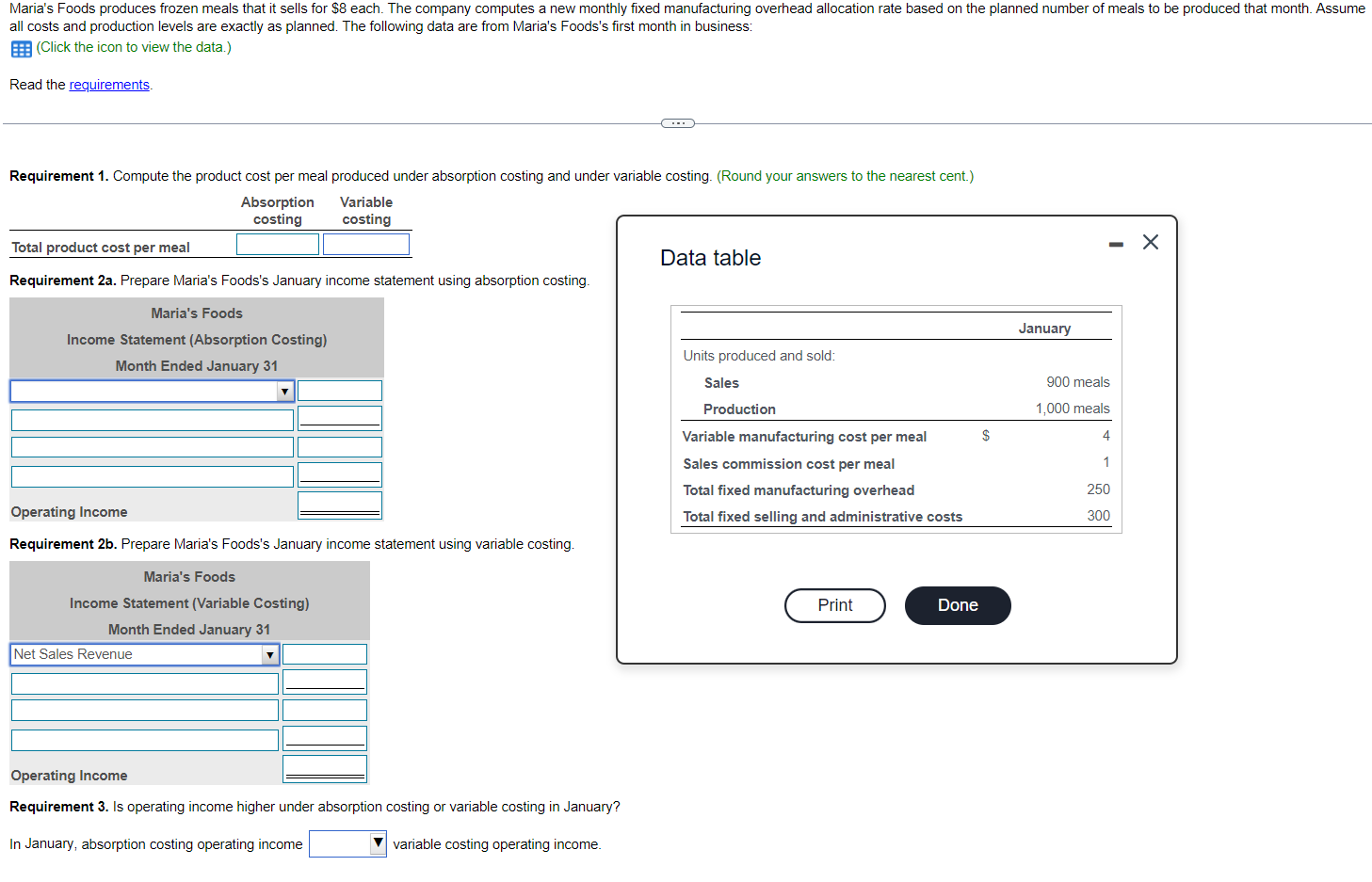

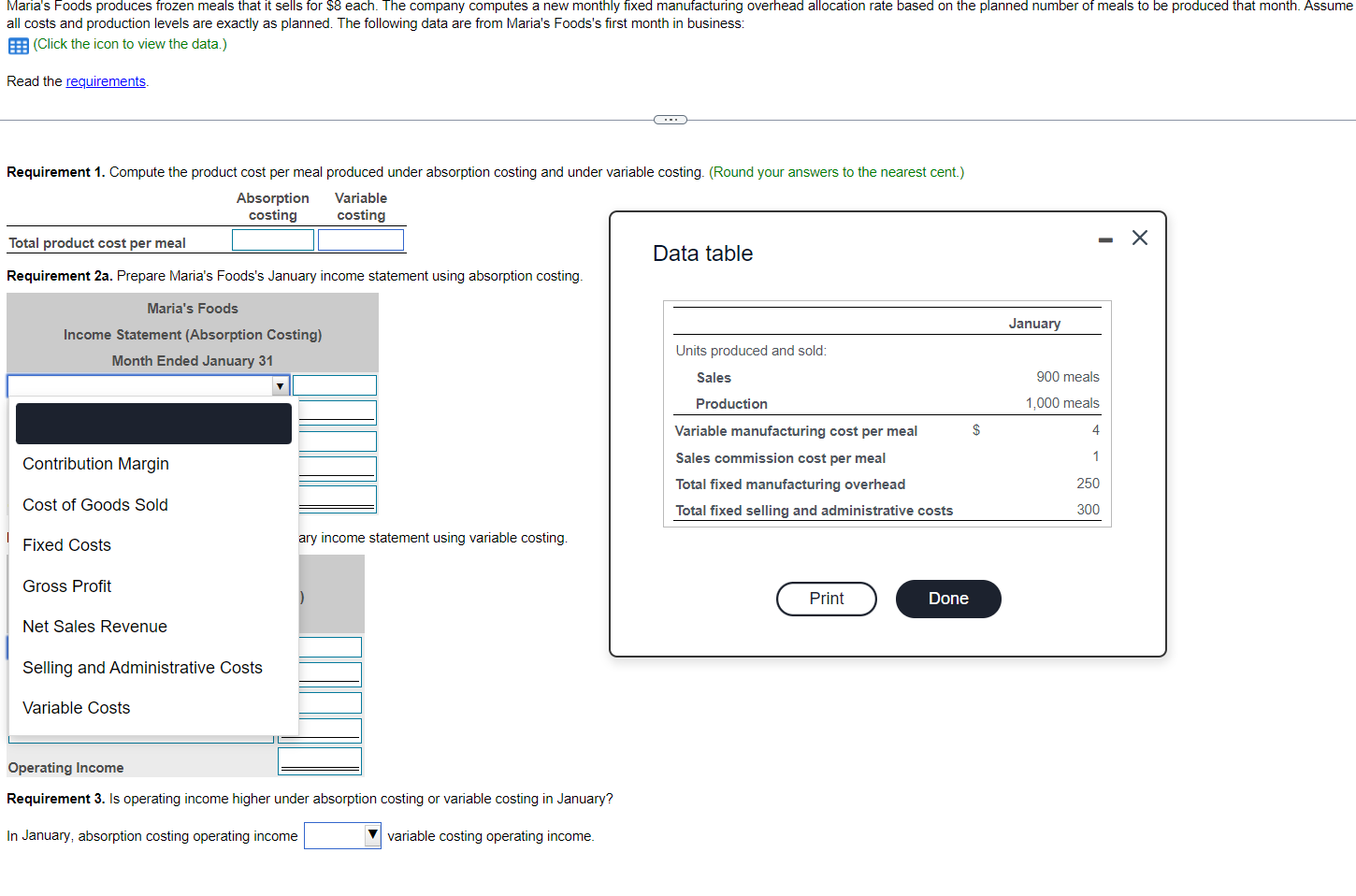

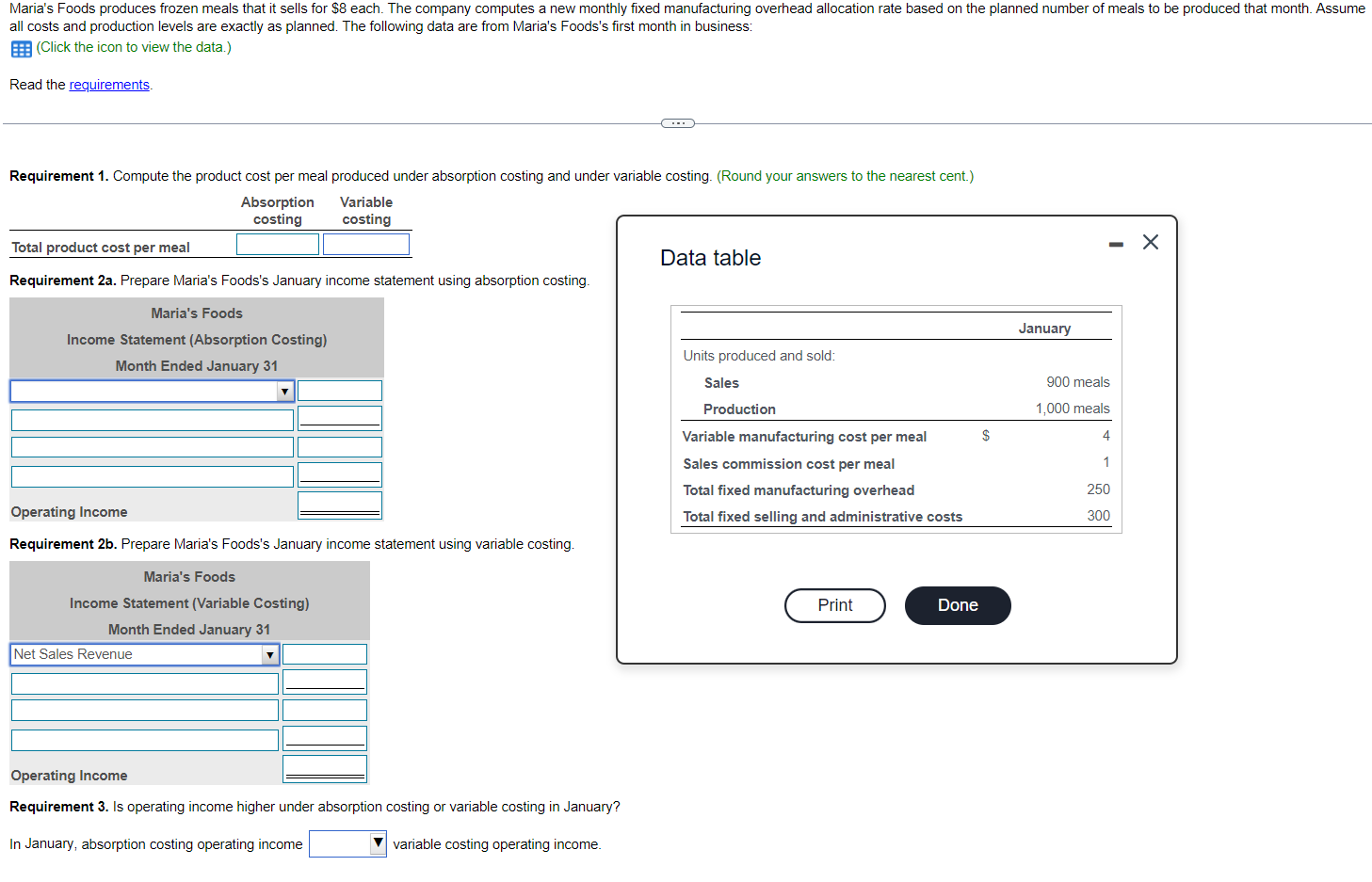

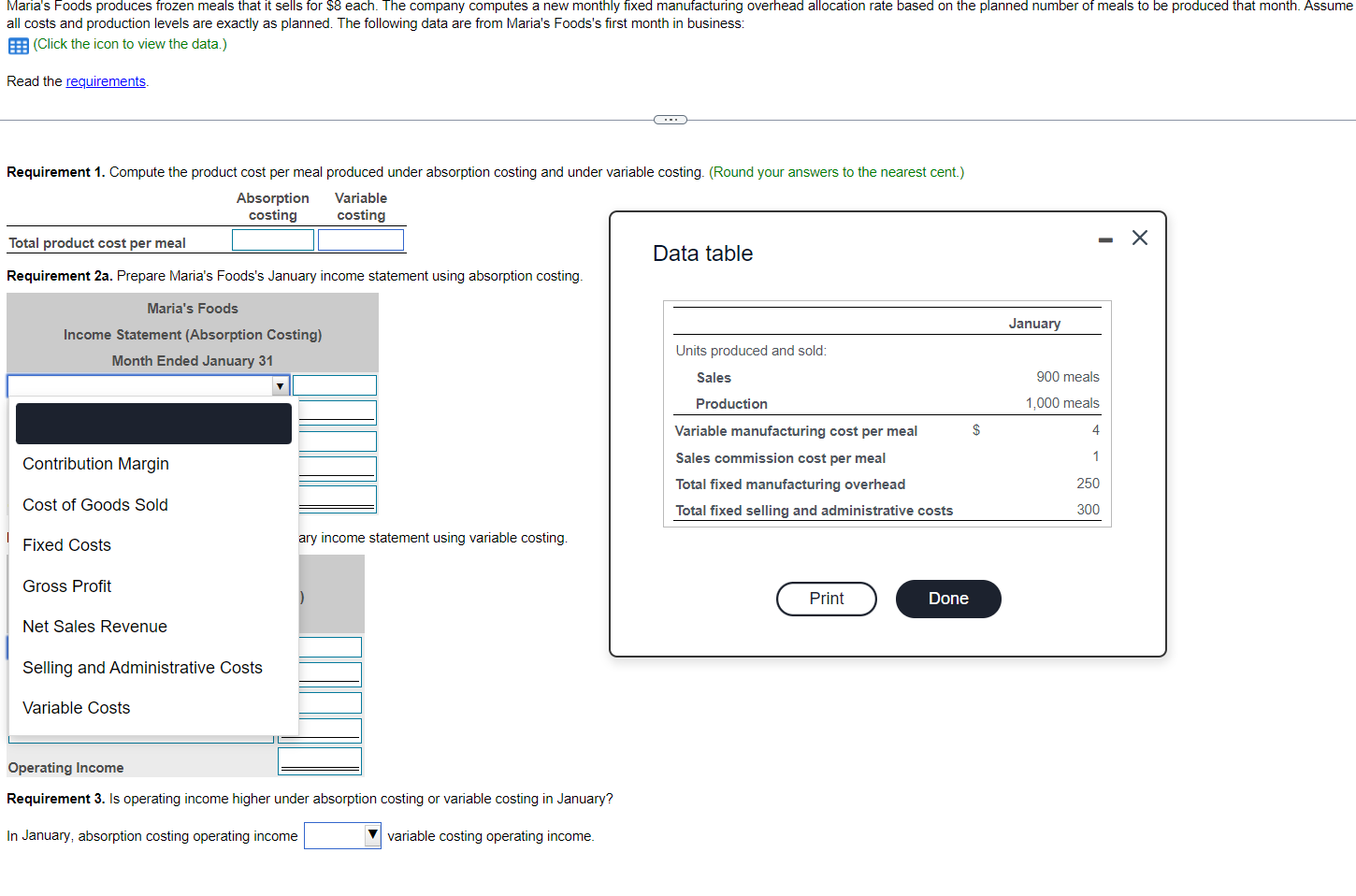

Maria's Foods produces frozen meals that it sells for $8 each. The company computes a new monthly fixed manufacturing overhead allocation rate based on the planned number of meals to be produced that month. Assume all costs and production levels are exactly as planned. The following data are from Maria's Foods's first month in business: (Click the icon to view the data) Read the requirements .. Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. (Round your answers to the nearest cent.) Absorption Variable costing costing Total product cost per meal