Question

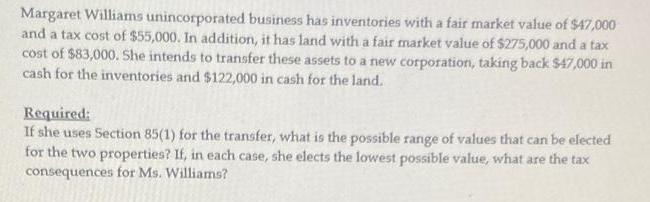

Margaret Williams unincorporated business has inventories with a fair market value of $47,000 and a tax cost of $55,000. In addition, it has land

Margaret Williams unincorporated business has inventories with a fair market value of $47,000 and a tax cost of $55,000. In addition, it has land with a fair market value of $275,000 and a tax cost of $83,000. She intends to transfer these assets to a new corporation, taking back $47,000 in cash for the inventories and $122,000 in cash for the land. Required: If she uses Section 85(1) for the transfer, what is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Williams?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Margaret Williams For inventory Elected value 47000 Taxable value 0 Tax consequences There is no gain on transfer but the business loss of 8000 which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App