Margaret is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new

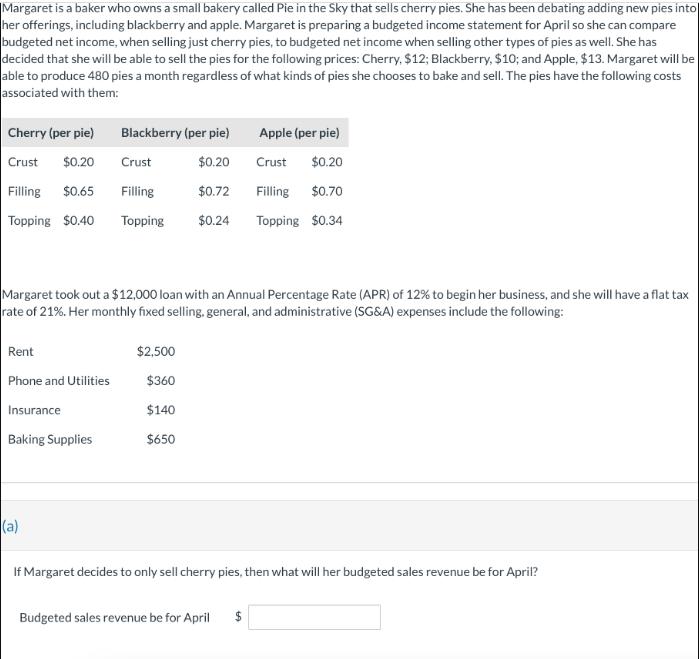

Margaret is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new pies into her offerings, including blackberry and apple. Margaret is preparing a budgeted income statement for April so she can compare budgeted net income, when selling just cherry pies, to budgeted net income when selling other types of pies as well. She has decided that she will be able to sell the pies for the following prices: Cherry, $12; Blackberry, $10; and Apple, $13. Margaret will be able to produce 480 pies a month regardless of what kinds of pies she chooses to bake and sell. The pies have the following costs associated with them: Cherry (per pie) Crust $0.20 Filling $0.65 Topping $0.40 Rent Phone and Utilities Insurance Baking Supplies Blackberry (per pie) Crust $0.20 Filling $0.72 Filling $0.70 Topping $0.24 Topping $0.34 Margaret took out a $12,000 loan with an Annual Percentage Rate (APR) of 12% to begin her business, and she will have a flat tax rate of 21%. Her monthly fixed selling, general, and administrative (SG&A) expenses include the following: (a) $2,500 $360 $140 $650 Apple (per pie) Crust $0.20 If Margaret decides to only sell cherry pies, then what will her budgeted sales revenue be for April? Budgeted sales revenue be for April $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the budgeted sales revenue for April w...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started