Below are the financial statement for XYZ Company. The company's net sales for 2020 and 2019 were $260,000 and $180,000, respectively. Assets Cash Accounts receivable

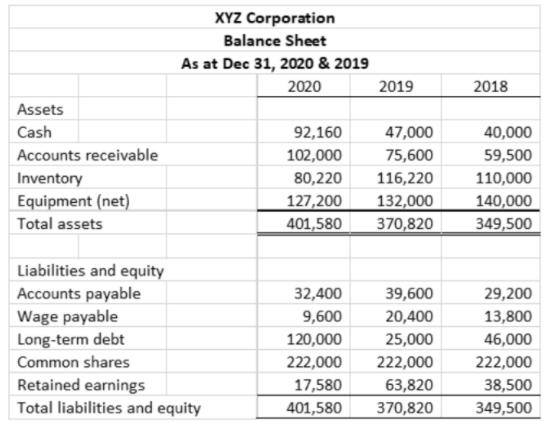

Below are the financial statement for XYZ Company. The company's net sales for 2020 and 2019 were $260,000 and $180,000, respectively.

Assets Cash Accounts receivable Inventory Equipment (net) Total assets XYZ Corporation Balance Sheet As at Dec 31, 2020 & 2019 2020 Liabilities and equity Accounts payable Wage payable Long-term debt Common shares Retained earnings Total liabilities and equity 92,160 102,000 80,220 127,200 401,580 32,400 9,600 120,000 222,000 17,580 401,580 2019 47,000 75,600 116,220 132,000 370,820 39,600 20,400 25,000 222,000 63,820 370,820 2018 40,000 59,500 110,000 140,000 349,500 29,200 13,800 46,000 222,000 38,500 349,500 Required for each of the following ratios (10 marks): 1. Calculate the following ratios for 2020 and 2019. 2. Indicate if it is a favourable or unfavourable change compared to the prior year. 3. Briefly describe what the 2020 ratio means in your own words. a) Current ratio b) Accounts receivable turnover c) Debt ratio

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started