Data table Requirement 2a. Prepare Maria's Foods's January income statement using absorption costing. - X January Maria's Foods Income Statement (Absorption Costing) Month Ended January 31 Units produced and sold: Sales 900 meals 1,000 meals $ 4 4 Production Variable manufacturing cost per meal Sales commission cost per meal Total fixed manufacturing overhead Total fixed selling and administrative costs 1 250 Operating Income 300 Requirement 2b. Prepare Maria's Foods's January income statement using variable costing. Maria's Foods Print Done Income Statement (Variable Costing) Month Ended January 31 Net Sales Revenue V Operating Income Requirement 3. Is operating income higher under absorption costing or variable costing in January? In January, absorption costing operating income variable costing operating income. Maria's Foods produces frozen meals that it sells for $8 each. The company computes a new monthly fixed manufacturing overhead allocation rate based on the planned number of meals to be produced that month. Assume all costs and production levels are exactly as planned. The following data are from Maria's Foods's first month in business: (Click the icon to view the data.) Read the requirements Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. (Round your answers to the nearest cent.) Absorption Variable costing costing - Total product cost per meal Data table Requirement 2a. Prepare Maria's Foods's January income statement using absorption costing. January Maria's Foods Income Statement (Absorption Costing) Month Ended January 31 Units produced and sold: Sales 900 meals 7 1,000 meals $ 4 Contribution Margin Production Variable manufacturing cost per meal Sales commission cost per meal Total fixed manufacturing overhead Total fixed selling and administrative costs 1 1 250 Cost of Goods Sold 300 Fixed Costs ary income statement using variable costing. Gross Profit Print Done Net Sales Revenue Selling and Administrative Costs Variable Costs Operating Income Requirement 3. Is operating income higher under absorption costing or variable costing in January? In January, absorption costing operating income variable costing operating income