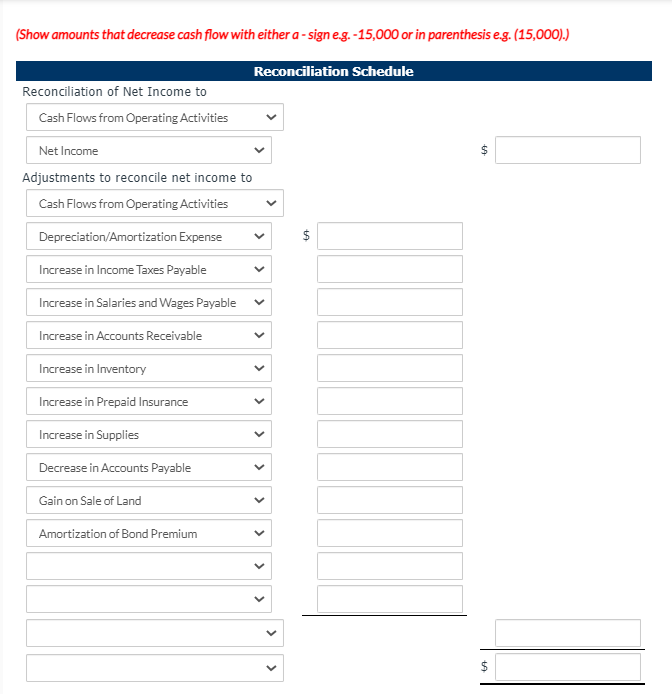

Question

Marigold Company had the following information available at the end of 2020. MARIGOLD COMPANY COMPARATIVE BALANCE SHEETS AS OF DECEMBER 31, 2020 AND 2019 2020

Marigold Company had the following information available at the end of 2020.

| MARIGOLDCOMPANY COMPARATIVE BALANCE SHEETS AS OF DECEMBER 31, 2020 AND 2019 | ||||||

| 2020 | 2019 | |||||

| Cash | $9,950 | $4,040 | ||||

| Accounts receivable | 20,400 | 12,940 | ||||

| Short-term investments | 21,900 | 29,820 | ||||

| Inventory | 41,810 | 34,990 | ||||

| Prepaid rent | 3,030 | 11,920 | ||||

| Prepaid insurance | 2,080 | 90 | ||||

| Supplies | 1,000 | 75 | ||||

| Land | 124,130 | 176,650 | ||||

| Buildings | 352,080 | 352,080 | ||||

| Accumulated depreciationbuildings | (104,780 | ) | (87,460 | ) | ||

| Equipment | 528,790 | 398,480 | ||||

| Accumulated depreciationequipment | (129,230 | ) | (112,850 | ) | ||

| Patents | 45,190 | 50,410 | ||||

| Total assets | $916,350 | $871,185 | ||||

| Accounts payable | $21,970 | $32,260 | ||||

| Income taxes payable | 4,960 | 3,960 | ||||

| Salaries and wages payable | 4,970 | 2,970 | ||||

| Short-term notes payable | 10,070 | 10,070 | ||||

| Long-term notes payable | 59,750 | 69,640 | ||||

| Bonds payable | 397,090 | 397,090 | ||||

| Premium on bonds payable | 28,020 | 31,605 | ||||

| Common stock | 241,550 | 221,910 | ||||

| Paid-in capital in excess of parcommon stock | 24,900 | 17,360 | ||||

| Retained earnings | 123,070 | 84,320 | ||||

| Total liabilities and stockholders equity | $916,350 | $871,185 | ||||

| MARIGOLD COMPANY INCOME STATEMENT AND DIVIDEND INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020 | ||||||

| Sales revenue | $1,161,520 | |||||

| Cost of goods sold | 754,390 | |||||

| 407,130 | ||||||

| Gross margin | ||||||

| Operating expenses | ||||||

| Selling expenses | $78,500 | |||||

| Administrative expenses | 155,730 | |||||

| Depreciation/Amortization expense | 38,920 | |||||

| Total operating expenses | 273,150 | |||||

| Income from operations | 133,980 | |||||

| Other revenues/expenses | ||||||

| Gain on sale of land | 7,930 | |||||

| Gain on sale of short-term investment | 4,020 | |||||

| Dividend revenue | 2,400 | |||||

| Interest expense | (51,420 | ) | (37,070 | ) | ||

| Income before taxes | 96,910 | |||||

| Income tax expense | 39,610 | |||||

| Net income | 57,300 | |||||

| Dividends to common stockholders | (18,550 | ) | ||||

| To retained earnings | $38,750 | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started