Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marigold Corporation is trying to determine the amount of inventory it should report at its December 31 year-end. Identify which of the following items Marigold

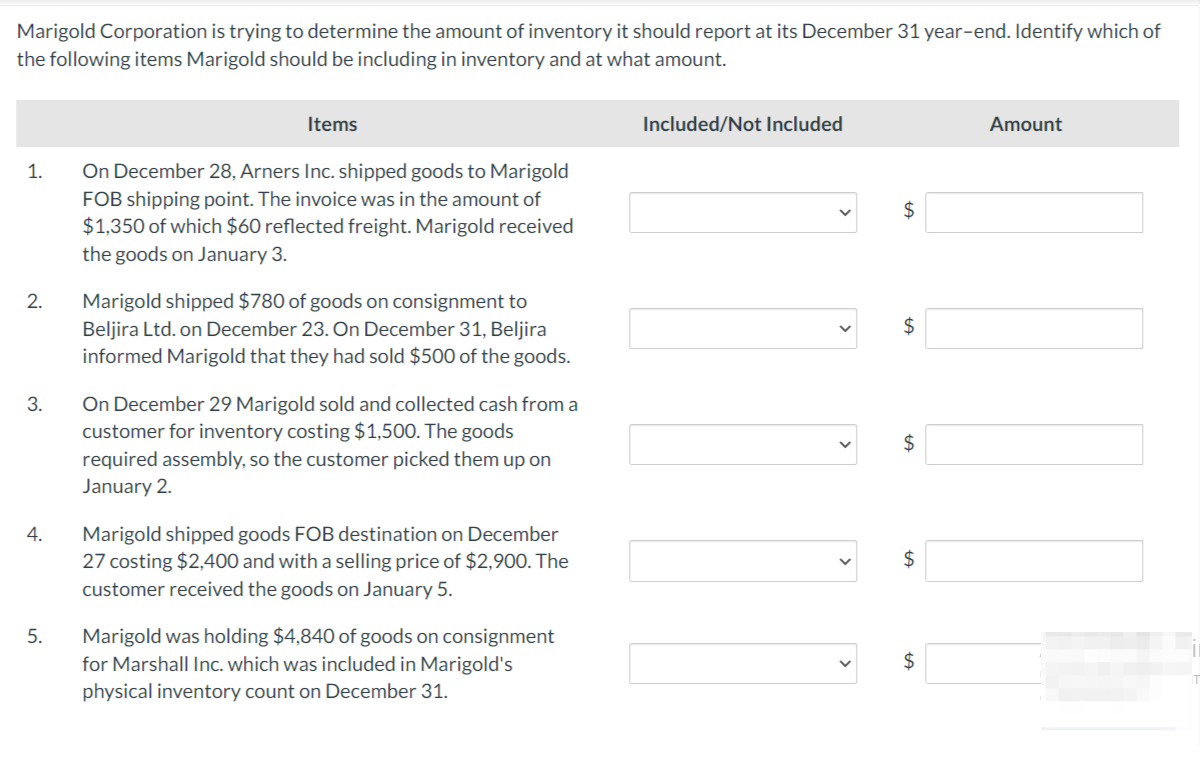

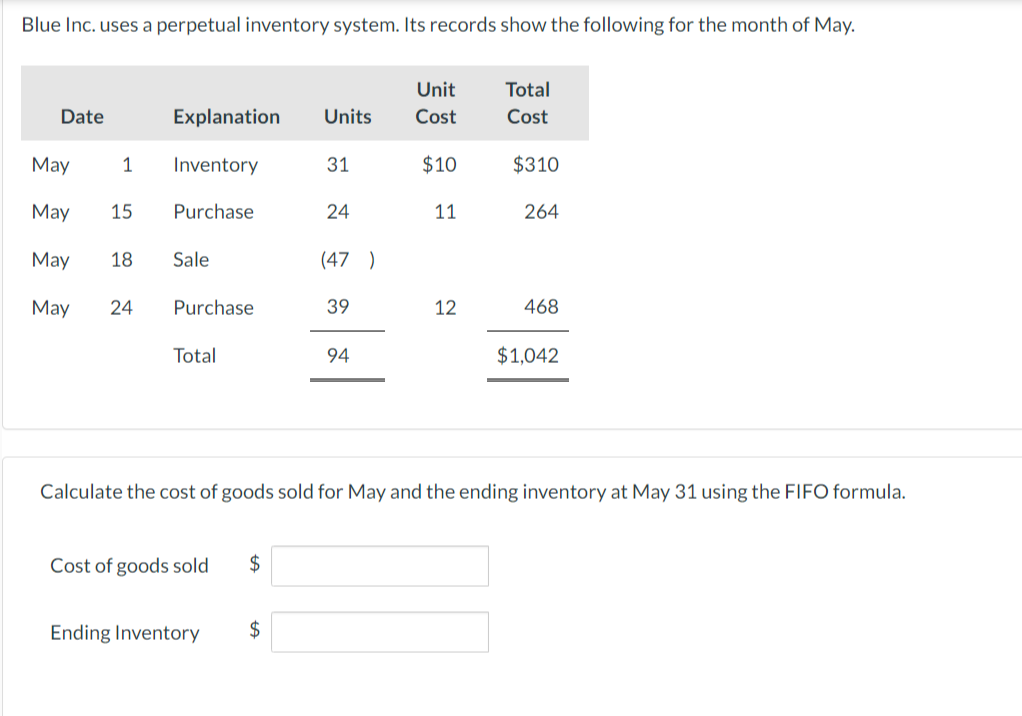

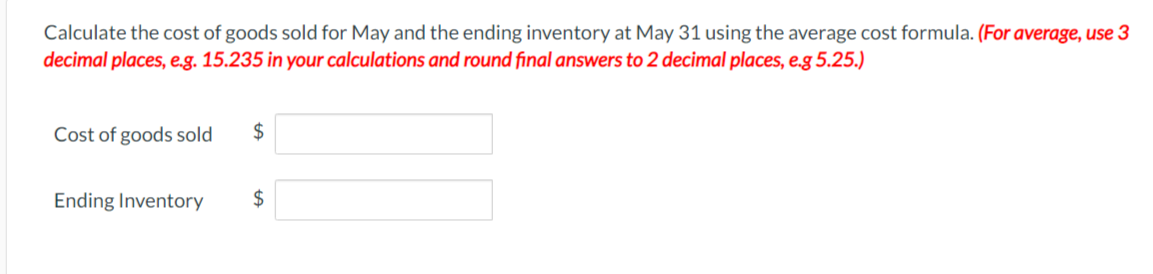

Marigold Corporation is trying to determine the amount of inventory it should report at its December 31 year-end. Identify which of the following items Marigold should be including in inventory and at what amount. Items Included/Not Included Amount 1. On December 28, Arners Inc. shipped goods to Marigold FOB shipping point. The invoice was in the amount of $1,350 of which $60 reflected freight. Marigold received the goods on January 3. 2. Marigold shipped $780 of goods on consignment to Beljira Ltd. on December 23. On December 31, Beljira informed Marigold that they had sold $500 of the goods. 3. On December 29 Marigold sold and collected cash from a customer for inventory costing $1,500. The goods required assembly, so the customer picked them up on January 2. 4. Marigold shipped goods FOB destination on December 27 costing $2,400 and with a selling price of $2,900. The customer received the goods on January 5 . 5. Marigold was holding $4,840 of goods on consignment for Marshall Inc. which was included in Marigold's physical inventory count on December 31. Blue Inc. uses a perpetual inventory system. Its records show the following for the month of May. Calculate the cost of goods sold for May and the ending inventory at May 31 using the FIFO formula. Cost of goods sold $ Ending Inventory $ Calculate the cost of goods sold for May and the ending inventory at May 31 using the average cost