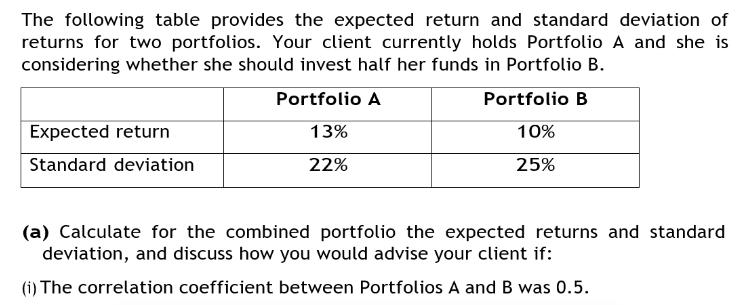

The following table provides the expected return and standard deviation of returns for two portfolios. Your client currently holds Portfolio A and she is

The following table provides the expected return and standard deviation of returns for two portfolios. Your client currently holds Portfolio A and she is considering whether she should invest half her funds in Portfolio B. Portfolio A Portfolio B 13% 10% 22% 25% Expected return Standard deviation (a) Calculate for the combined portfolio the expected returns and standard deviation, and discuss how you would advise your client if: (i) The correlation coefficient between Portfolios A and B was 0.5.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Given Expected return of Portfolio A 13 or EA Expected return of Por...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started