Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suwit Semailee Berhad (SSB) is a manufacturer of branded and generic prescription pharmaceuticals, vaccines and over-the-counter medications, based in Penang, Malaysia. The company was

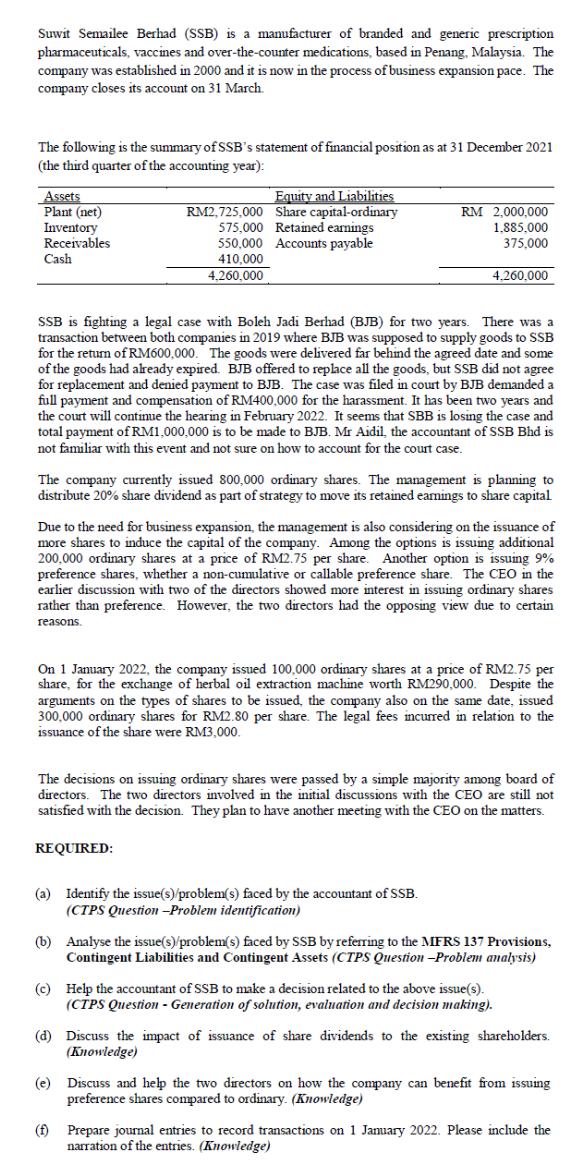

Suwit Semailee Berhad (SSB) is a manufacturer of branded and generic prescription pharmaceuticals, vaccines and over-the-counter medications, based in Penang, Malaysia. The company was established in 2000 and it is now in the process of business expansion pace. The company closes its account on 31 March. The following is the summary of SSB's statement of financial position as at 31 December 2021 (the third quarter of the accounting year): Assets Plant (net) Inventory Receivables Cash Equity and Liabilities Share capital-ordinary Retained earnings 550,000 Accounts payable 410,000 4.260,000 RM2,725,000 575,000 SSB is fighting a legal case with Boleh Jadi Berhad (BJB) for two years. There was a transaction between both companies in 2019 where BJB was supposed to supply goods to SSB for the return of RM600,000. The goods were delivered far behind the agreed date and some of the goods had already expired. BJB offered to replace all the goods, but SSB did not agree for replacement and denied payment to BJB. The case was filed in court by BJB demanded a full payment and compensation of RM400,000 for the harassment. It has been two years and the court will continue the hearing in February 2022. It seems that SBB is losing the case and total payment of RM1,000,000 is to be made to BJB. Mr Aidil, the accountant of SSB Bhd is not familiar with this event and not sure on how to account for the court case. RM 2,000,000 1.885.000 375,000 The company currently issued 800,000 ordinary shares. The management is planning to distribute 20% share dividend as part of strategy to move its retained earnings to share capital REQUIRED: 4.260,000 Due to the need for business expansion, the management is also considering on the issuance of more shares to induce the capital of the company. Among the options is issuing additional 200,000 ordinary shares at a price of RM2.75 per share. Another option is issuing 9% preference shares, whether a non-cumulative or callable preference share. The CEO in the earlier discussion with two of the directors showed more interest in issuing ordinary shares rather than preference. However, the two directors had the opposing view due to certain reasons. On 1 January 2022, the company issued 100,000 ordinary shares at a price of RM2.75 per share, for the exchange of herbal oil extraction machine worth RM290,000. Despite the arguments on the types of shares to be issued, the company also on the same date, issued 300,000 ordinary shares for RM2.80 per share. The legal fees incurred in relation to the issuance of the share were RM3,000. The decisions on issuing ordinary shares were passed by a simple majority among board of directors. The two directors involved in the initial discussions with the CEO are still not satisfied with the decision. They plan to have another meeting with the CEO on the matters. (a) Identify the issue(s)/problem(s) faced by the accountant of SSB. (CTPS Question -Problem identification) (b) Analyse the issue(s)/problem(s) faced by SSB by referring to the MFRS 137 Provisions, Contingent Liabilities and Contingent Assets (CTPS Question -Problem analysis) (f) (c) Help the accountant of SSB to make a decision related to the above issue(s). (CTPS Question - Generation of solution, evaluation and decision making). (d) Discuss the impact of issuance of share dividends to the existing shareholders. (Knowledge) (e) Discuss and help the two directors on how the company can benefit from issuing preference shares compared to ordinary. (Knowledge) Prepare journal entries to record transactions on 1 January 2022. Please include the narration of the entries. (Knowledge)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a 1 The accountant is not aware of the liability that will be arising on SSB bhd in relation to the goods supplied by BJB where he needs to make a pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started