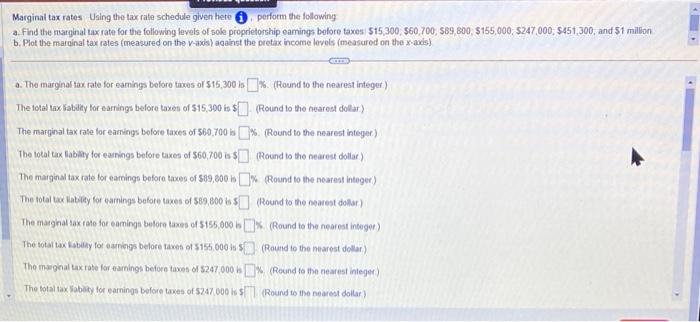

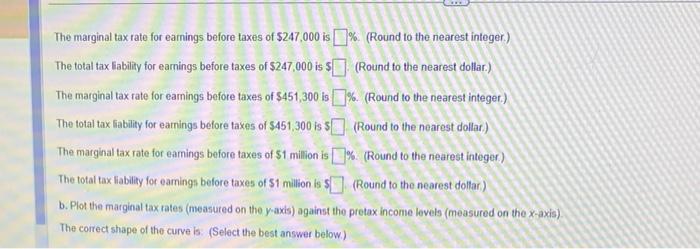

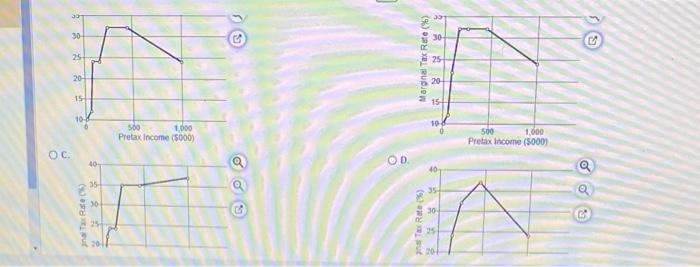

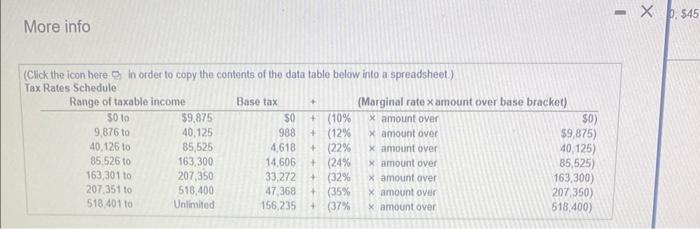

Marginal tax rates Using the tax rate schedule given hete (i), perform the following a. Find the matginal tax rate for the following levels of sole pioprietorship eamings bofore taxes $15,300,$60,700,569,800,$155,000;5247,000,$451,300, and $1 million b. Plot the marginal tax rates (measured on the v-axis) against the pretax income lovols (measured on the x-axis) a. The marginal tax rate for earnings before taxes of 515,300 is \$5. (Round to the nearest integer.) The fotal tax Fability for earnings before taxes of 515,300 is 5 (Round to the nearest dollar.) The marginal tax rase for eamings before taxes of 560.700ia \%. (Round to the nearest integer) The total cax flability for earings before taxes of 560,700 is S (Round to the nearest dollar.) The marginal tax rate for earrings before taxes of 589,600b \&. (Round to the nearest integer) The total tax kablity for earnings before toxes of 589,800 is 4 (Round to the nearest dollar) The magkal tax rate for eamings belore taxes of 5155,000 is $. (Round to the nearest integer) The totai tax labiliny for earrings belore taxes of 5155.000 is 5 (Round to the nearest dollar) The maxinal tax rate for tharnings before taxes of 5247.000b. \$. (Round to the nearest integer) The fotal tax labelity for earnings bofore taxes of 5247.000is5 (Round to the nearest dollar) The marginal tax rate for earnings before taxes of $247,000 is %. (Round to the nearest integer.) The total tax liability for earnings before taxes of $247,000 is $ (Round to the nearest dollar.) The marginal tax rate for earnings before taxes of $451,300 is %. (Round to the nearest integer.) The total tax fability for eamings before taxes of $451,300 is $ (Round to the nearest dollar.) The marginal tax rate for eamings before taxes of $1 million is \%. (Round to the nearest integer) The total tax liability for eamings before taxes of $1 million is 5 (Round to the nearest dollar) b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis) The correct shape of tho curve is. (Select the best answer below.) (C) (C) Oc. Q Oo. Q (C) More info