Question

Marian Manufacturing (2M) applies manufacturing overhead to jobs based on direct labor costs. For Year 2, 2M estimates its manufacturing overhead to be $421,200 and

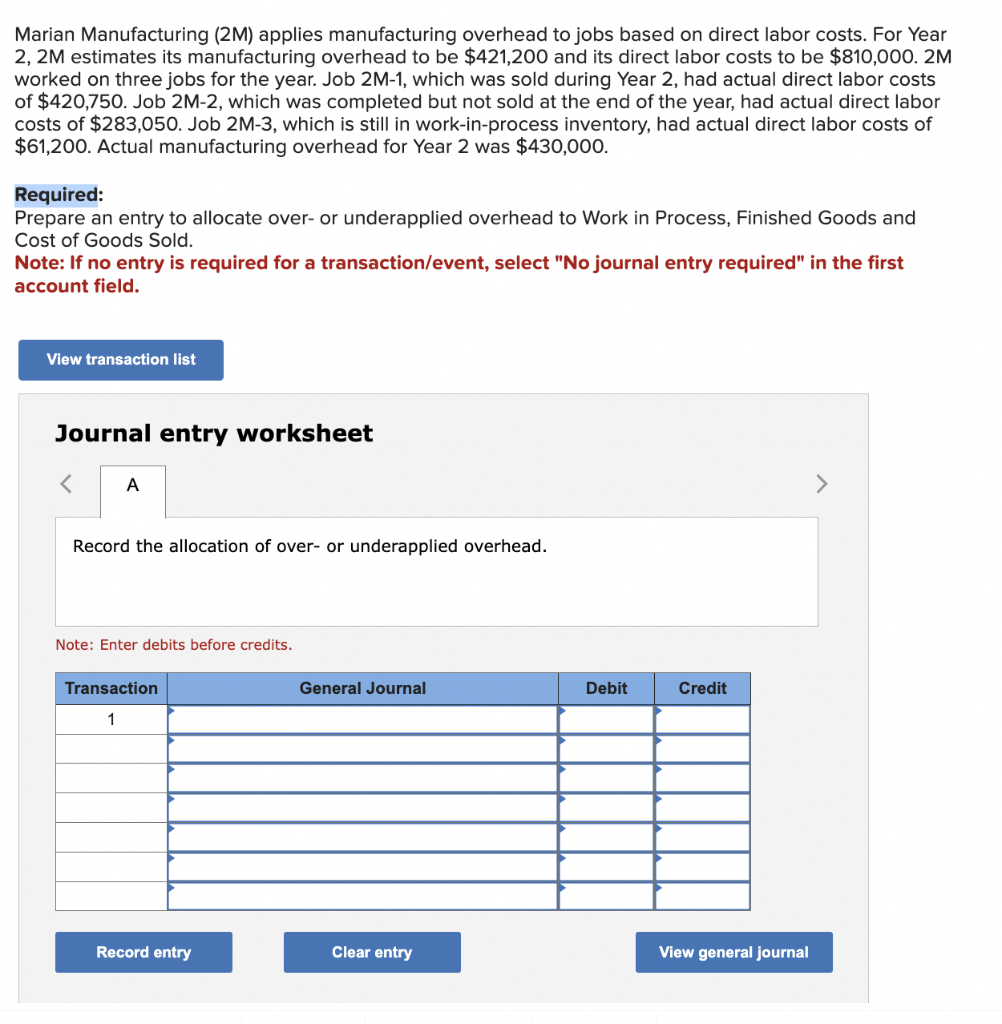

Marian Manufacturing (2M) applies manufacturing overhead to jobs based on direct labor costs. For Year 2, 2M estimates its manufacturing overhead to be $421,200 and its direct labor costs to be $810,000. 2M worked on three jobs for the year. Job 2M-1, which was sold during Year 2, had actual direct labor costs of $420,750. Job 2M-2, which was completed but not sold at the end of the year, had actual direct labor costs of $283,050. Job 2M-3, which is still in work-in-process inventory, had actual direct labor costs of $61,200. Actual manufacturing overhead for Year 2 was $430,000.

Required:

Prepare an entry to allocate over- or underapplied overhead to Work in Process, Finished Goods and Cost of Goods Sold.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started