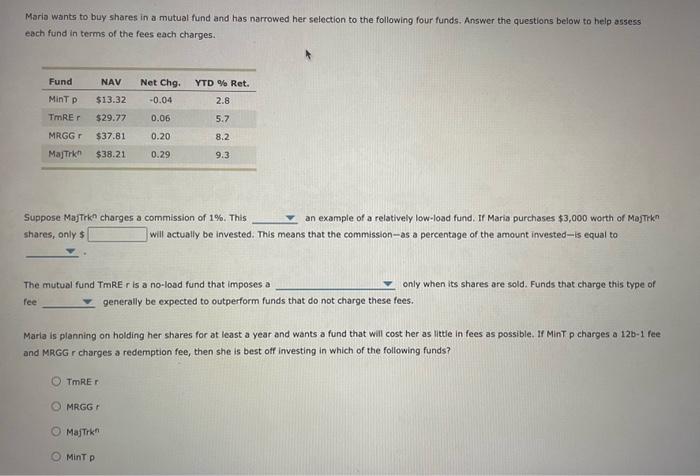

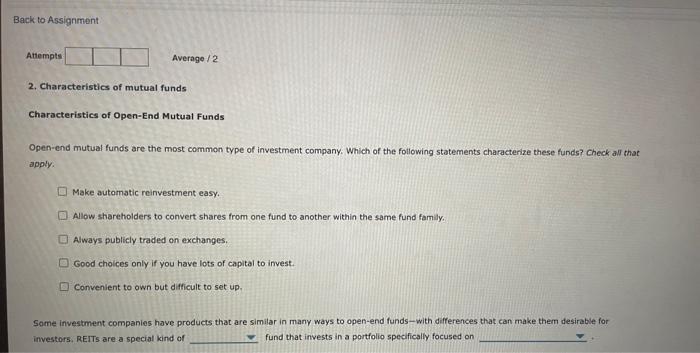

Maria wants to buy shares in a mutual fund and has narrowed her selection to the following four funds. Answer the questions below to help assess each fund in terms of the fees each charges. Suppose Majtrin charges a commission of 1%. This an example of a relatively low-load fund. If Maria purchases $3,000 worth of MajTrkn shares, only 5 will actually be invested. This means that the commission-as a percentage of the amount invested-is equal to The mutual fund TmRE i is a no-load fund that imposes a only when its shares are sold. Funds that charge this type of fee generally be expected to outperform funds that do not charge these fees. Marla is planning on holding her shares for at least a year and wants a fund that will cost her as little in fees as possible. If MinT p charges a 12b1 fee and MRGG r charges a redemption fee, then she is best off investing in which of the following funds? TimRE r. MRGG MajTrkn MinT p 2. Characteristics of mutual funds Characteristics of Open-End Mutual Funds Open-end mutual funds are the most common type of investment company. Which of the following statements characterize these funds? Check alf that apply. Make automatic reinvestment easy. Allow shareholders to convert shares from one fund to another within the same fund family. Always publicly traded on exchanges. Good choices only if you have lots of capital to invest. Comvenient to own but difficult to set up. Some investment companies have products that are similar in many ways to open-end funds-with differences that can make them desirable for investors. REITS are a special kind of fund that invests in a portfolio specifically focused on Maria wants to buy shares in a mutual fund and has narrowed her selection to the following four funds. Answer the questions below to help assess each fund in terms of the fees each charges. Suppose Majtrin charges a commission of 1%. This an example of a relatively low-load fund. If Maria purchases $3,000 worth of MajTrkn shares, only 5 will actually be invested. This means that the commission-as a percentage of the amount invested-is equal to The mutual fund TmRE i is a no-load fund that imposes a only when its shares are sold. Funds that charge this type of fee generally be expected to outperform funds that do not charge these fees. Marla is planning on holding her shares for at least a year and wants a fund that will cost her as little in fees as possible. If MinT p charges a 12b1 fee and MRGG r charges a redemption fee, then she is best off investing in which of the following funds? TimRE r. MRGG MajTrkn MinT p 2. Characteristics of mutual funds Characteristics of Open-End Mutual Funds Open-end mutual funds are the most common type of investment company. Which of the following statements characterize these funds? Check alf that apply. Make automatic reinvestment easy. Allow shareholders to convert shares from one fund to another within the same fund family. Always publicly traded on exchanges. Good choices only if you have lots of capital to invest. Comvenient to own but difficult to set up. Some investment companies have products that are similar in many ways to open-end funds-with differences that can make them desirable for investors. REITS are a special kind of fund that invests in a portfolio specifically focused on