Marie Todd is a head of household. She is 37 years old and her address is 4110 N.E. 13th Street, Miami, FL 33127. Additional information about Ms. Todd is as follows:

Social security number: 412-43-5760

Date of birth: 1/14/1984

W-2 for Marie shows these amounts:

Wages (box 1) $43,600.00

Federal W/H (box 2) $2,488.00

Social security wages (box 3) $43,600.00

Social security W/H (box 4) $2,703.20

Medicare wages (box 5) $43,600.00

Medicare W/H (box 6) $632.20

Form 1099-INT for Marie shows this amount:

Box 1 = $556.00 from A & D Bank.

Dependent: Son Steven is 10 years old. HIs date of birth is 5/11/2011/ His social security number is 412-34-5672.

Marie is a Retail store manager.

Required:

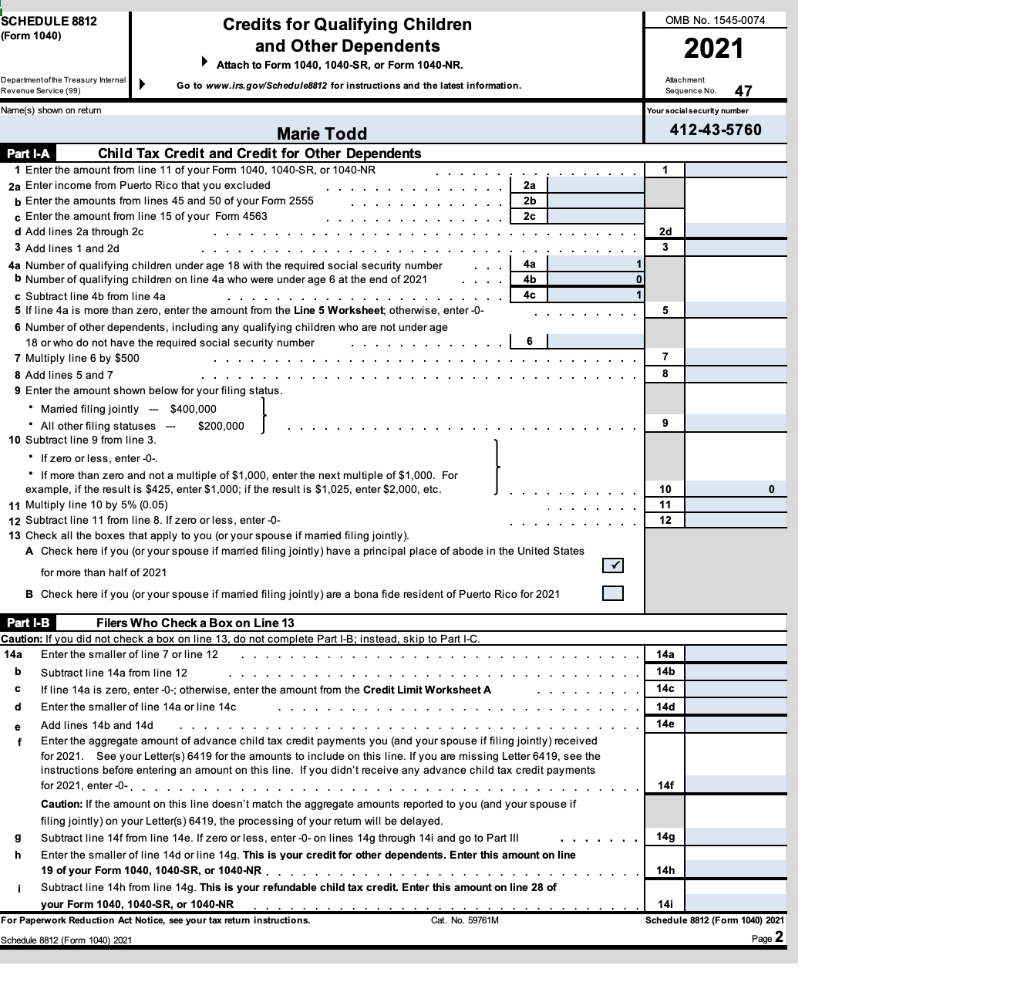

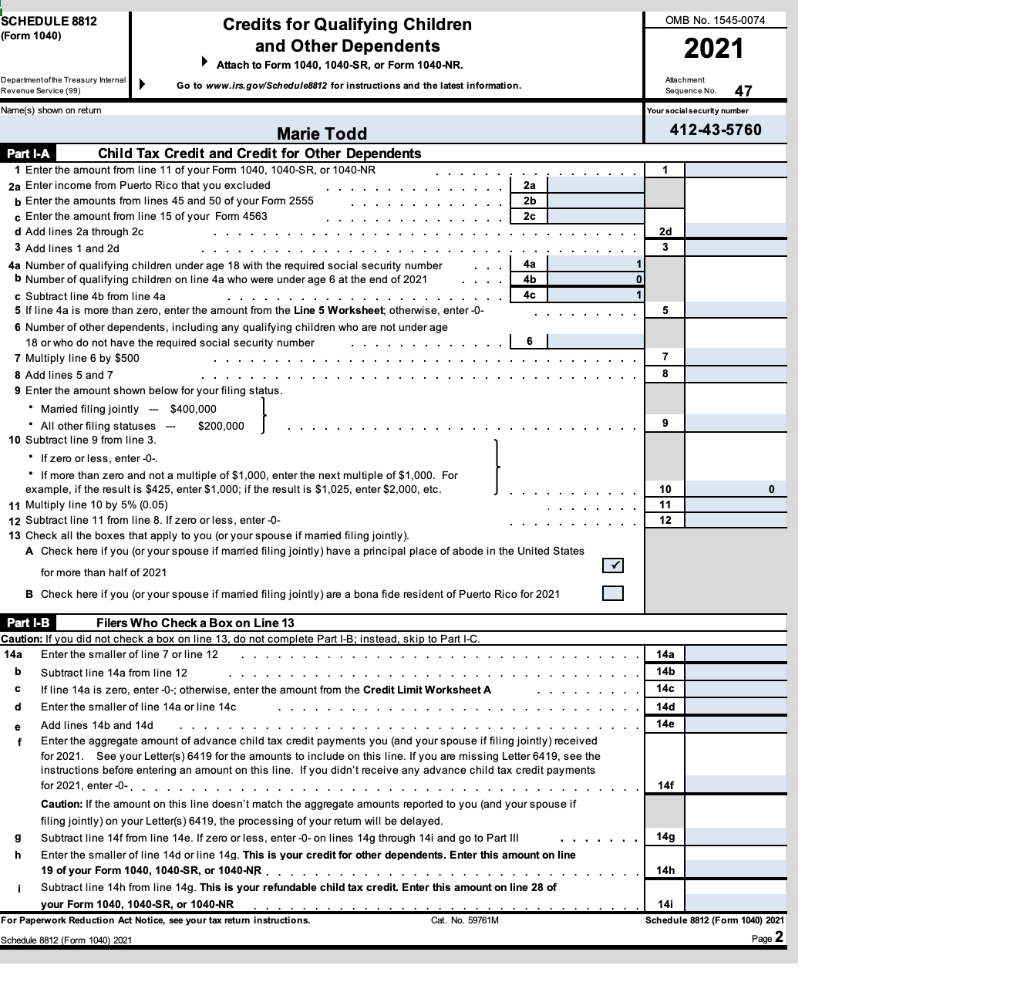

Prepare Form 1040 Plus all the appropriate schedules and worksheets for 2021. She is entitles to a $3,000 child tax credit. For now, enter the credit on Schedule 8812, line 5.

Assume taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem.

Assume all taxpayers did not receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year.

