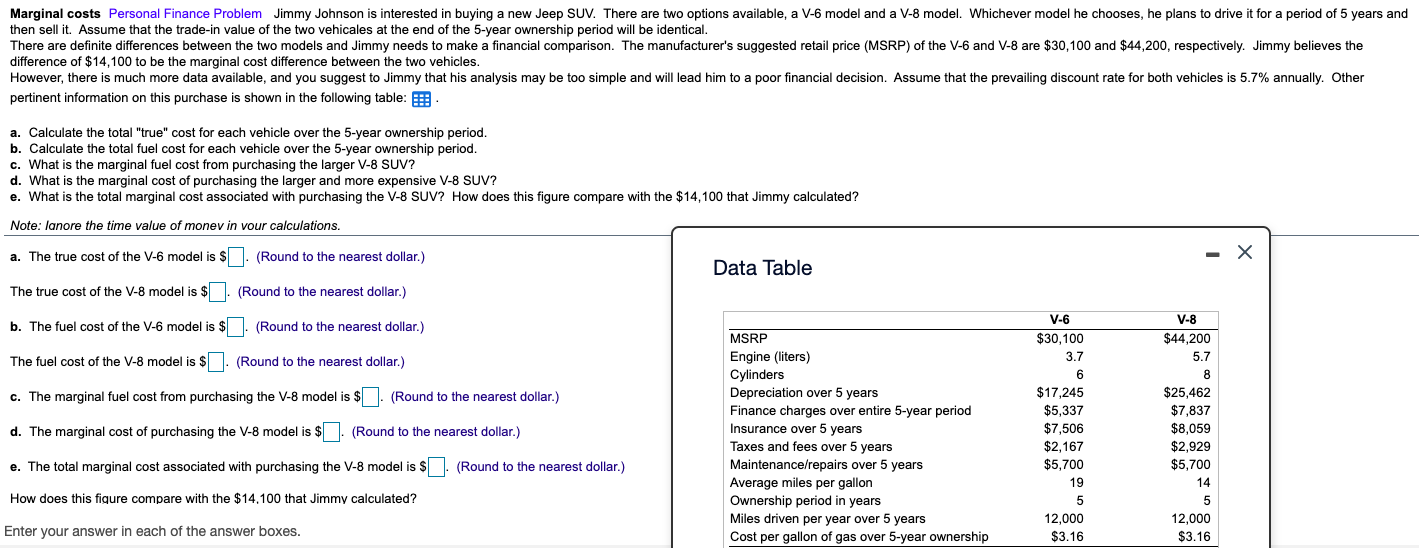

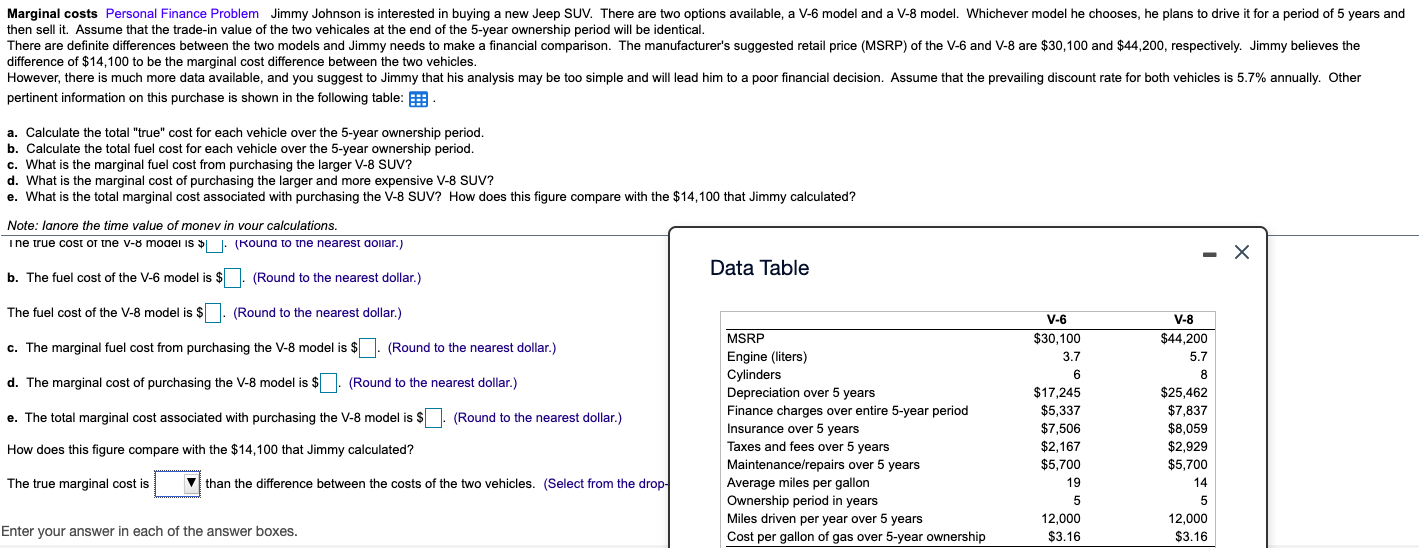

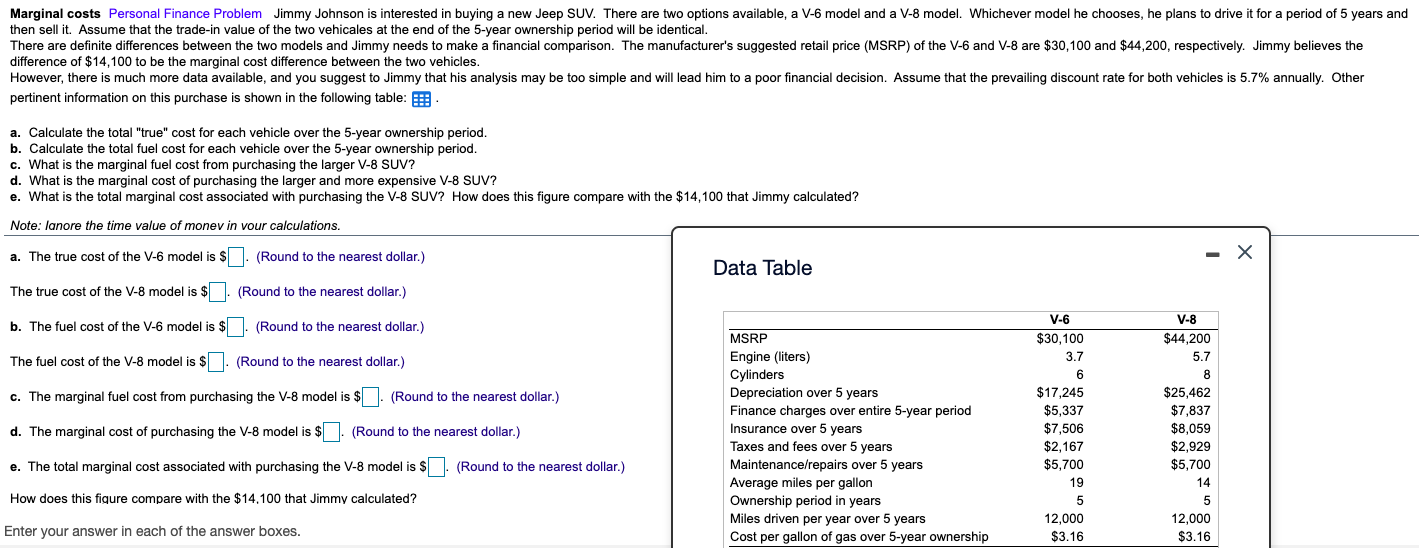

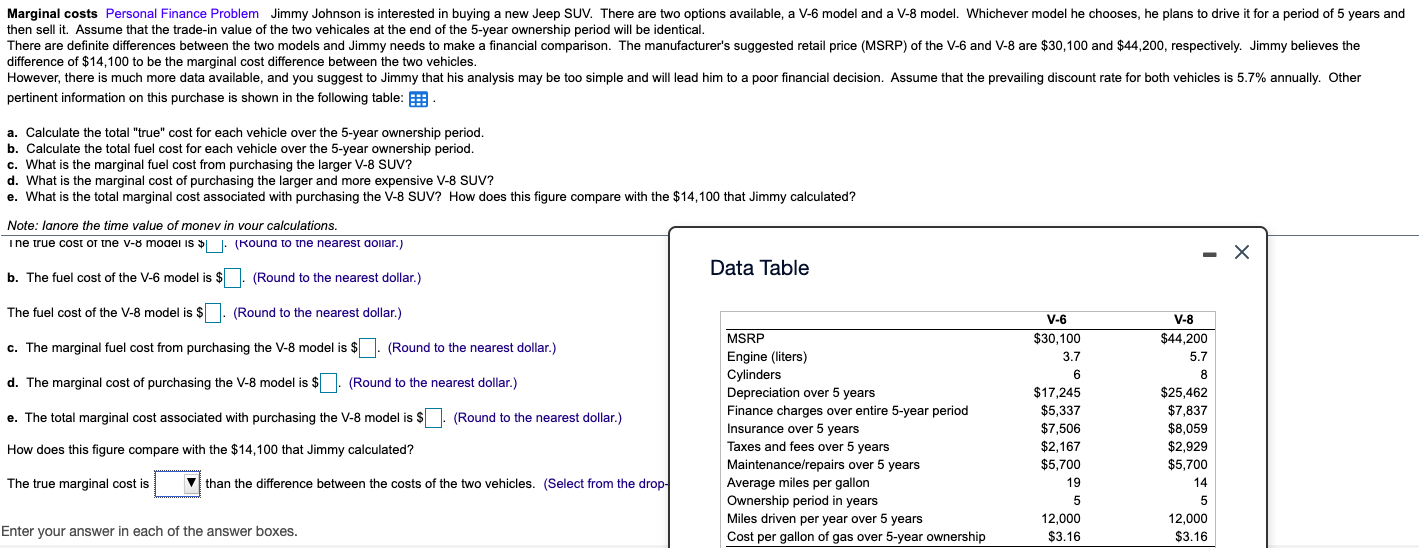

Marginal costs Personal Finance Problem Jimmy Johnson is interested in buying a new Jeep SUV. There are two options available, a V-6 model and a V-8 model. Whichever model he chooses, he plans to drive it for a period of 5 years and then sell it. Assume that the trade-in value of the two vehicales at the end of the 5-year ownership period will be identical. There are definite differences between the two models and Jimmy needs to make a financial comparison. The manufacturer's suggested retail price (MSRP) of the V-6 and V-8 are $30,100 and $44,200, respectively. Jimmy believes the difference of $14,100 to be the marginal cost difference between the two vehicles. However, there is much more data available, and you suggest to Jimmy that his analysis may be too simple and will lead him to a poor financial decision. Assume that the prevailing discount rate for both vehicles is 5.7% annually. Other pertinent information on this purchase is shown in the following table: : a. Calculate the total "true" cost for each vehicle over the 5-year ownership period. b. Calculate the total fuel cost for each vehicle over the 5-year ownership period. c. What is the marginal fuel cost from purchasing the larger V-8 SUV? d. What is the marginal cost of purchasing the larger and more expensive V-8 SUV? e. What is the total marginal cost associated with purchasing the V-8 SUV? How does this figure compare with the $14, 100 that Jimmy calculated? Note: lanore the time value of monev in vour calculations. a. The true cost of the V-6 model is $. (Round to the nearest dollar.) Data Table The true cost of the V-8 model is $(Round to the nearest dollar.) b. The fuel