Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marider Industries makes two types of windbreaker jackets: one for spring and one for winter. Marider uses a traditional costing system and is considering switching

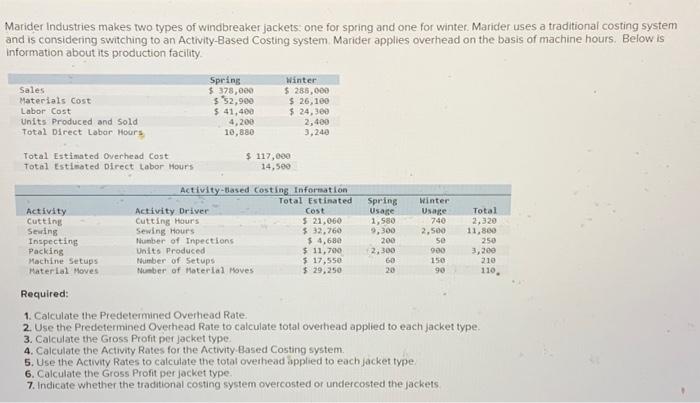

Marider Industries makes two types of windbreaker jackets: one for spring and one for winter. Marider uses a traditional costing system and is considering switching to an Activity-Based Costing system. Marider applies overhead on the basis of machine hours. Below is information about its production facility. Sales Materials Cost Labor Cost Units Produced and Sold Total Direct Labor Hours Total Estimated Overhead Cost Total Estimated Direct Labor Hours Activity Cutting Sewing Inspecting Packing Machine Setups Material Moves Required: Spring $ 378,000 $ 52,900 $ 41,400 4,200 10,880 Activity Driver Cutting Hours Activity-Based Sewing Hours Number of Inpections Units Produced $ 117,000 14,500 Winter $ 288,000 $ 26,100 $ 24,300 Number of Setups Number of Material Moves 2,400 3,240 Costing Information Total Estimated Cost $ 21,060 $ 32,760 $ 4,680 $ 11,700 $ 17,550 $ 29,250 Spring Usage 1,580 9,300 200 2,300 60 20 Winter Usage 740 2,500 50 900 150 90 Total 2,320 11,800 250 3,200 210 110 1. Calculate the Predetermined Overhead Rate. 2. Use the Predetermined Overhead Rate to calculate total overhead applied to each jacket type. 3. Calculate the Gross Profit per jacket type. 4. Calculate the Activity Rates for the Activity-Based Costing system. 5. Use the Activity Rates to calculate the total overhead applied to each jacket type. 6. Calculate the Gross Profit per jacket type. 7. Indicate whether the traditional costing system overcosted or undercosted the jackets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started