Answered step by step

Verified Expert Solution

Question

1 Approved Answer

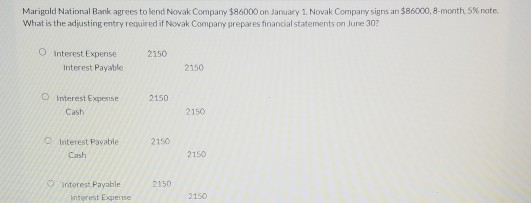

Marigold National Bank agrees to lend Novak Company $86000 on January 1. Novak Company signs an $86000 8-month 5% note. What is the adjusting entry

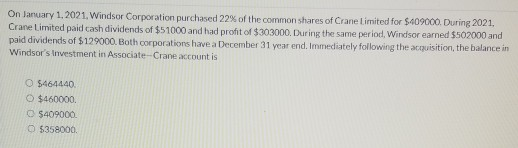

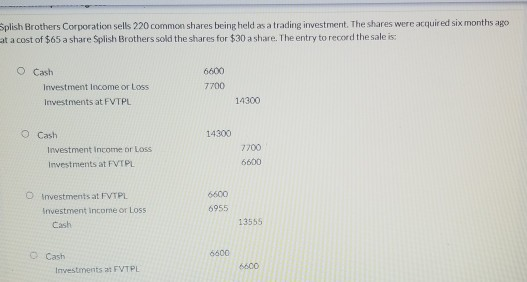

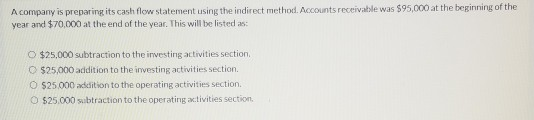

Marigold National Bank agrees to lend Novak Company $86000 on January 1. Novak Company signs an $86000 8-month 5% note. What is the adjusting entry required if Novak Company prepares financial statements on June 302 2150 interest Expense Interest Payable 2150 2150 O interest Expense Cash 2150 2150 Interest Payable Cash 2150 2150 Interest Payable Interest Expense 2150 On January 1, 2021, Windsor Corporation purchased 22% of the common shares of Crane Limited for $409000. During 2021, Crane Limited paid cash dividends of $51000 and had profit of $303000. During the same period, Windsor earned $502000 and paid dividends of $129000. Both corporations have a December 31 year end. Immediately following the acquisition, the balance in Windsor's Investment in Associate-Crane account is O $464440 $460000 O $409000 O $358000 Splish Brothers Corporation sells 220 common shares being held as a trading investment. The shares were acquired six months ago at a cost of $65 a share Splish Brothers sold the shares for $30 a share. The entry to record the sale is: O Cash 6600 7700 Investment Income or Loss Investments at FVTPL 14300 O Cash 14300 Investment income or Loss Investments at FVTPL 7700 6600 o Investments at FVTPL Investment income or LOSS Cash 6600 6955 13555 Cash 6600 Investments at FVTPL 6600 A company is preparing its cash flow statement using the indirect method Accounts receivable was $95,000 at the beginning of the year and $70,000 at the end of the year. This will be listed as: O $25,000 subtraction to the investing activities section, O $25,000 addition to the investing activities section, O $25000 addition to the operating activities section O $25.000 subtraction to the operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started