formula. (For average, use 3 decimal places, e.g. 15.235 in your calculations and round final answers to 2 decimal places, e.g 5.25.) Cost of goods sold $ Ending Inventory Marigold Corporation is trying to determine the amount of inventory it should report at its December 31 year-end. Identify which of the following items Marigold should be including in inventory and at what amount. Items Included/Not Included Amount 1. On December 28, Arners Inc. shipped goods to Marigold FOB shipping point. The invoice was in the amount of $1,350 of which $60 reflected freight. Marigold received the goods on January 3. 2. Marigold shipped $780 of goods on consignment to Beljira Ltd. on December 23. On December 31, Beljira informed Marigold that they had sold $500 of the goods. 3. On December 29 Marigold sold and collected cash from a customer for inventory costing $1,500. The goods required assembly, so the customer picked them up on January 2. 4. Marigold shipped goods FOB destination on December 27 costing $2,400 and with a selling price of $2,900. The customer received the goods on January 5 . 5. Marigold was holding $4,840 of goods on consignment for Marshall Inc. which was included in Marigold's physical inventory count on December 31. Blue Inc. uses a perpetual inventory system. Its records show the following for the month of May. Calculate the cost of goods sold for May and the ending inventory at May 31 using the FIFO formula. Cost of goods sold $ Ending Inventory $ Calculate the cost of goods sold for May and the ending inventory at May 31 using the average cost formula. (For average, use 3 decimal places, e.g. 15.235 in your calculations and round final answers to 2 decimal places, e.g 5.25.) Cost of goods sold $ Ending Inventory

