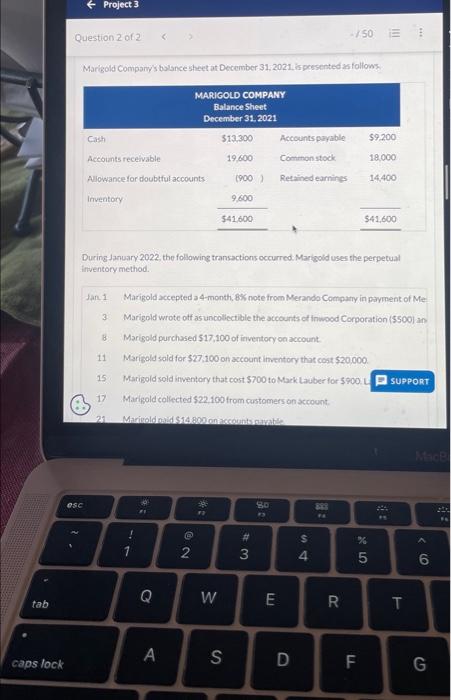

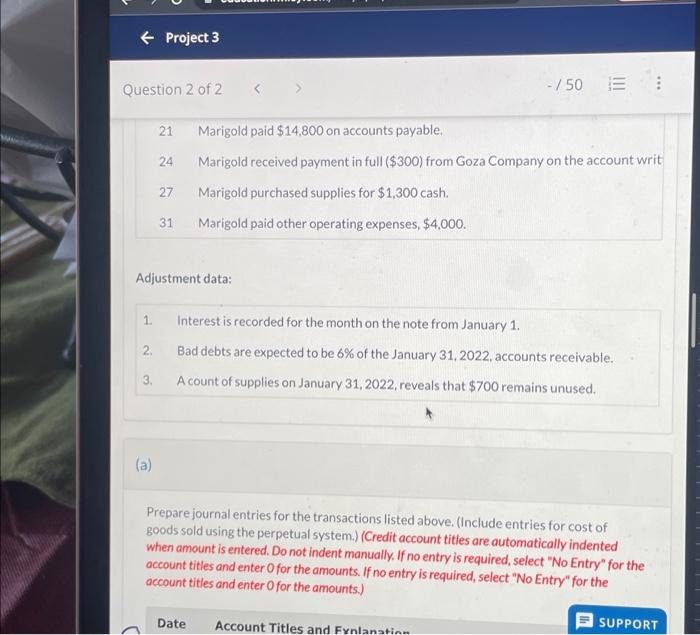

Marigold Company s bulance sheet at December 31,2021 , is pesesented as follows. During January 2022, the following transactions occurred Marbold uses the perpetual inventory method. Jan 1 Marigold accepted a 4-month, 8% note from Merando Compary in payment of Me: 3. Marisold wrote off as uncoliectible the accounts ef inwoed Comoration (5500) an 6. Marbold purchused $17,100 of irventony on account: 11 Maripold sold for $27,100 on account inventory that cost $20,000. 15. Marigold sold inventory that cost $700 to Mark Laiber for 3900L 17 Marigold collected $22,100 from customers on sccount. 21 Marigold paid $14,800 on accounts payable. 24 Marigold received payment in full ($300) from Goza Company on the account writ 27 Marigold purchased supplies for $1,300 cash. 31. Marigold paid other operating expenses, $4,000. Adjustment data: 1. Interest is recorded for the month on the note from January 1. 2. Bad debts are expected to be 6% of the January 31,2022 , accounts receivable. 3. A count of supplies on January 31,2022 , reveals that $700 remains unused. (a) Prepare journal entries for the transactions listed above. (Include entries for cost of goods sold using the perpetual system.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Marigold Company s bulance sheet at December 31,2021 , is pesesented as follows. During January 2022, the following transactions occurred Marbold uses the perpetual inventory method. Jan 1 Marigold accepted a 4-month, 8% note from Merando Compary in payment of Me: 3. Marisold wrote off as uncoliectible the accounts ef inwoed Comoration (5500) an 6. Marbold purchused $17,100 of irventony on account: 11 Maripold sold for $27,100 on account inventory that cost $20,000. 15. Marigold sold inventory that cost $700 to Mark Laiber for 3900L 17 Marigold collected $22,100 from customers on sccount. 21 Marigold paid $14,800 on accounts payable. 24 Marigold received payment in full ($300) from Goza Company on the account writ 27 Marigold purchased supplies for $1,300 cash. 31. Marigold paid other operating expenses, $4,000. Adjustment data: 1. Interest is recorded for the month on the note from January 1. 2. Bad debts are expected to be 6% of the January 31,2022 , accounts receivable. 3. A count of supplies on January 31,2022 , reveals that $700 remains unused. (a) Prepare journal entries for the transactions listed above. (Include entries for cost of goods sold using the perpetual system.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)