Question

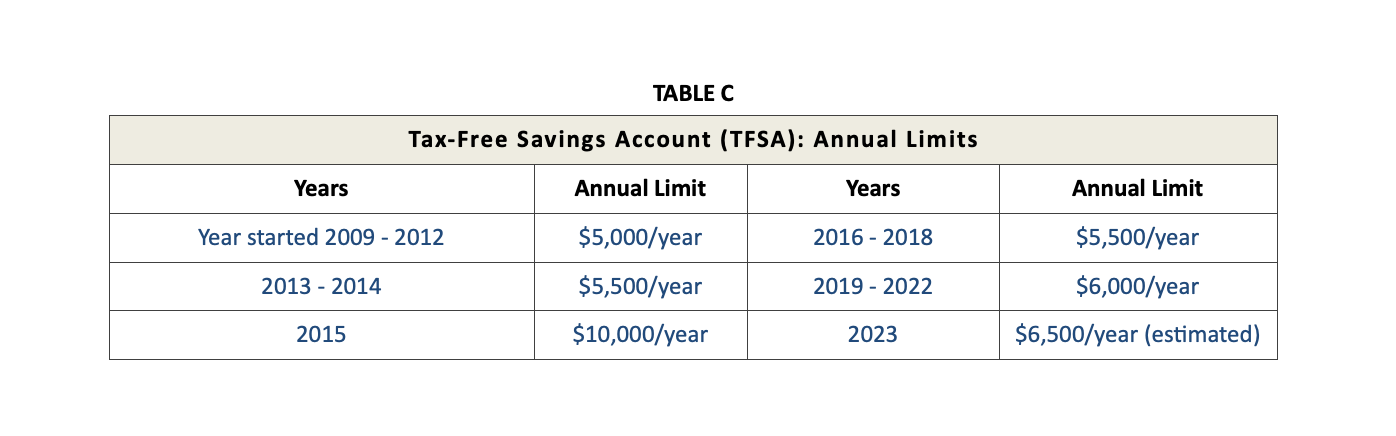

Mariela understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with

Mariela understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with your responses. She knows the following:

Mariela understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with your responses. She knows the following:

