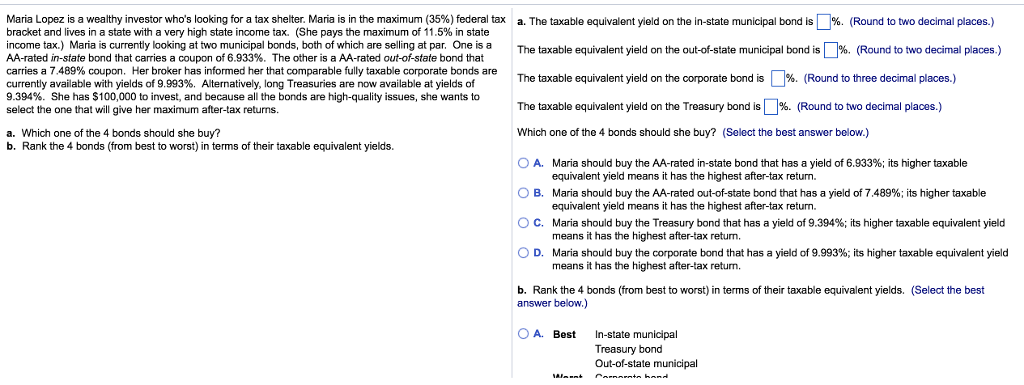

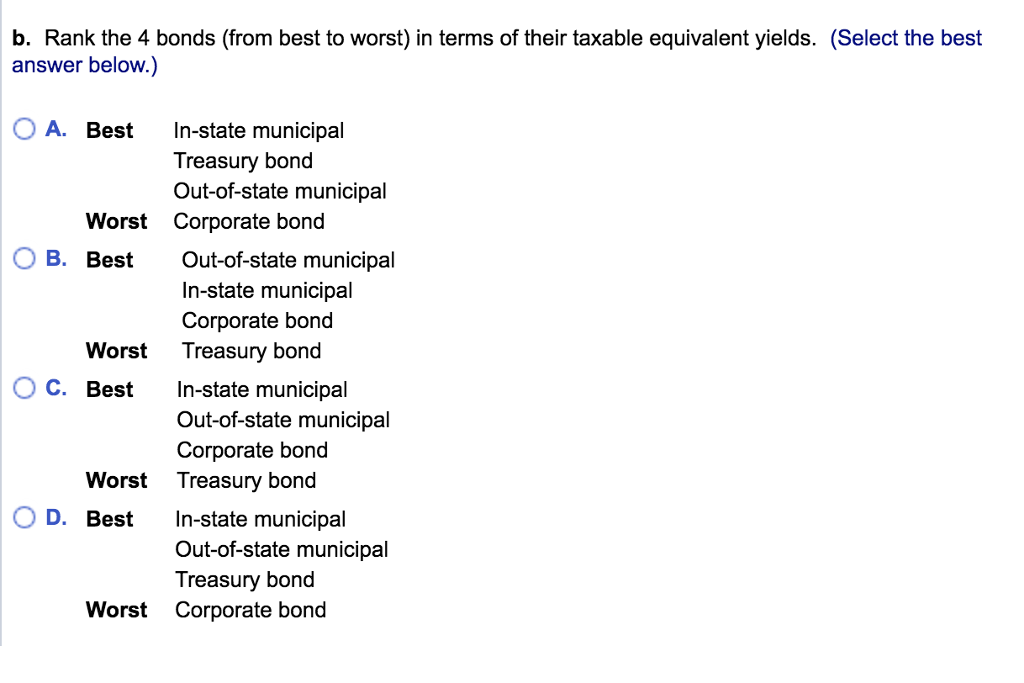

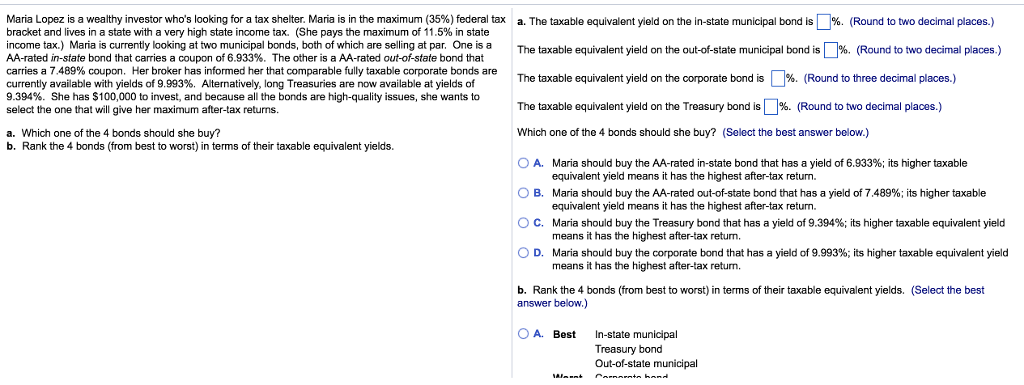

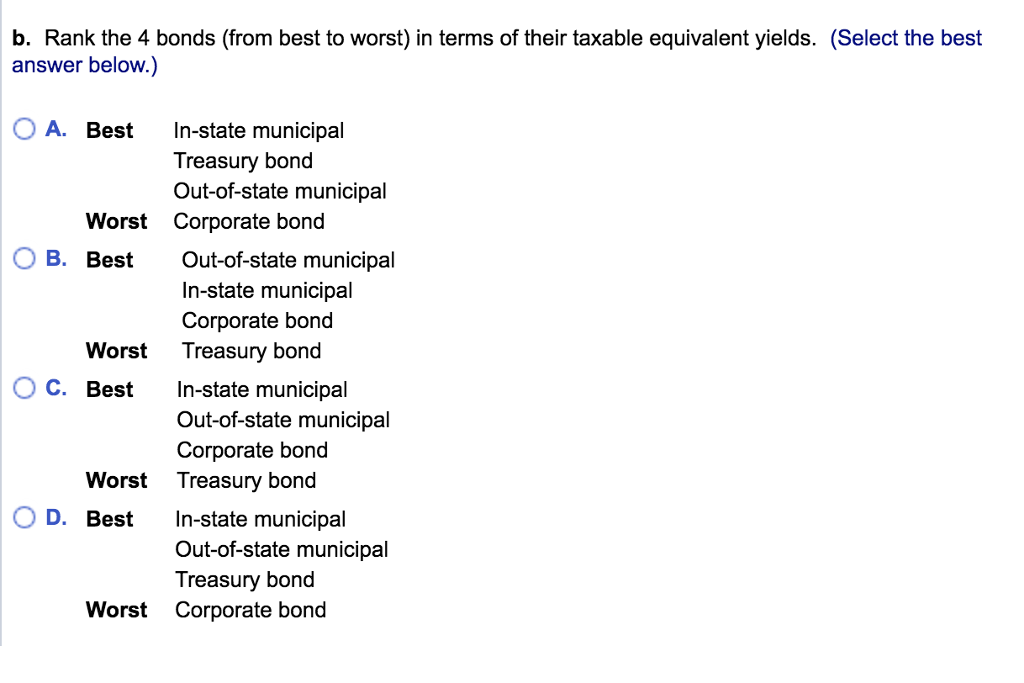

Maria Lopez is a wealthy investor who's looking for a tax shelter. Maria Is in the maximum 35% federal tax bracket and lives in a state with a very high state income tax. (She pays the maximum of 11.5% in state income tax.) Maria is currently looking at two municipal bonds, both of which are selling at par. One is a AA-rated in-state bond that carries a coupon of 6.933%. The other is a AA-rated out-of-state bond that % a. The taxable equivalent yield on the in-state municipal bond is The taxable equivalent yield on the out-of-state municipal bond is The taxable equivalent yield on the corporate bond is The taxable equivalent yield on the Treasury bond is 1% Round to two decimal places Which one of the 4 bonds should she buy? (Select the best answer below.) Round to two deci al places. (Round to two decimal places.) currently available with yields of 0993 a Aternativ he that copa a selytaxable para eld nds are % Round to three decimal places.) Round to tree deci al laces. currently available with yields of 9.993%. Alternatively, long Treasuries are now available at yields of 9.394%. She has $100,000 to invest, and because all the bonds are high-quality issues, she wants to select the one that will give her maximum after-tax returns a. Which one of the 4 bonds should she buy? b. Rank the 4 bonds (from best to worst) in terms of their taxable equivalent yields A. B. C. D. Maria should buy the AA-rated in-state bond that has a yield of 6.933%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the AA-rated out-of-state bond that has a yield of 7.489%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the Treasury bond that has a yield of 9.394%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the corporate bond that has a yield of 9.993%; its higher taxable equivalent yield means it has the highest after-tax return. (Select the best b. Rank the 4 bonds (from best to worst) in terms of their taxable equivalent yields. answer below.) OA. Best