eight lots were capital assets in Margarets hands. Margaret contested the resulting deficiency by filing a petition in the United States Tax Court. How should the court rule in this case?

Year Lots Sold Total Gain (Loss) Seventeen Eighteen Nineteen Twenty Twenty-one Twenty-two Twenty-three Twenty-four Twenty-five Twenty-six 7 O 2 3 13 11 $231,000) (0) ($133,000) ($166,000) ($248,000) ($300,000) ($208,000) ($167,000) ($125,000) $48,000) 4 2 1 Year Lots Sold Total Gain (Loss) Seventeen Eighteen Nineteen Twenty Twenty-one Twenty-two Twenty-three Twenty-four Twenty-five Twenty-six 7 O 2 3 13 11 $231,000) (0) ($133,000) ($166,000) ($248,000) ($300,000) ($208,000) ($167,000) ($125,000) $48,000) 4 2 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started