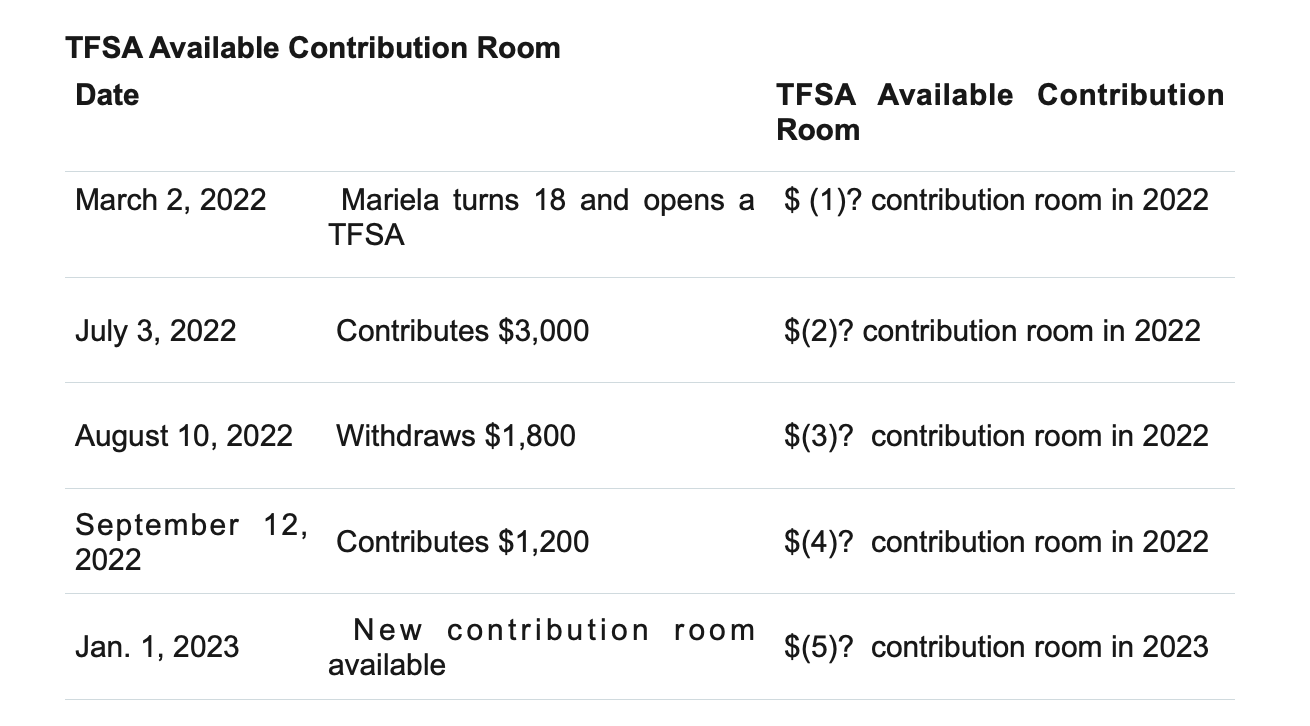

-you can withdraw any amount from your TFSA whenever you want;

-all withdrawals are tax-free;

-withdrawing from your TFSA doesnt result in lost TFSA contribution room;

-withdrawals you make this year will be added to your unused contribution room the following year (i.e. withdrawing from your TFSA has no effect on your contribution room in the year that you make the withdrawal, it only affects your contribution room for the following year); and

-you can re-contribute any funds that you have withdrawn from your TFSA back into your account starting the year after the year in which you make the withdrawal (i.e. January 1st of the following year).

a) Complete the TFSA available contribution room below. Fill in the amounts indicated by a question mark (?)( answer Table attached below)

b) Marielas mother is interested in knowing her own TFSA contribution room. She is receiving a rather large company bonus and figures this is the best place for her to place her money. She has only made one TFSA contribution to date when the government first introduced TFSAs in 2009, she contributed $5,000 but has not made any further contributions since. What is the maximum amount that Marielas mother can contribute to her TFSA in 2022? Do not forget to consider contribution room from previous years?

c) Marielas father has always made the maximum annual TFSA contribution since the program started in 2009. His TFSA has grown significantly as he has invested in some very aggressive stocks that have done well. The market value of his TFSA as of October 28, 2022 is valued at $605,890. He has never made any withdrawals from his TFSA but is now looking to withdraw the full amount on October 31, 2022, as he is interested in buying a side-business. If he withdraws the entire amount, what is the maximum amount that he can contribute to his TFSA on January 1, 2023? Do not forget to consider contribution room from previous years.

d) What is the amount of tax that Marielas father will have to pay on the withdrawal?

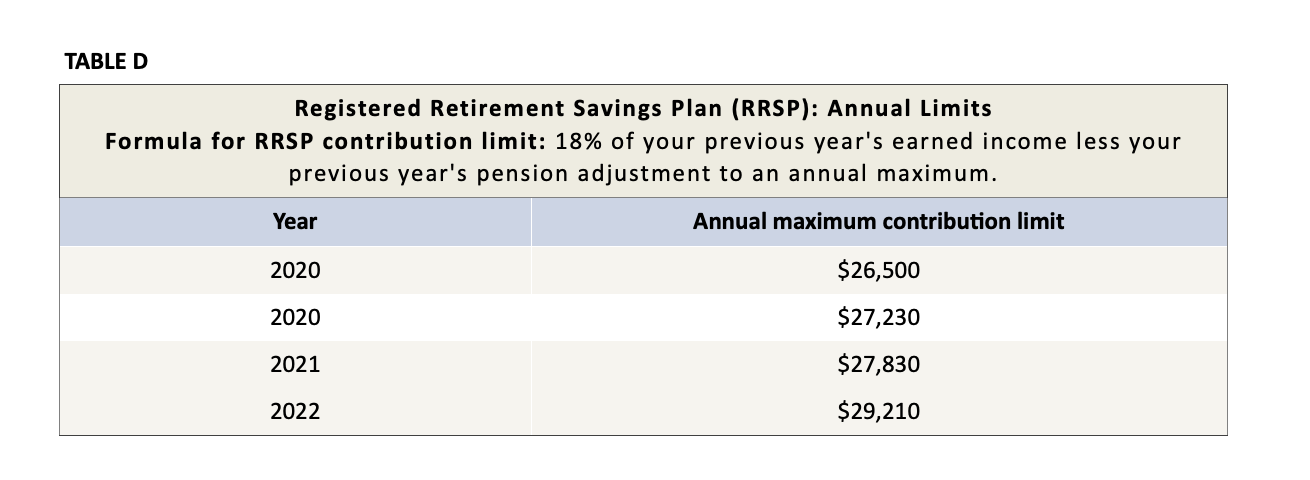

TABLE C Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum. TFSA Available Contribution Room

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started