In-state municipal Treasury bond Out-of-state municipal Maria Lopez is a wealthy investor who's looking for a tax shelter. Maria Is in the maximum 35% federal tax bracket and lives in a state with a very high state income tax. (She pays the maximum of 11.5% in state income tax.) Maria is currently looking at two municipal bonds, both of which are selling at par. One is a AA-rated in-state bond that carries a coupon of 6.933%. The other is a AA-rated out-of-state bond that % a. The taxable equivalent yield on the in-state municipal bond is The taxable equivalent yield on the out-of-state municipal bond is The taxable equivalent yield on the corporate bond is The taxable equivalent yield on the Treasury bond is 1% Round to two decimal places Which one of the 4 bonds should she buy? (Select the best answer below.) Round to two deci al places. (Round to two decimal places.) currently available with yields of 0993 a Aternativ he that copa a selytaxable para eld nds are % Round to three decimal places.) Round to tree deci al laces. currently available with yields of 9.993%. Alternatively, long Treasuries are now available at yields of 9.394%. She has $100,000 to invest, and because all the bonds are high-quality issues, she wants to select the one that will give her maximum after-tax returns a. Which one of the 4 bonds should she buy? b. Rank the 4 bonds (from best to worst) in terms of their taxable equivalent yields A. B. C. D. Maria should buy the AA-rated in-state bond that has a yield of 6.933%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the AA-rated out-of-state bond that has a yield of 7.489%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the Treasury bond that has a yield of 9.394%; its higher taxable equivalent yield means it has the highest after-tax return. Maria should buy the corporate bond that has a yield of 9.993%; its higher taxable equivalent yield means it has the highest after-tax return. (Select the best b. Rank the 4 bonds (from best to worst) in terms of their taxable equivalent yields. answer below.) OA. Best In-state municipal Treasury bond Out-of-state municipal