cost of the V-6 model is $. (Round to the nearest dollar.) The fuel cost of the V-8 model is $. (Round to the nearest dollar.) c. The marginal fuel cost from purchasing the V-8 model is $. (Round to the nearest dollar.) d. The marginal cost of purchasing the V-8 model is $. (Round to the nearest dollar.) MSRP Engine (liters) Cylinders Depreciation over 5 years Finance charges over entire 5-year period Insurance over 5 years Taxes and fees over 5 years Maintenance/repairs over 5 years Average miles per gallon Ownership period in years Miles driven per year over 5 years Cost per gallon of gas over 5-year ownership V-6 $30,100 3.7 6 $17,245 $5,337 $7,506 $2,167 $5,700 19 5 12,000 $3.16 V-8 $44,200 5.7 8 $25,462 $7,837 $8,059 $2,929 $5,700 14 5 12,000 $3.16 e. The total marginal cost associated with purchasing the V-8 model is $ U. (Round to the nearest dollar.) How does this figure compare with the $14,100 that Jimmy calculated? Enter your answer in each of the answer boxes. Marginal costs Personal Finance Problem Jimmy Johnson is interested in buying a new Jeep SUV. There are two options available, a V-6 model and a V-8 model. Whichever model he chooses, he plans to drive it for a period of 5 years and then sell it. Assume that the trade-in value of the two vehicales at the end of the 5-year ownership period will be identical. There are definite differences between the two models and Jimmy needs to make a financial comparison. The manufacturer's suggested retail price (MSRP) of the V-6 and V-8 are $30,100 and $44,200, respectively. Jimmy believes the difference of $14,100 to be the marginal cost difference between the two vehicles. However, there is much more data available, and you suggest to Jimmy that his analysis may be too simple and will lead him to a poor financial decision. Assume that the prevailing