Margo, a calendar year taxpayer, paid $1,580,000 for new machinery (seven-year recovery property) placed in service on August 1, 2023. Required: a. Assuming that

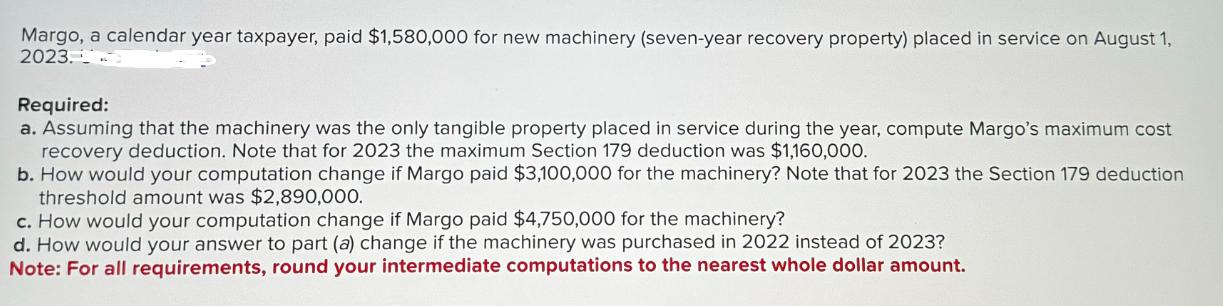

Margo, a calendar year taxpayer, paid $1,580,000 for new machinery (seven-year recovery property) placed in service on August 1, 2023. Required: a. Assuming that the machinery was the only tangible property placed in service during the year, compute Margo's maximum cost recovery deduction. Note that for 2023 the maximum Section 179 deduction was $1,160,000. b. How would your computation change if Margo paid $3,100,000 for the machinery? Note that for 2023 the Section 179 deduction threshold amount was $2,890,000. c. How would your computation change if Margo paid $4,750,000 for the machinery? d. How would your answer to part (a) change if the machinery was purchased in 2022 instead of 2023? Note: For all requirements, round your intermediate computations to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Margos maximum cost recovery deduction for the machinery purchased in 2023 would be calculated as follows Section 179 Deduction The maximum S...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started