Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maria is trying to decide if she should refinance her mortgage. Maria has a 30-year mortgage loan at 6.5%. She knows that her monthly

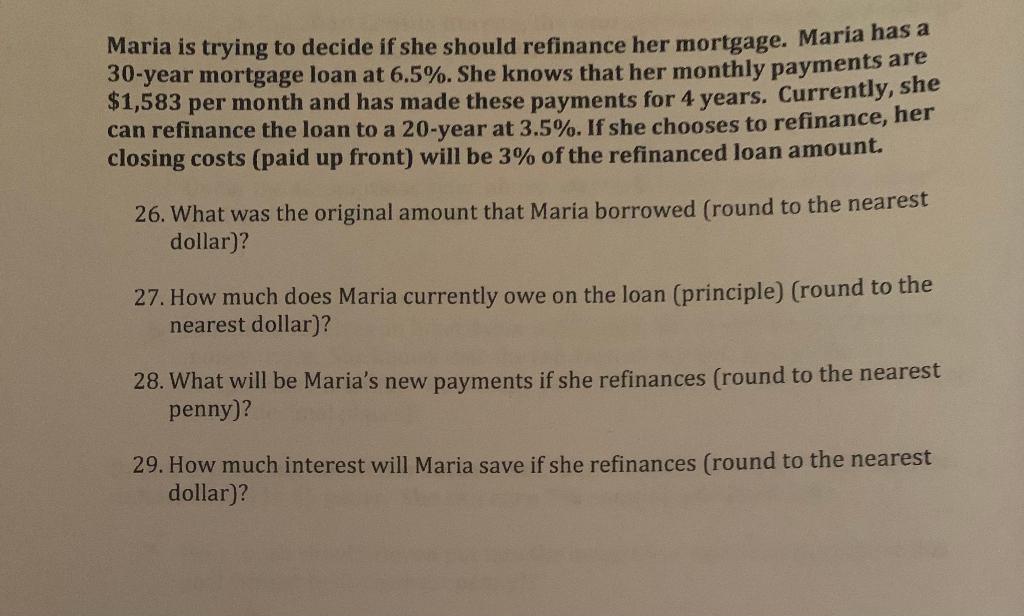

Maria is trying to decide if she should refinance her mortgage. Maria has a 30-year mortgage loan at 6.5%. She knows that her monthly payments are $1,583 per month and has made these payments for 4 years. Currently, she can refinance the loan to a 20-year at 3.5%. If she chooses to refinance, her closing costs (paid up front) will be 3% of the refinanced loan amount. 26. What was the original amount that Maria borrowed (round to the nearest dollar)? 27. How much does Maria currently owe on the loan (principle) (round to the nearest dollar)? 28. What will be Maria's new payments if she refinances (round to the nearest penny)? 29. How much interest will Maria save if she refinances (round to the nearest dollar)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the answers to the questions we will follow these steps 1 Calculate the original loan amount 2 Calculate the remaining loan balance 3 Cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started