discount rate for both vehicles is 5.7% annually. Other pertinent information on this purchase shown in the following table: :: a. Calculate the total "true" cost for each vehicle over the 5-year ownership period. b. Calculate the total fuel cost for each vehicle over the 5-year ownership period. c. What is the marginal fuel cost from purchasing the larger V-8 SUV? d. What is the marginal cost of purchasing the larger and more expensive V-8 SUV? e. What is the total marginal cost associated with purchasing the V-8 SUV? How does this figure compare with the $14, 100 that Jimmy calculated? Note: lanore the time value of monev in vour calculations. i ne true cost of ine v-8 model is U. (Round to the nearest dollar.) - X Data Table b. The fuel cost of the V-6 model is $(Round to the nearest dollar.) The fuel cost of the V-8 model is $. (Round to the nearest dollar.) c. The marginal fuel cost from purchasing the V-8 model is $. (Round to the nearest dollar.) d. The marginal cost of purchasing the V-8 model is $. (Round to the nearest dollar.) e. The total marginal cost associated with purchasing the V-8 model is $ (Round to the nearest dollar.) MSRP Engine (liters) Cylinders Depreciation over 5 years Finance charges over entire 5-year period Insurance over 5 years Taxes and fees over 5 years Maintenance/repairs over 5 years Average miles per gallon Ownership period in years Miles driven per year over 5 years Cost per gallon of gas over 5-year ownership V-6 $30,100 3.7 6 $17,245 $5,337 $7,506 $2,167 $5,700 19 5 12,000 $3.16 V-8 $44,200 5.7 8 $25,462 $7,837 $8,059 $2,929 $5,700 14 5 12,000 $3.16 How does this figure compare with the $14,100 that Jimmy calculated? The true marginal cost is than the difference between the costs of the two vehicles. (Select from the drop- Enter your answer in each of the answer boxes