Marigold Corporation is trying to determine the amount of inventory it should report at its December 31 year-end. Identify which of the following items Marigold should be including in inventory and at what amount. Items Included/Not Included Amount 1. On December 28, Arners Inc. shipped goods to Marigold FOB shipping point. The invoice was in the amount of $1,350 of which $60 reflected freight. Marigold received the goods on January 3. 2. Marigold shipped $780 of goods on consignment to Beljira Ltd. on December 23. On December 31, Beljira informed Marigold that they had sold $500 of the goods. 3. On December 29 Marigold sold and collected cash from a customer for inventory costing $1,500. The goods required assembly, so the customer picked them up on January 2. 4. Marigold shipped goods FOB destination on December 27 costing $2,400 and with a selling price of $2,900. The customer received the goods on January 5 . 5. Marigold was holding $4,840 of goods on consignment for Marshall Inc. which was included in Marigold's physical inventory count on December 31. Blue Inc. uses a perpetual inventory system. Its records show the following for the month of May. Calculate the cost of goods sold for May and the ending inventory at May 31 using the FIFO formula. Cost of goods sold $ Ending Inventory $ Calculate the cost of goods sold for May and the ending inventory at May 31 using the average cost formula. (For average, use 3 decimal places, e.g. 15.235 in your calculations and round final answers to 2 decimal places, e.g 5.25.) Cost of goods sold $ Ending Inventory Marigold Corporation is trying to determine the amount of inventory it should report at its December 31 year-end. Identify which of the following items Marigold should be including in inventory and at what amount. Items Included/Not Included Amount 1. On December 28, Arners Inc. shipped goods to Marigold FOB shipping point. The invoice was in the amount of $1,350 of which $60 reflected freight. Marigold received the goods on January 3. 2. Marigold shipped $780 of goods on consignment to Beljira Ltd. on December 23. On December 31, Beljira informed Marigold that they had sold $500 of the goods. 3. On December 29 Marigold sold and collected cash from a customer for inventory costing $1,500. The goods required assembly, so the customer picked them up on January 2. 4. Marigold shipped goods FOB destination on December 27 costing $2,400 and with a selling price of $2,900. The customer received the goods on January 5 . 5. Marigold was holding $4,840 of goods on consignment for Marshall Inc. which was included in Marigold's physical inventory count on December 31. Blue Inc. uses a perpetual inventory system. Its records show the following for the month of May. Calculate the cost of goods sold for May and the ending inventory at May 31 using the FIFO formula. Cost of goods sold $ Ending Inventory $ Calculate the cost of goods sold for May and the ending inventory at May 31 using the average cost formula. (For average, use 3 decimal places, e.g. 15.235 in your calculations and round final answers to 2 decimal places, e.g 5.25.) Cost of goods sold $ Ending Inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started