\begin{tabular}{l|c|c} SCHEDULE 8812 & Credits for Qualifying Children & OMB No. 1545-0074 \\ \hline \multicolumn{1}{|c|}{ Corm 1040) } \\ and Other Dependents \\ Attach to Form 1040, 1040-SR, or Form 1040-NR. \end{tabular} Part I-A Child Tax Credit and Credit for Other Dependents 1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 2a Enter income from Puerto Rico that you excluded b Enter the amounts from lines 45 and 50 of your Form 2555 c Enter the amount from line 15 of your Form 4563 d Add lines 2a through 2c 3 Add lines 1 and 2d 4a Number of qualifying children under age 18 with the required social security number b Number of qualifying children on line 4 a who were under age 6 at the end of 2021 c Subtract line 4b from line 4a 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet; otherwise, enter 0 - 6 Number of other dependents, including any qualifying children who are not under age 18 or who do not have the required social security number 7 Multiply line 6 by $500 8 Add lines 5 and 7 9 Enter the amount shown below for your filing status. - Married filing jointly $400,000 - All other filing statuses - $200,000} 10 Subtract line 9 from line 3. - If zero or less, enter 0 - - If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 11 Multiply line 10 by 5%(0.05) 12 Subtract line 11 from line 8. If zero or less, enter 0 - 13 Check all the boxes that apply to you (or your spouse if married filing jointly). A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United States for more than half of 2021 B Check here if you (or your spouse if mamed filing jointly) are a bona fide resident of Puerto Rico for 2021 Part I-B Filers Who Check a Box on Line 13 Caution: If you did not check a box on line 13, do not complete Part I-B; instead, skip to Part I-C. 14a Enter the smaller of line 7 or line 12 b Subtract line 14 a from line 12 c If line 14a is zero, enter- 0-; otherwise, enter the amount from the Credit Limit Worksheet A d Enter the smaller of line 14a or line 14c e Add lines 14b and 14d f Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. See your Letter(s) 6419 for the amounts to include on this line. If you are missing Letter 6419 , see the instructions before entering an amount on this line. If you didn't receive any advance child tax credit payments Caution: If the amount on this line doesn't match the aggregate amounts reported to you (and your spouse if filing jointly) on your Letter(s) 6419 , the processing of your retum will be delayed. g Subtract line 14f from line 14e. If zero or less, enter 0 - on lines 14g through 14i and go to Part III h Enter the smaller of line 14d or line 14g. This is your credit for other dependents. Enter this amount on line 19 of your Form 1040, 1040-SR, or 1040-NR. i Subtract line 14h from line 14g. This is your refundable child tax credit. Enter this amount on line 28 of your Form 1040, 1040-SR, or 1040-NR For Paperwork Reduction Act Notice, see your tax retum instructions. \begin{tabular}{|c|c} \hline 14a & \\ \hline 14b & \\ \hline 14c & \\ \hline 14d & \\ \hline 14e & \\ \hline & \\ 14f & \\ \hline & \\ \hline 14g & \\ \hline 14h & \\ \hline 14i & \\ \hline Schedule 8812 (Form 1040) 2021 \\ \hline \end{tabular} Schedie 8812( Form 1040) 2021 Page 2 \begin{tabular}{l|c|c} SCHEDULE 8812 & Credits for Qualifying Children & OMB No. 1545-0074 \\ \hline \multicolumn{1}{|c|}{ Corm 1040) } \\ and Other Dependents \\ Attach to Form 1040, 1040-SR, or Form 1040-NR. \end{tabular} Part I-A Child Tax Credit and Credit for Other Dependents 1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 2a Enter income from Puerto Rico that you excluded b Enter the amounts from lines 45 and 50 of your Form 2555 c Enter the amount from line 15 of your Form 4563 d Add lines 2a through 2c 3 Add lines 1 and 2d 4a Number of qualifying children under age 18 with the required social security number b Number of qualifying children on line 4 a who were under age 6 at the end of 2021 c Subtract line 4b from line 4a 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet; otherwise, enter 0 - 6 Number of other dependents, including any qualifying children who are not under age 18 or who do not have the required social security number 7 Multiply line 6 by $500 8 Add lines 5 and 7 9 Enter the amount shown below for your filing status. - Married filing jointly $400,000 - All other filing statuses - $200,000} 10 Subtract line 9 from line 3. - If zero or less, enter 0 - - If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 11 Multiply line 10 by 5%(0.05) 12 Subtract line 11 from line 8. If zero or less, enter 0 - 13 Check all the boxes that apply to you (or your spouse if married filing jointly). A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United States for more than half of 2021 B Check here if you (or your spouse if mamed filing jointly) are a bona fide resident of Puerto Rico for 2021 Part I-B Filers Who Check a Box on Line 13 Caution: If you did not check a box on line 13, do not complete Part I-B; instead, skip to Part I-C. 14a Enter the smaller of line 7 or line 12 b Subtract line 14 a from line 12 c If line 14a is zero, enter- 0-; otherwise, enter the amount from the Credit Limit Worksheet A d Enter the smaller of line 14a or line 14c e Add lines 14b and 14d f Enter the aggregate amount of advance child tax credit payments you (and your spouse if filing jointly) received for 2021. See your Letter(s) 6419 for the amounts to include on this line. If you are missing Letter 6419 , see the instructions before entering an amount on this line. If you didn't receive any advance child tax credit payments Caution: If the amount on this line doesn't match the aggregate amounts reported to you (and your spouse if filing jointly) on your Letter(s) 6419 , the processing of your retum will be delayed. g Subtract line 14f from line 14e. If zero or less, enter 0 - on lines 14g through 14i and go to Part III h Enter the smaller of line 14d or line 14g. This is your credit for other dependents. Enter this amount on line 19 of your Form 1040, 1040-SR, or 1040-NR. i Subtract line 14h from line 14g. This is your refundable child tax credit. Enter this amount on line 28 of your Form 1040, 1040-SR, or 1040-NR For Paperwork Reduction Act Notice, see your tax retum instructions. \begin{tabular}{|c|c} \hline 14a & \\ \hline 14b & \\ \hline 14c & \\ \hline 14d & \\ \hline 14e & \\ \hline & \\ 14f & \\ \hline & \\ \hline 14g & \\ \hline 14h & \\ \hline 14i & \\ \hline Schedule 8812 (Form 1040) 2021 \\ \hline \end{tabular} Schedie 8812( Form 1040) 2021 Page 2