Assume the following four scenarios: E(Click the icon to view the scenarios.) Requirement In each of the four scenarios, determine whether the corporation is

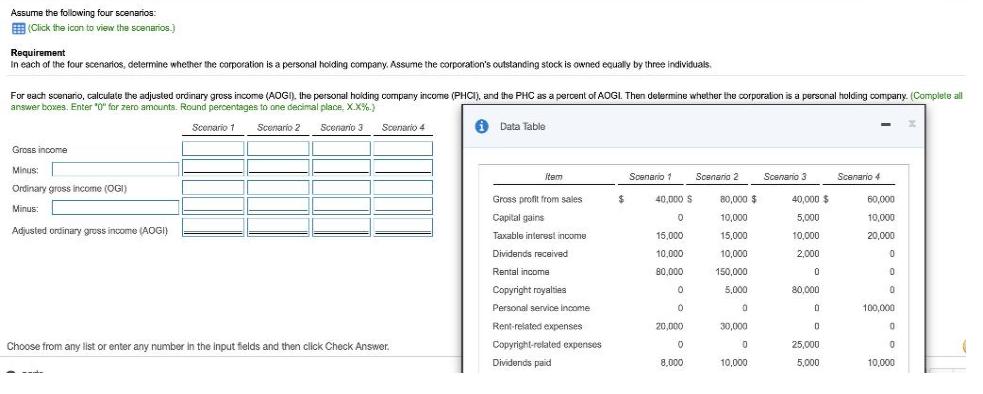

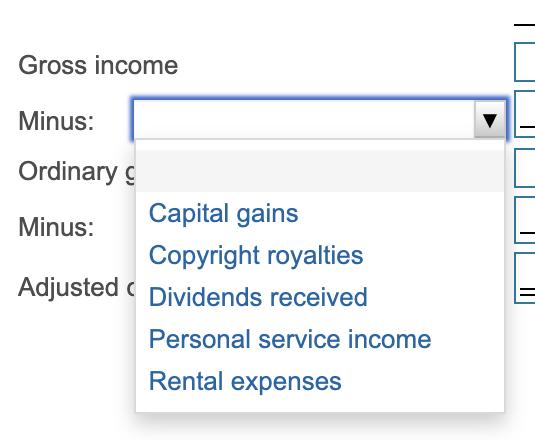

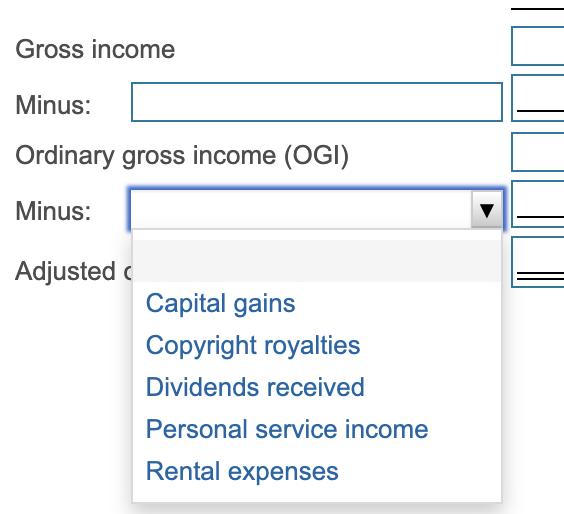

Assume the following four scenarios: E(Click the icon to view the scenarios.) Requirement In each of the four scenarios, determine whether the corporation is a personal holding company. Assume the corporation's outstanding stock is owned equally by three individuals. For sach scenario, calculate the adjusted ordinary gross income (AOGI). Ihe personal holding company income (PHCI), and the PHC as a percent of AOGI. Then delermine whether the corporalion is a personal holding company. (Complete all answer boxes. Enter "0" for zero amounts. Round percentages to one decimal place, X.X%.) Scenario 2 Scenario 3 Scenario 4 i Data Tablo Scenario 1 Gross income Minus: item Scenario 1 Scenaria 2 Scenario 3 Scanario 4 Ordinary gross income (OGI) Gross profit from sales 40,000 S 80,000 $ 40,000 $ 60,000 Minus: Capital gains 10,000 5,000 10,000 Adjusted ordinary gross income (AOGI) Taxable interest income 15,000 15,000 10,000 20,000 Dividends received 10,000 10,000 2,000 Rental income 80,000 150,000 Copyright royalties 5,000 80,000 Personal service income 100,000 Rent-related expenses 20,000 30,000 Choose from any list or enter any number in the input fields and then click Check Answer. Copyright-related expenses 25,000 Dividends paid 8,000 10,000 5,000 10,000 ---d Gross income Minus: Ordinary g Capital gains Minus: Copyright royalties Adjusted Dividends received Personal service income Rental expenses Gross income Minus: Ordinary gross income (OGI) Minus: Adjusted c Capital gains Copyright royalties Dividends received Personal service income Rental expenses

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started